The battle between the Fed and inflation has been making headlines almost every other week. Along with the ongoing fight against inflation, an ominous question has been coming up from time to time: is a US recession coming?

Various events have been indicating that the economy is getting worse. With inflation reaching historical highs, the stock market has seen the brunt end of things as investors are shying away from risky assets. Major US stock indices have already fallen by more than 20% and have yet to retake significant levels to indicate a bottom. Earnings reports have also shown declines and negative surprises.

To those unaware, a US recession will affect most of the financial markets around the world. Economic developments in the US will affect even the portfolios of traders and investors from other countries. Let’s deep dive into recessions and how they affect markets everywhere.

What is a recession?

In economics, a recession happens when an economy starts to experience a decline in overall production. Typically, a country is in a recession when the national GDP declines for two consecutive quarters. During recessions, you will commonly see businesses struggle and unemployment rates rising. Usually, a recession may last up to several months or years based on the situation and how the government handles economic issues. The cause usually differs from case to case as many factors affect how economies move. Most of the time, central banks are at the center of the efforts to mitigate and prevent recessions as they can control interest rate policies dictating how fast or slow an economy grows.

History of US recessions

To better understand recessions and their impact on the stock market, let’s look back into history and see how past recessions unfolded. Let’s start with the 1970s – a decade of instability brought by a mismanaged economy.

1973 US recession

In 1973, the US went into a 16-month-long recession brought about by inflation reaching double digits. The president during that time wanted cheap money to flow into the economy in the hopes of solving the unemployment problem. The Fed keep rates low during the build-up to the recession in the hopes that solving unemployment would eventually lead to lower inflation. However, this was not the case as the country’s GDP had negative growth for a long time and unemployment rose to almost 9%. The stock market fell by more than 50% and would not be able to recover for a long time. Even though the recession stopped sometime in 1975, the economy was still in shambles as inflation and unemployment continued to ravage the country.

Paul Volcker induced recessions in the 1980s

The next recession came in 1980, with another quickly following in 1981 until 1982 as Paul Volcker came in as the new Fed chairman. As they had a new mandate that focused on cracking down on inflation, interest rates rose to as high as 20%. GDP declined while unemployment reached double digits. Although recessions are usually bad for the market, this specific recession didn’t do much to hurt stocks as the fallout was shallow and would lead to a strong bull run.

1990 US recession

In 1990, the US economy faced another recession that lasted until 1991. This time it was caused by a savings and loans crisis wherein numerous institutions failed to handle the finances of many citizens. Coupled with Iraq invading Kuwait, commodity prices rose again globally leading to instability in correlated markets. Unemployment peaked at 6.8% while the stock market fell by roughly 20%.

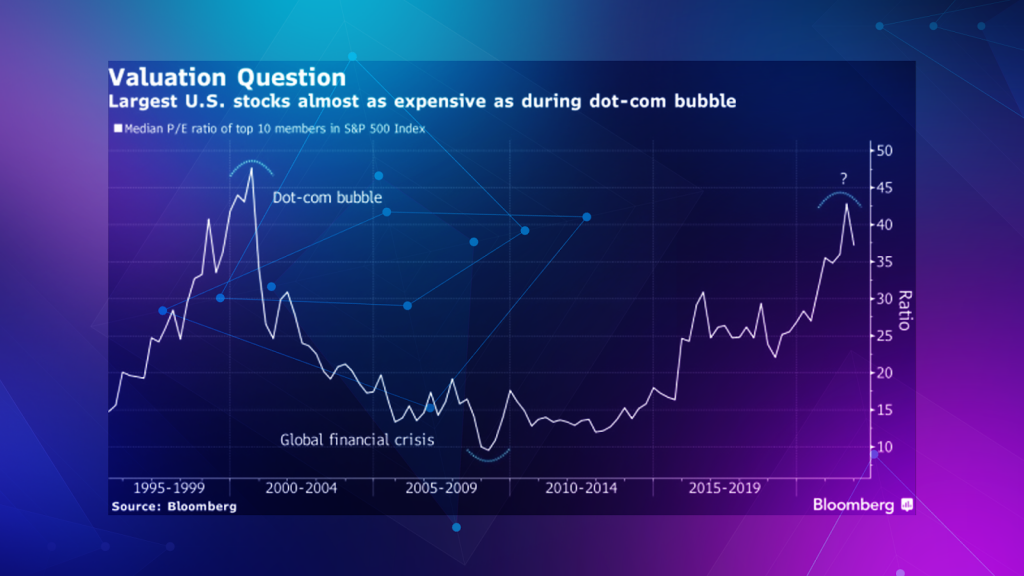

Dot-com bubble

In the early 2000s, the US would face another recession. This time the US recession was brought by an overheating stock market as the dot com bubble burst. Many companies and startups failed, causing a lot of wealth to vanish from the whole economy. The recession took eight months. Companies during that time were overvalued and failed, causing the stock market to fall by 50%.

