Have you ever wondered when you first started trading in the financial markets on whether a golden indicator and strategy exist? Is there such an indicator that is far superior to the ones we currently know right now?

It is normal for a beginner to seek for a means to have an edge in trading. People would seek foolproof and perfect strategies that they have heard or seen from various sources. They try to find the holy grail in articles or videos online. When I first read a book about trading, I immediately used every indicator that was taught in that material.

To the point that it looked like figure 1 and 2.

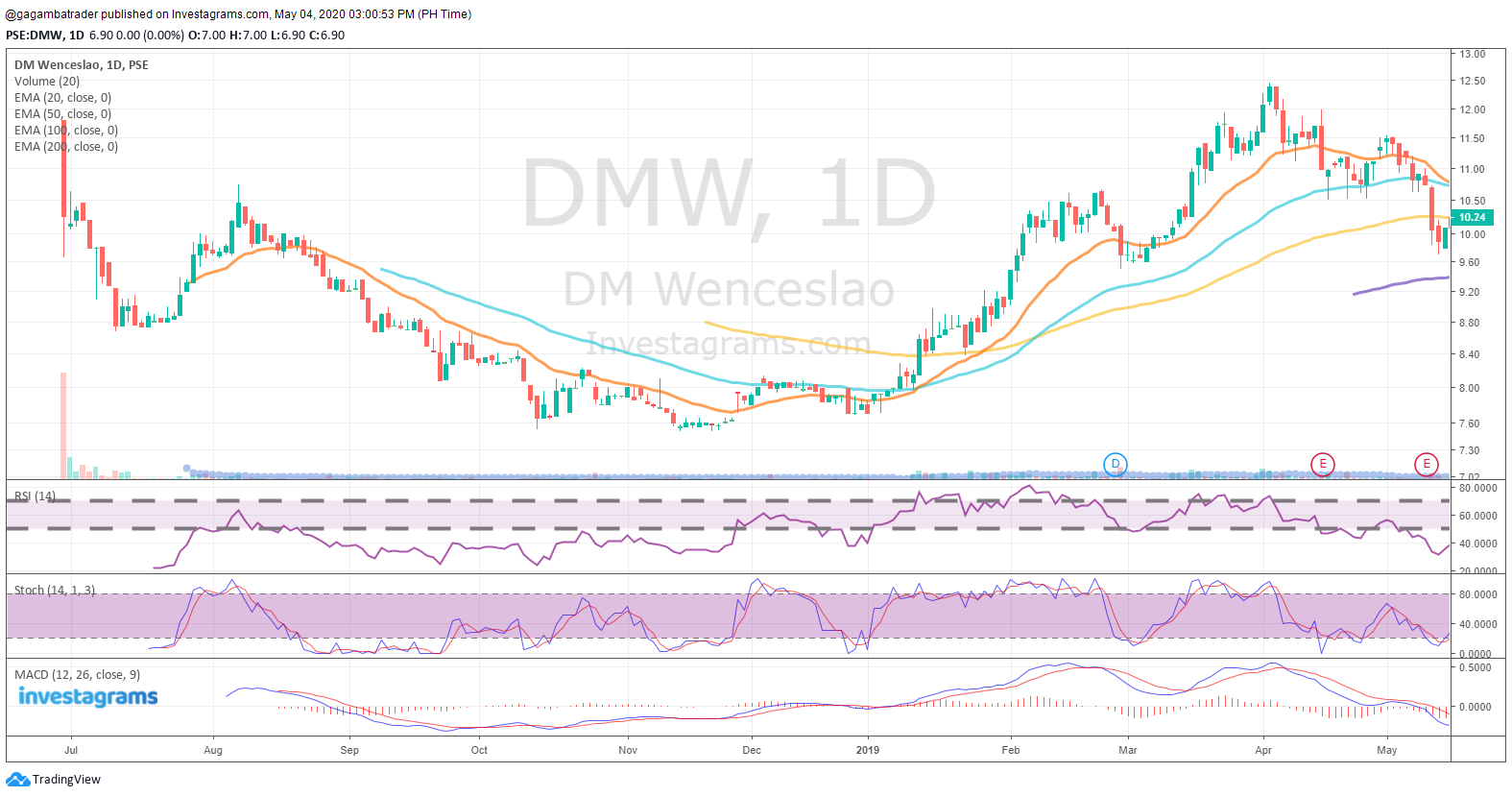

Figure 1. $DMW Chart

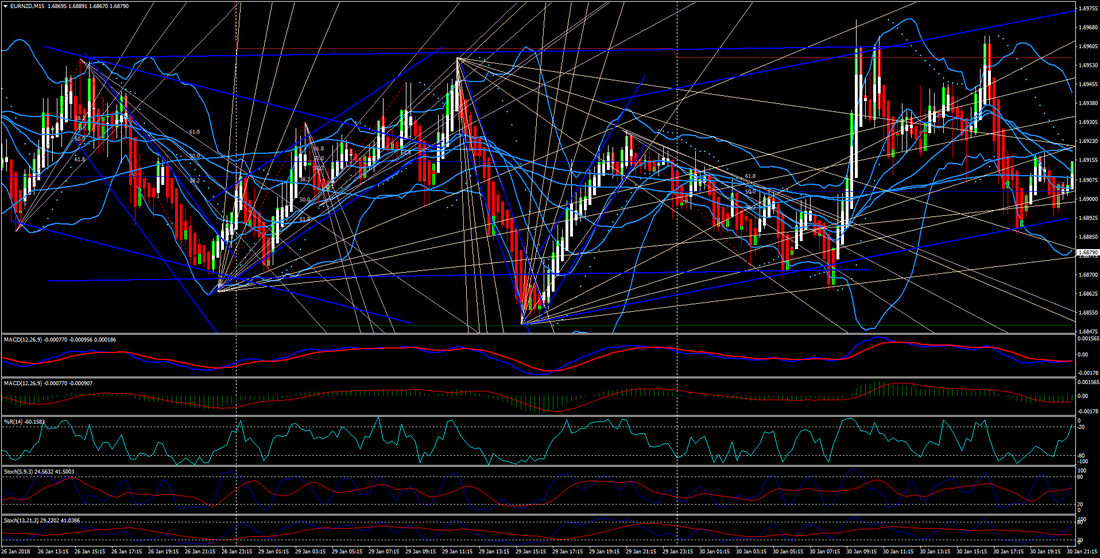

Figure 2. A Chart with many indicators. Source: FX Trading Revolution.

Referring to the figures above, when you first started learning how to trade, did your chart look like this?

I too am guilty of this. I thought that the more indicators present on the chart, the more accurate the readings and analysis would be. I thought that I would be more profitable when I did this on my chart.

Contrary to common belief, less is actually more. As you can see from the illustration above, having too many indicators would just result in “Analysis Paralysis”. This happens when a trader is about to place a buy order and experiences a “freeze” moment since all the indicators on the chart show mixed signals, some show that it’s time to buy while the others show that it’s better to wait. Using too many indicators may lead to missing out on a winning trade because you’re too hesitant to pull the trigger.

