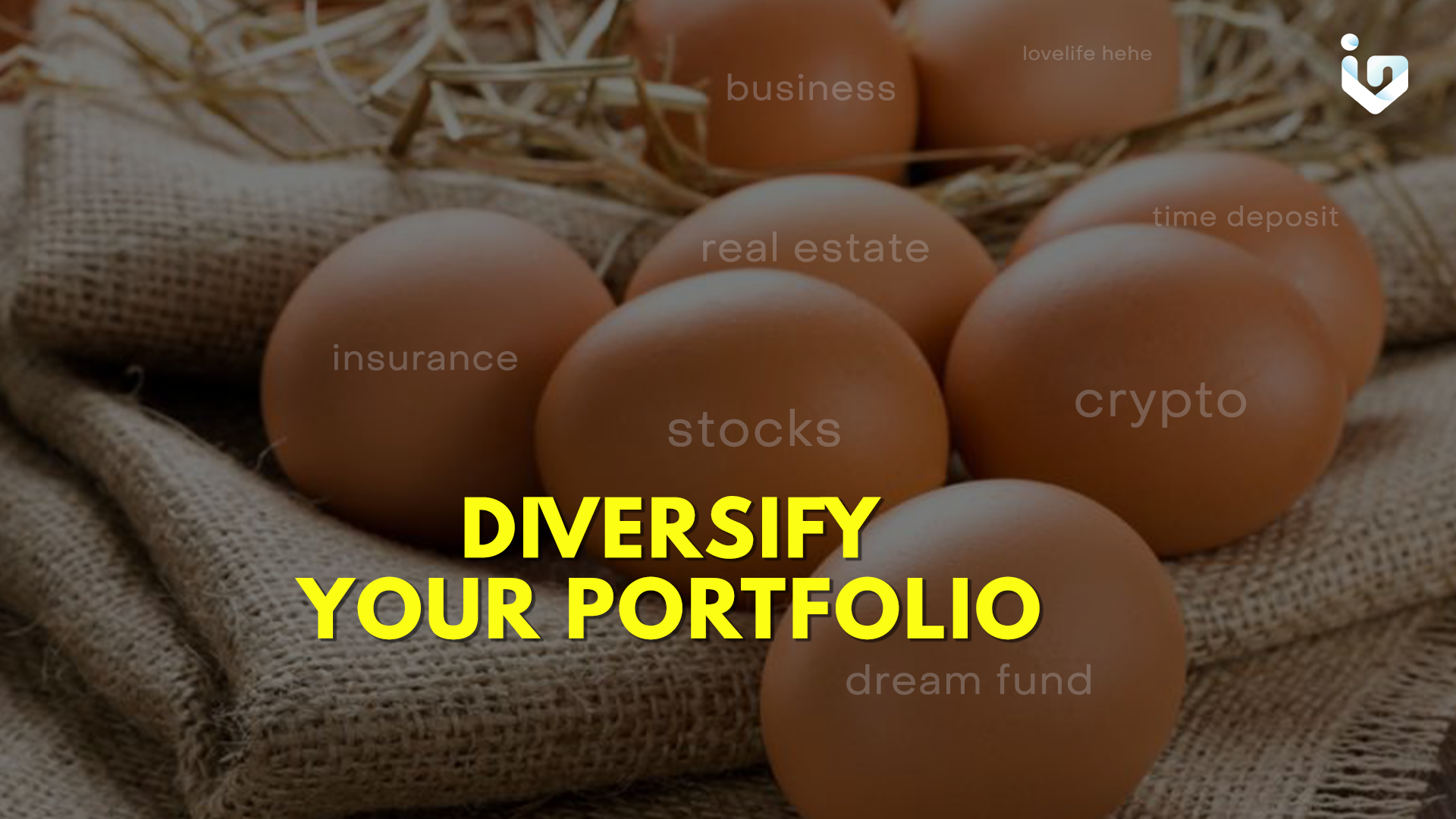

Ever heard of the term diversification? A common phrase heard in the financial world is “diversify your portfolio”. Many have heard it and the next phrase would come up, “is it important?” It’s actually key for most financial successes. So, let us explain why.

Diversification is the practice of spreading your investments around so that your exposure to one type of asset is limited. Essentially, if you have your money all-around, you’ll be able to cushion yourself for riskier investments with safer ones. By diversifying your portfolio, your risk and reward in your investment portfolio would be more balanced.

It reduces risk and is designed to help reduce the volatility of your portfolio over time. Most investment professionals agree that diversification is the most important component of reaching long-range investment goals while also minimizing risk.

Balancing a diversified portfolio may be complicated and expensive but there are many options to widen your diversification without having a difficult time. These options are specially designed for beginners or for people who would like to be more hands-off with their portfolio.

A great example would be found in mutual funds. There are so many choices to mutual funds to fit your preferences, goals, and needs. By investing in mutual funds like real estate funds, sector funds, and commodity-focused funds, you will instantly have a diversified portfolio.

Because market risk is generally unavoidable, diversification is a great way to soften the blow. In practical terms, diversification is holding investments that will react differently to the same market or economic event. Being able to invest in different assets reduces the consequences of a wrong forecast. This is very important in investing because markets can be volatile and unpredictable.

With this practice, you’ll be able to spread your risk across different types of investments, the goal being to increase your odds of investment success.