Although one of the prominent formulas in the financial industry, not a lot of traders are familiar with the term Market Risk Premium. While jargons and buzzwords like this usually make it seem difficult to understand, the Market Risk Premium is really just a simple formula:

In a nutshell, the market risk premium is the measure of how much excess returns a portfolio gets from the market in return for the increased risk taken. Its application in the real world is widespread. Financial models and quantitative trading used by institutions usually take this into account.

UNDERSTANDING THE MARKET RISK PREMIUM FORMULA

First, we need to understand the components. Essentially all you would need are the expected market return and the risk-free rate.

RISK-FREE RATE

The risk-free rate is the easier of the two to find. Traditionally, risk-free rates are based on treasury yields.

The reason for this is simple: would you doubt the government’s ability to repay you? There is a very small chance of a nation’s default. However, the probability of it happening is so small for most cases that treasuries are considered virtually risk-free. If you’re not convinced about the safety of certain treasuries, you can change it with the returns of a “safer” asset. The rule of thumb is that the risk-free rate is ROI you can get with almost no risk.

EXPECTED MARKET RETURN

The expected market return is where many start to have different opinions. Different groups and individuals will have varying opinions on this. Some may prefer using the Capital Asset Pricing Model (CAPM). Others might prefer using their own market valuation methods, using a custom slew of fundamental indicators. Whichever method is used, the gist is that the expected ROI from the market is used

MARKET RISK PREMIUM: HISTORICAL, EXPECTED, AND REQUIRED

The formula can also reflect the historical, expected, and required market risk premium. In order to succeed in the markets, you need to have a holistic view. The historical risk premium can tell you how much excess returns market participants have demanded in exchange for increased risk. The expected market risk premium is an attempt at finding what the risk premium might be. The required market risk premium is where you start with the return you want and try to figure out the values of the variables.

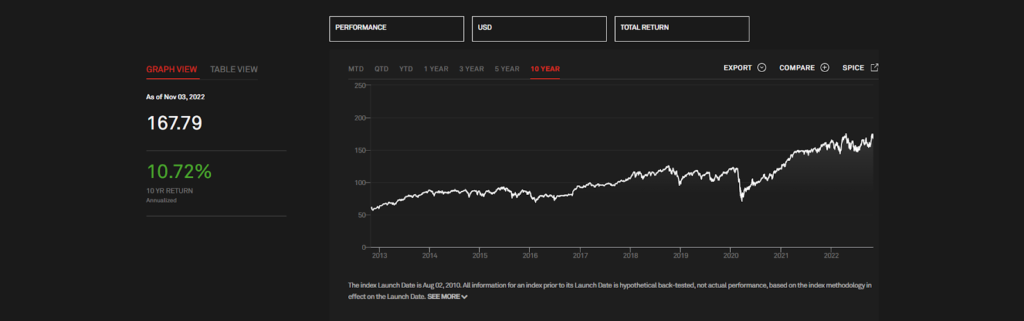

When you use the formula solely for equities, the name can be interchanged with equity risk premium. Over the past decade, subtracting the compounded annual rate of return of long-term US government bonds against the S&P500 yielded an equity risk premium above 10%. Basically, the market has been looking for 10% returns above risk-free rates over the decade.

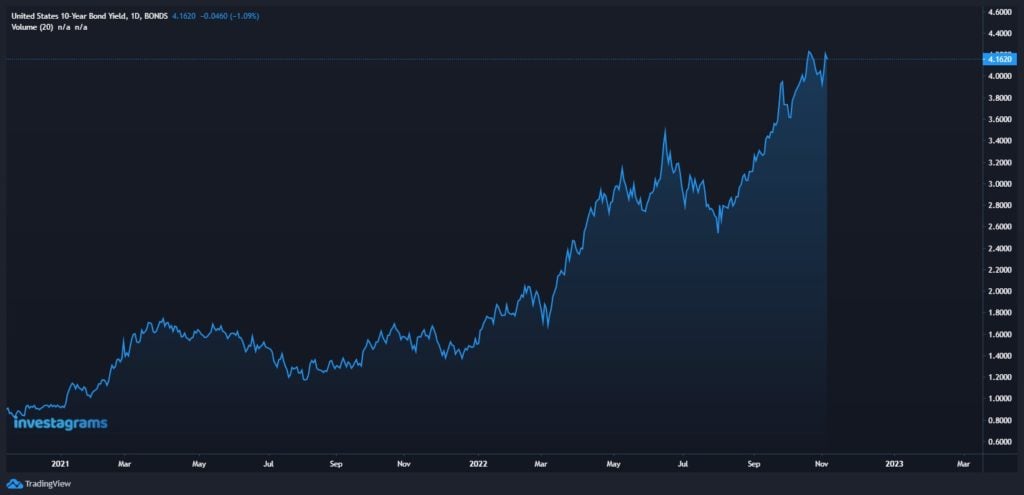

Throughout 2022, interest rates have been rising – causing treasury yields to soar. This has caused the expected equity risk premium to fall, swaying investors away from stocks. As seen below, US equities have been in a slump as treasury yields continue to rise. For investors who require a higher risk premium, they would rather wait for better conditions and more lucrative rewards before allocating funds.

Last Remarks

The gist of the market risk premium is that it helps investors find how big additional returns should be to justify investing in riskier assets. It’s important to note that there are a lot of other models and calculations used to price securities. However, understanding and knowing the market risk premium is an essential first step towards valuating assets.

Want to learn more lessons to help you build a crisis-proof system? Check out the Investa Summit 2022: Opportunities in Crisis! Our world-class and industry-leading speakers will be giving you in-depth experiences and lessons on the bear market we’re facing, and how we can find opportunities moving forward.