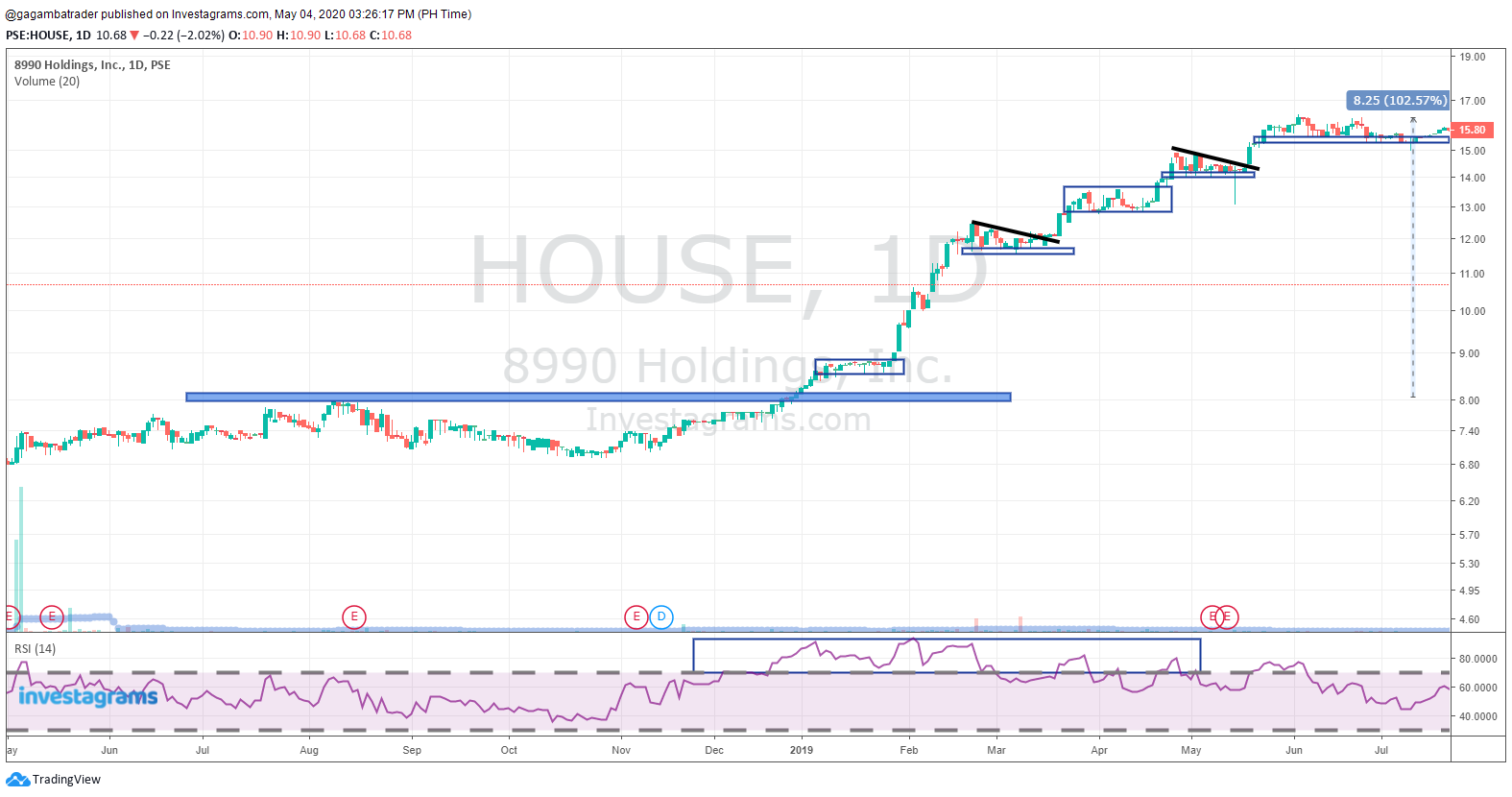

Figure 3. $HOUSE Chart

There is no such thing as a golden indicator or strategy known to mankind. Each strategy and indicator is unique. There are even some that contradict one another. For example, figure 3 shows $HOUSE. It is commonly taught that when RSI (14) reaches overbought levels (equal or above 70), it’s time to sell your position.

So not only do you need to know which indicator works best for your strategy, you also need to know the proper applications of it. For the case of the RSI, trading based simply off overbought and oversold conditions in a textbook manner is only advisable if a stock is consolidating. However, if you’re in a trending market, if a stock is overbought or oversold it’s likely that it will continue in the direction of the trend.

If you sold $HOUSE just because it was already overbought, then you would have missed the entire 100% move. Note that $HOUSE was in a clear uptrend and was making new all time highs at the time the RSI was overbought.

