Growing up as kids we may have found ourselves playing with crosswords, and some other visual puzzles that challenge our cognitive skills. More often than not, we look for clues and cues from context and previous dots that we have already connected.

This maze game for instance will surely keep most of us occupied for maybe more than a couple of minutes trying to solve and find our way out.

While we may have some fun at the beginning following the path laid out as shown, patience eventually finds its limits and we do one of two things. Either we quit; or move forward to find an easier way to solve it. Linear thinking as most of us tend to have tells us to do one simple thing – that is to start at the end and find the right path by process of elimination.

And as many who have lived before us have done, which is also probably life’s greatest hack, is to BEGIN WITH THE END IN MIND. The thought on its own may sound philosophical and perhaps even spiritual or esoteric, but the translation to practice is what we do all the time. Visualization is a powerful tool. And as Steve Jobs once famously said,

“You cannot connect the dots looking forward. You can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future.”

What we conceive is always what we achieve. Or at least try to. And unless you are of the belief that all in this world is totally RANDOM, our hopes, dreams and aspirations will usually begin with the VISION of “what ought to be”.

Thereafter we go back to reality, create a plan and find ways to make it happen.

In the arena of trading and investment, a prudent participant will always make due diligence studies prior to engaging himself to a specific activity. Best effort projections, and calculations based on available information, for the most part is the end game in any feasibility study. And the basic thesis that needs to be formed and satisfied is the probability that it will be a “potentially gainful” venture, before one will even take initial steps to proceed .

To further relate and break this down for equities, forex, and commodities traders, it essentially applies to the most rudimentary idea of finding proper ENTRIES and EXITS. And we all come to know that almost everything will not be always as what it seems.

Trading as many of us find out the hard way, may be as simple as it sounds but is easily the most difficult endeavor to be engaged in. The investment is not only monetary. Many would eventually come to realize, they have to be emotionally and psychologically invested as well.

SEATBELTS AND AIRBAGS

First mindset to instill before anything else is that TRADING is a business. We probably have seen a few who may regard it as more of a hobby, all because some friend or acquaintance egged him on. Nothing wrong with that. That’s how most of us started anyway.

Bear in mind though that while businesses are undertaken to EARN, a hobby will always COST. So if you’re just in it for the thrill and/or the novelty, you would be better off picking up some racquet sport or joining in some competitive event.

And following the idea of beginning at the end, a trader’s primary rule is not only look at what he or she stands to gain but more importantly, FOCUS on what is at risk or what the potential losses can be.

As any sensible trader or investor will tell you, the result of any trade SHOULD and MUST always only END as any one of the following:

- A small win;

- A small loss / break even, or;

- A BIG win.

Recent events in our history amplified the importance of prudent actions. Without the need to further rationalize being knee-deep into this era of the pandemic, the words “SAFETY FIRST” became ingrained in our consciousness and thrust itself to be of paramount importance.

In the investment realm we can equate this idea of instinctive survival to the all important concept of CAPITAL PRESERVATION.

Simply translated, the principles of risk management must ALWAYS be applied as all capital are limited. Although unlike the current protocols that we observe to avoid contracting and transmitting the virus, total avoidance is not an option in trading. The dynamics is such that we have to be constantly aware and engaged – either in an active trade or in search of set ups for one.

With the enough technical motivation, involving ourselves in a particular trade we see as potentially profitable is what it is all about. Not taking any chance when opportunity presents itself is actually the greater failing. After all, RISKS are inherent in everything and will always be present in all aspects of our existence. The impetus should just then be on properly managing them.

That said, you of course need a proven and tested METHOD; and a process that gives you an edge over time. Having a certain degree of mental fortitude in executing an actionable idea should always be a step in the right direction. But for now, let those be topics for another time.

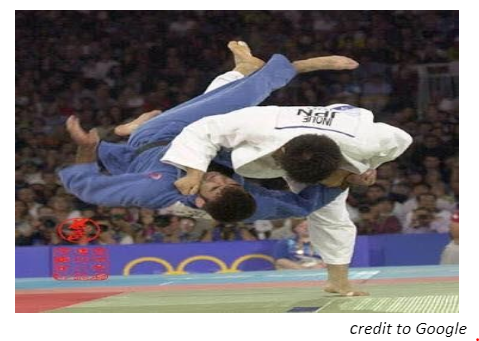

TAKING THE FALL is inevitable. But not all falls are equal.

A ten foot vertical drop onto a concrete pavement will definitely hurt more than if you just stepped and slipped on a banana peel while walking on grass. While not entirely unexpected, failures can and will happen from time to time. The trick is we have to train and prepare to endure them.

Defense should always take the forefront in all beginner’s lessons. In the Japanese art of Judo, your sensei would have likely started you off with the basics of falling. Simple roll offs from side to side, to dampening a fall after being thrown are almost always taught first to novices. The rationale is of course simple. As you cannot avoid hitting the ground for the most times you engage, the best you can do is not to get hurt. You have to be able to get back up for the next grapple.

