The tulip mania happened during the 1600s in the Netherlands. The Dutch were so entranced with the beauty of tulips that it led to a speculative frenzy. Historically, this was the first-ever speculative bubble. The tulip mania was the forefather of the dot-com bubble, the housing bubble, and all the meme stocks that soared to the moon of late.

The Makings of the Tulip Mania

It all started when tulips first came to the Dutch. Tulips were imported to the Netherlands from the Ottoman Empire. From the get-go, tulips became widely popular. The exoticness of the flowers caused them to immediately become a must-have luxury among the rich. It was “proof of bad taste” among the wealthy and noble to not have a collection of tulips.

Of course, the merchants had to follow the trend. As they sought to be like the upper class, they also brought more demand for tulips to the table. The Dutch heavily bought tulips. However it’s important to note that tulips were only merely purchased as a status symbol. Although a beautiful flower, much of the demand for it was due ironically to the big price tag.

While the flower was already priced very high, the tulip mania hasn’t even started yet. What triggered the prices to rampage was the discovery of “broken bulb” tulips. Since the demand for tulips was high, locals started learning how to nurture and cultivate tulips. Soon producers discovered a new kind of tulip. Whereas usually tulips had single solid colors, broken bulb tulips had striped multicolor designs. This specific variation caused market prices to go up in a frenzy.

The Market in a State of Frenzy

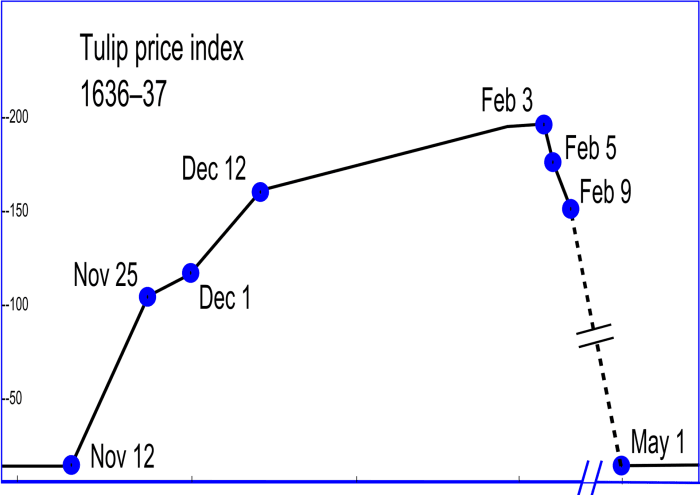

The demand for tulips quickly outpaced the supply, causing prices to shoot upwards. Of course, this caught the attention of traders and speculators who then came into the markets – providing more fuel to the flame. While an exact value is hard to precisely calculate, estimates pegged some of the rarest tulips to cost up to $1,000,000 by today’s standards. On average, tulips traded for around $50,000 to $150,000. The market for tulips was very active to the point that a market was set up for contracts.

“Many who, for a brief season, had emerged from the humbler walks of life, were cast back into their original obscurity. Substantial merchants were reduced almost to beggary, and many a representative of a noble line saw the fortunes of his house ruined beyond redemption.”

– charles mackay

By this time, everyone now wanted to own tulips. According to Mackay’s account of the event in his book Memoirs of Extraordinary Popular Delusions and the Madness of Crowds, different people from different walks of life took part in the trade of tulips. From nobles to farmers and even servants. However, everything that glitters doesn’t always turn out to be gold. Similar to the bubbles that followed in history, tulip prices plummeted. Many were left with contracts worth nothing, and the tulip mania was considered to be the first recorded bubble.

While the market crash wasn’t as economically devastating as depicted in tales (thankfully no, the tulip mania did not cause a depression), there was still real economic damage done. Nobles drew in losses worth millions in dollars by today’s standards. Business relationships built on trust were destroyed. A cultural shock was felt in a society with complex credit systems for their time.

Similarities to the Markets Today

“I can calculate the movement of stars, but not the madness of men.”

– Isaac newton

The tulip mania has many traits similar to more modern market bubbles. One of the main driving forces of bubbles is the nature of human behavior. Despite financial literacy becoming more widely taught, the same old patterns of behavior are still prevalent in the markets. In any market, speculation can be a strong force that pushes prices higher.

As prices keep going higher, herd mentality can take place where investors follow the actions of others in the market rather than making their own informed decisions. Similar to the tulip mania, people invest in certain assets just because other people are making money doing so. Likewise, the ending is always the same for bubbles – an abrupt and unsightly market crash.

Usually, market bubbles have some telltale signs, including rapid price increases, widespread speculation, and a disconnect between underlying fundamentals. Although different speculative bubbles have different characteristics, there is one unifying trait that can be noticed. In bubbles, investors are often in a state of euphoria. When things seem too good to be true for everyone, that’s usually indicative of a bubble getting ready to burst.

Moving Forward

While we will never know what will exactly happen in the future, we can often use history as a reference. The tulip mania was just one of the bubbles in history – we can read about the many others to get a grasp of the dynamics involved in these peculiar situations and gain an edge in the process.

As always, the markets often don’t reward the smart or the wealthy. The markets reward those who show up and take the time to understand the recurring behaviors of market participants.