Real Estate Investment Trusts or REITs are investment vehicles that allow individuals to invest in real estate assets. They generate rental income, capital appreciation, and interest income from mortgages. Investing in REITs in the Philippines has become more accessible for individual investors in recent years. It can be a great way to diversify your investment portfolio while earning passive income.

In this article, we will provide a comprehensive guide on how to start investing in REITs in the Philippines.

Understanding REITs

Before investing in REITs, it’s essential to understand what they are, how they work, and how they generate income. A REIT is a company that owns and operates income-generating real estate properties. By law, a REIT must distribute at least 90% of its taxable income to shareholders as dividends. This makes investing in them an attractive investment for passive income.

Different REIT types exist, namely equity, mortgage, and hybrid. Equity REITs own and operate income-generating real estate properties, while mortgage REITs invest in real estate mortgages. Hybrid REITs combine the features of both equity and mortgage types/

As mentioned, these investments generate rental income, capital appreciation, and mortgage interest income. Rental income is generated from leasing out properties, while capital appreciation is earned through increased property value over time. Interest income is generated from mortgages that the REITs hold. It’s important to note that REITs’ income streams can vary depending on the type and their properties.

Choosing the REIT to fit for you

Choosing the suitable REIT to invest in is crucial in maximizing your returns and minimizing risks. Here are some factors to consider

- Financial performance – Review the REITs’ financial statements, including income statements, balance sheets, and cash flow statements. This is to evaluate their financial health and performance.

- Property portfolio – Analyze the quality, location, and types of properties in the REITs’ portfolio. This is in order to assess their potential for generating income and appreciation.

- Dividend history – Check the REITs’ dividend history to determine their dividend payout stability and growth potential.

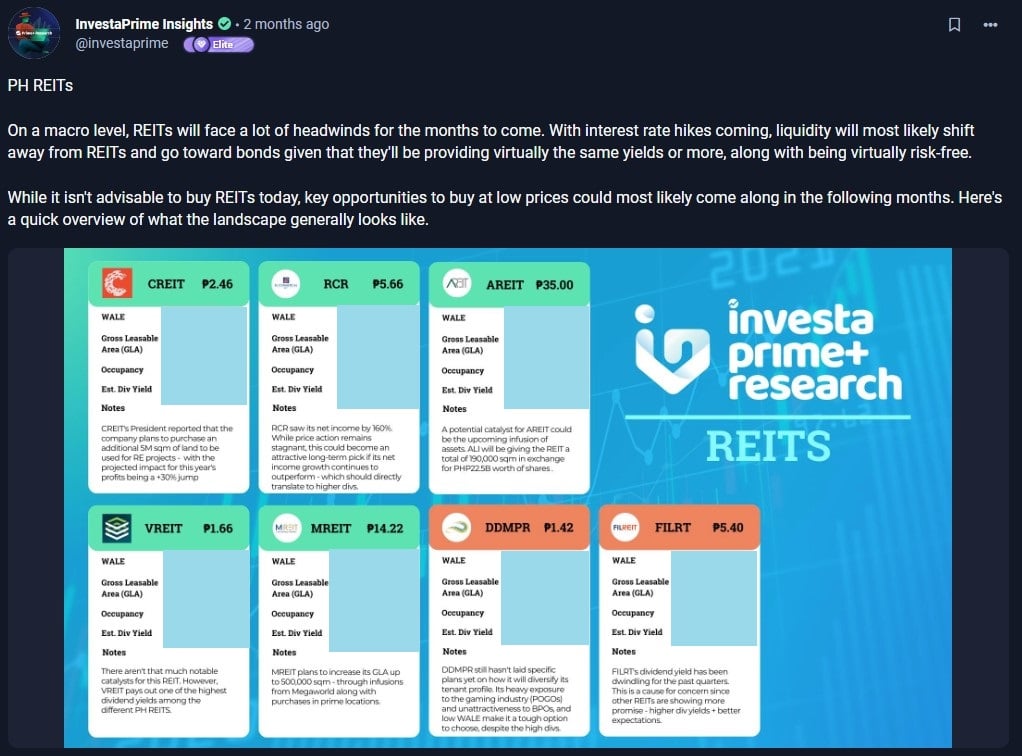

- Market conditions – Consider the current and expected market conditions, including interest rates and economic indicators. This will aid you in evaluating the REITs’ growth potential and risks.

