In the US Stock Market, traders and investors all over the world are always looking forward to the earnings season. It is an important period for traders and investors since publicly listed companies release their earnings report. It is announced quarterly.

The Earnings Season typically commences in January, April, July, and October. Although keep in mind that not all companies release their earnings at those dates, there are instances that some firms release between those dates since it ultimately depends on the given company’s quarter ends.

This period is crucial for a market participant as these earnings could either result in a gap up or gap down in price, depending on the quality of the report. It’s no stranger for traders and investors in the US Stock Market to experience these wild swings during the earnings season.

According to Mark Minervini, one of the best traders in the world, the best way to approach the earnings season, assuming that you own shares of a stock before its earnings release, is to simply sell all of your position if you do not have a profit cushion in the first place. If you have at least a 15-30% profit cushion, then you may opt to hold into earnings.

If for instance, you bought a stock at the long side, then you sold it before earnings, then the next day it gapped up, just move on and assess whether an opportunity represents itself. You can always buyback a stock whenever possible. You do not want any surprises. It is truly difficult to anticipate it, given the fact that a gap up or gap down could happen.

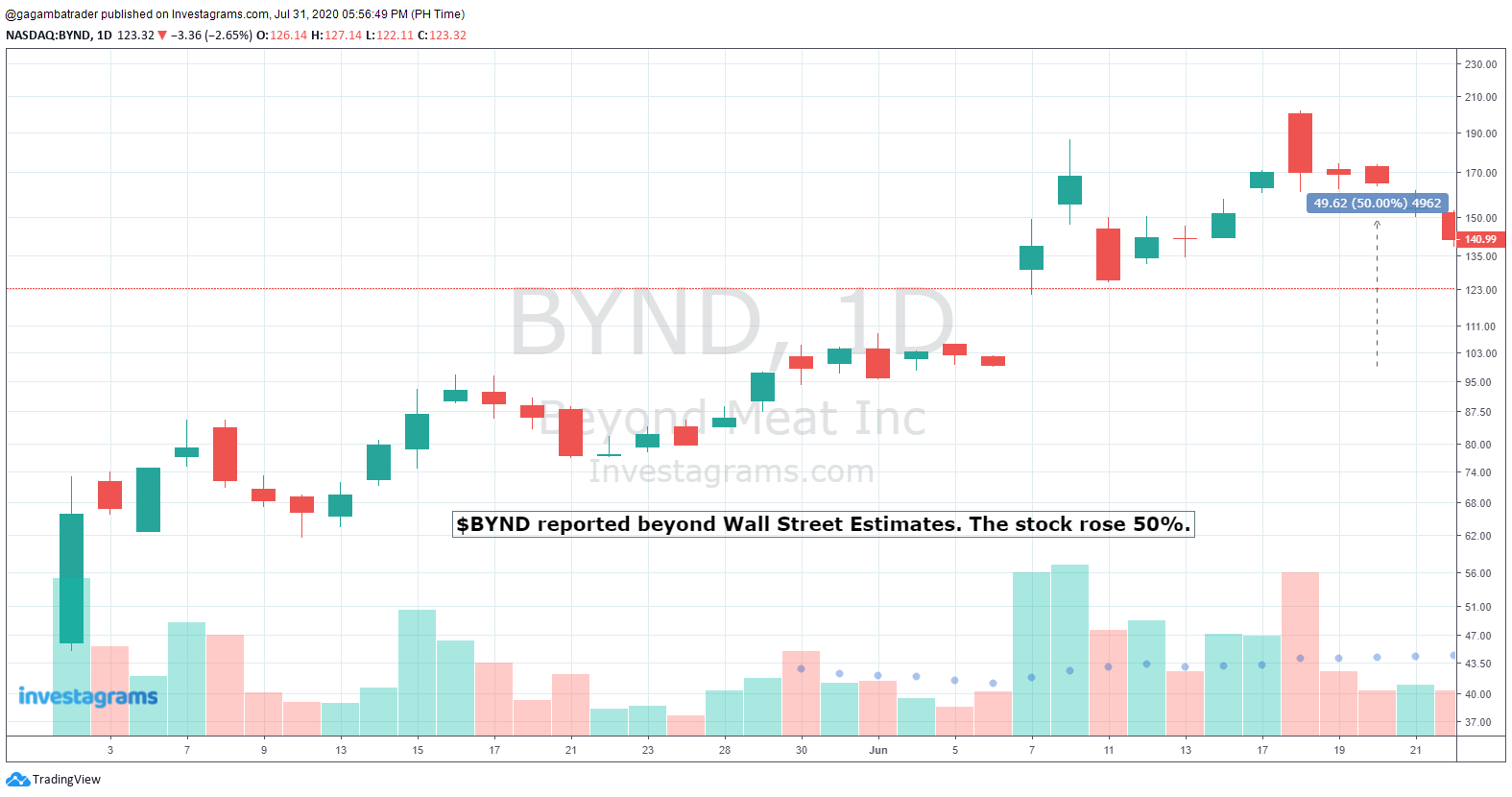

Here are some examples of stocks after earnings season:

Figure 1. $AMD Chart

Figure 1. $AMD Chart

Figure 2. $CHGG Chart

Figure 3. $TWLO Chart

Figure 3. $TWLO Chart

Figure 4. $BYND Chart

Figure 4. $BYND Chart

Figure 5. $INTC Chart

Figure 6. $SMAR Chart

Figure 7. $ZNGA Chart

As you can see, this does not happen in our local market. It is critical for a trader or investor who participates in the US Stock Market to be keen with the earnings season. It is a must to be prepared for occurrences like this. Per Mark Douglas, anything can happen, and we cannot influence what the stock price will do next.