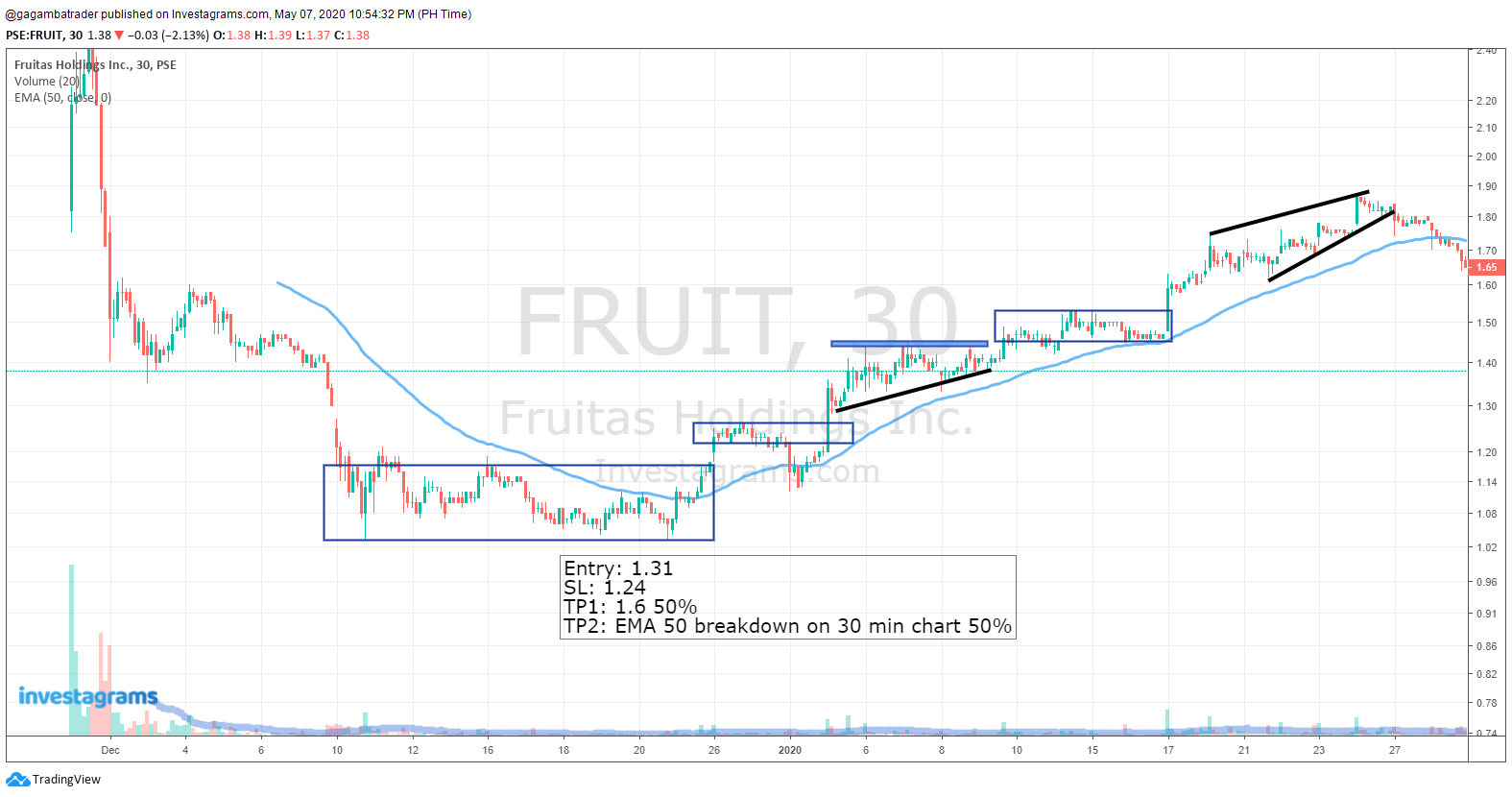

Figure 4. $FRUIT Chart

For illustration purposes, figure 4 is an actual trade that I did for $FRUIT earlier this year. This is how I chart, I mainly use Price, Volume, and EMAs. It may seem simple for a lot of people, but I realized that keeping it simple works best for me.

If you’re really looking for a golden indicator, I’d say it’s actually your TRADING PSYCHOLOGY. As said by countless traders, trading success is 80% Trading Psychology and 20% System used. Mark Douglas, the father of trading psychology, said that the best traders, regardless of the strategy applied, are those who can master their psychology and avoid the common pitfalls average traders go through.

More important than a golden indicator is using a strategy that works best for your personality and circumstances. For example, when I first started trading, I adjusted my strategy based on my current situation at the time. I decided to be a swing and a trend follower given the busy schedule at school. I was able to execute my trades well with the use of InvestaWatcher that lets me know whether to execute the trade based on price alerts.

It’s time to invalidate these trading myths that we hear all the time:

- A foolproof strategy exists.

- The more indicators that I use will yield more chances of winning.

- Mastery of a system is much more important than the mastery of oneself.

Contributor:

Name: Miguel Lorenzo L. Cagampan

Investagrams Username: @Gagambatrader

Channels:

www.investagrams.com/Profile/gagambatrader

www.facebook.com/gagambatraderph/

About the Contributor:

Gagambatrader is a personal brand that aims to provide value and content with regards to trading in the financial markets using Technical Analysis. Gagambatrader aims to influence and provide to the growing community of traders in the country.