- Regulatory compliance: Ensure the REITs comply with the Philippine Securities and Exchange Commission (SEC) regulatory requirements and standards.

Considering these factors, you can choose the REITs that align with your investment goals and risk tolerance. It also allows you to maximize your returns while minimizing risks.

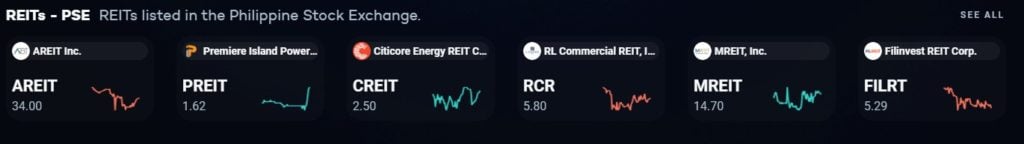

To know more about REITs and their performance, dividend yields, and price, you can check out the Investa Screener or the Investa homepage to make finding these REITs easier.

Steps to start investing in REITs

Here are the steps to get started investing in REITs.

- Choose a stockbroker – Look for a reputable and licensed stockbroker that offers access to REITs in the Philippine Stock Exchange (PSE). Do your research and compare their fees, services, and reputation.

- Open a stock trading account – Once you have chosen a stockbroker, you must open a stock trading account with them. Provide documents such as IDs, proof of billing, and other requirements.

- Fund your account – You need to fund your account with the minimum required amount. You can use online banking or visit the stockbroker’s office to deposit money.

- Find your REIT of choice – Aside from using the Investa ProScreener to find the list of REITs, you can also find more in-depth details about them on the platform! Simply search for them (ex. $CREIT) and you’ll find everything you need to make an informed decision.

- Place an order for REIT shares – Once your account is funded, you can now place an order to buy REIT shares. You can choose from the available REITs in the PSE and acknowledge the many shares you can afford.

It is important to note that investing in REITs also involves risks. Hence, it is essential to do your research and seek professional advice before making any investment decisions. Should you want to look for broken-down information, our team of analysts frequently shares insights about the fundamentals of REITs, stocks, and even the overall markets to our Prime subscribers!

Tips for investing in REITs

Here are some additional tips to help you start your REIT investment journey!

- Do your research – Before investing in any REIT, it is crucial to research the company and the market conditions. Look into your chosen investment’s history, track record, management team, financial statements, and growth potential. Analyze the current market trends and economic conditions that may impact the investment’s performance.

- Diversify your portfolio – As with any investment, it is advisable to diversify your portfolio to minimize risks. Spread your investments across different sectors and locations.

- Monitor your investments – Keep track of the performance of your investments regularly. Watch for any news or developments affecting the company’s operations and profitability. You can set alerts on your stockbroker’s trading platform to stay updated on the latest market news and trends. You could also follow Investagrams for financial news, real-time updates, and analysis to make informed investment decisions.

- Seek professional advice – Seek advice from a licensed financial advisor if you’re new to investing or uncertain about your decisions. They can help you assess your risk tolerance and investment goals and guide you on the best investment strategies.

By following these tips, you can make informed investment decisions and manage the risks of investing in REITs. Remember to keep a long-term perspective and have patience, as real estate investments tend to be slow but steady.

Invest with knowledge and discipline, and success will follow

Putting money into REITs can be a profitable method to diversify your portfolio of investments and generate passive income. However, it’s essential to note that investing involves risks, including market volatility, interest rate fluctuations, and property-specific risks. Therefore, thorough due diligence and research are crucial before making investment decisions.

Investing in REITs can be a profitable and exciting way to grow your wealth in the Philippines. Following the steps outlined in this article, you can start your journey toward financial freedom and achieve your investment goals.

Easily track your PSE and Crypto portfolio on Investagrams for FREE!

Try it today: https://invs.st/PortfolioDaily