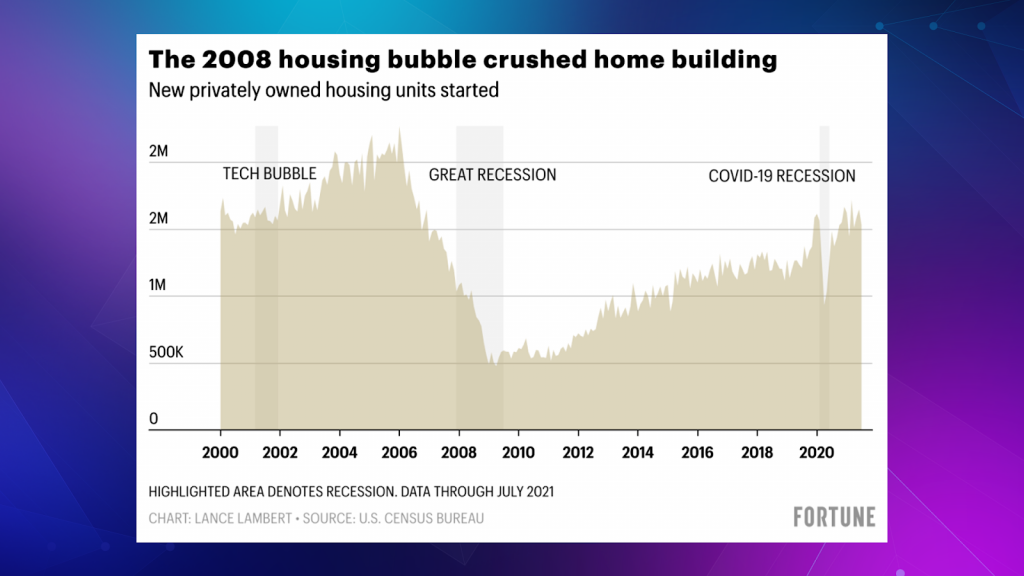

2008 Financial crisis

Just years afterward, the US economy would face yet another recession brought by troubles from the financial system. The housing market crisis lasted from December 2007 to June 2009, triggered by various shady loan defaulting and the widespread use of derivatives. The stock market would then fall by 50% again, while unemployment reached 10% throughout the recession.

Covid-19 pandemic recession

A couple of years ago, the US technically faced another recession as the pandemic caused the economy to decline by 5.1% and 31.2% simultaneously. With Covid hampering businesses everywhere, unemployment rose to a whopping 14.7%, but the market only crashed for two months before reaching all-time highs. This recession was the shortest recorded as it would only last one quarter.

How US recessions affect global markets

Let’s make one thing clear: the biggest mover of assets is LIQUIDITY. No matter what happens, assets will only increase in price if there is demand and money follows. A great story or situation will only translate to higher prices if people buy into it. It’s undeniable that the US stock market is the largest in the world. The majority of funds, and therefore liquidity, are centered around the US financial markets. Should any pain be felt there, the negative sentiment will spill over to other risky assets. With the advent of electronic trading and faster transactions, the correlation between different markets has grown stronger

A prime example of this was the 2008 US recession brought about by the housing market bubble. Liquidity was sapped away from stock markets everywhere. European markets like the FTSE weren’t safe as stocks fell by almost 50%.

The Philippine stock market was in a prime position for growth. Many companies and even big names were poised for major rallies. However, the US recession caused investors everywhere to shy away from stocks, stunting the local market’s growth and causing share prices to fall sharply.

Going back to the present

Inflation is once again reaching historical highs after going all the way up to 9.1%. Even as the Fed aggressively hikes rates, inflation continues to climb. Wages have grown, but purchasing power is still being eaten up by absurdly high inflation. Stocks have fallen by as much as 20% from their recent highs. The only bright spot now is that oil in the global markets has started to cool down and drop from its highs, while stocks have also started to rally a little bit – but have yet to retake major levels.

The best comparison we could make right now is relating the great inflation of the 1970s to today’s situation. As with the situation back then, it could be safe to assume that a sense of control needs to be established in the US economy before we can see the markets start to shine bright again. Keep looking out for whatever developments happen moving forward as we could be at a major turning point for the markets.