To clarify the analogy, here are a few basic RISK MANAGEMENT concepts that should protect your portfolio and act as a bubble wrap for your trades:

1. Setting and executing STOPS.

Hands down it is the most important and basic component of any RISK management strategy. No trading plan should be without it. These identified and pre-planned price points for EXITS can be classified as any of the following:

- Cut loss

- Trailing stop

- Time stop

There are hundreds of references that a newbie trader can study up on to understand these generalized concepts and apply to their trades. While most active traders should already know this concept, the emphasis can never be undermined. Google is always our friend if you are still alien to the above terms. For now just believe me when I say that a properly placed stop will make certain that you live to trade another day.

2. Knowing the CONTEXT of your trade.

Almost anyone can become a trader of the equities market. It does not really matter if you have a small or large amount of capital in order to understand basic concepts of PRICE ACTION. And knowing the context of the trade you will be embarking on, is an input that is ever critical in order to be aligned with an acceptable MARGIN of SAFETY.

One of the first of the many cliches a newbie will hear is “the TREND is your FRIEND.” Overused in many forum and opinion posts, it is perpetual wisdom. Being a long-only market, the PSE investors know only too well that to make gains you need to BUY LOW and SELL HIGH, or at least buy high then sell higher.

From a perspective of a prudent, and safety-conscious trader it simply IMPLIES to take positions only in names that are trending UP.

As one of the not-so-few who had it good during the bull market that kicked off in circa 2009, it meant buying anything that moved. And because a “high tide lift all boats” (yes, another cliche’), most of the time, entries in uptrending stocks did not play too much critical importance.

While a seemingly wrong entry might stall enthusiasm for a bit it should not matter for too long. In the end, the drawdowns (or negative portfolio values) as a result of PULLBACKS or corrections will cease to exist as the UPTREND resumes. Eventually it should conquer higher price levels the way we want them.

But wait. There’s more.

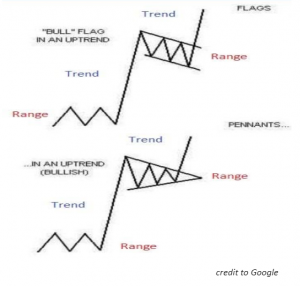

Even in an established trend (up or down), the trade context will alternate to the more time-consuming phase of price action, that we call a RANGE or consolidation.

Simply put, it is an area where price settles for a while. This is also the zone where the previously identified SUPPORTS and RESISTANCES are either re-defined or re-established.

Of course price action that constantly moves higher is what most of us desire to be locked onto. However as “divergences” will occur as a result of relative rapid price expansion, we cannot disregard the fact that a transition to a “boxed” or ranging price action is inevitable.

All depending on where you entered, a range more often seen as a correction may also viewed in a couple of other perspectives, namely:

a. An opportunity to enter or add to positions at a relatively lower / safer level – range price action offer pullbacks and redefines support and resistance. This eventually evolves as either a FLAG or a PENNANT which are what we call CONTINUATION patterns. It allows other participants to come in while others liquidate for reasons of their own making (profit taking, cutloss, or time stopped).

b. Range trading idea – on the transition to the RANGE context where a new “support” is defined by way of the crowd buying or buying back into at specific price points, a RANGE TRADE may be initiated. Meaning, buying near said new range support then selling into or near the established resistance of the recent high. As mentioned, range context is more time-consuming as all correctives are. Typically they take at least near twice the time of the trending move. In Elliott Wave Principles, the idea is estimated by way of Fibonacci Time measurements. What is implied here, is that a RANGE trade may also be considered where you buy near supports of the range and sell near the resistance of the range.

As this can go on for more than a few times, it’s a WASH, RINSE, REPEAT idea. And surely, it can also be most profitable. The important mindset to take here is that price action is only in a range – UNTIL IT IS NOT.

3. Knowing your REWARD TO RISK ratio.

Not really a cliche but sounds like one is another primary rule for traders, “BUY NEAR SUPPORTS, SELL NEAR RESISTANCE”, is hands down the most important one to achieve profitable trading. Either in the context of the general trend or inside a range trade, this is a must know for everyone.

Necessarily of course, one should need to have properly identified the major price points that attract most buyers (supports), and the levels that entice holders to turn sellers (resistance) aiming to lock in profits.

And the widely accepted rule of thumb is to take only trade positions with at least a 3:1 ratio.

This again simply means that for every one unit loss you are willing to take, you must at least have the prospect of gaining three (3) times that said amount. Another translation would be for every one peso you are willing to risk (as a loss), you should at least find that there is the potential of gaining three pesos (as profit). Naturally, a higher R/R or reward to risk ratio is more desirable.

And the simple formula:

Target price minus BUY price / BUY price minus STOP.

For example:

If you bought XYZ stock at 0.95 and have a set stop at 0.85 with a target price of 1.25, your R/R will be:

1.25 – 0.95 = 0.30

0.95 – 0.85 = 0.10

= 0.30/0.10

Reward to Risk ratio = 3.0 x

Again, this cannot be overemphasized. A good R/R is ALWAYS the key to profitable trading.

4. PROPER POSITION SIZING

Does the term “ALL IN” sound familiar to you? If there is such a thing as a mortal sin in trading, it would have to be taking too big a position size upon entry.

If you are doing some kind of project of entrepreneurial orientation, it would be highly unlikely that you will spend your entire budget for said venture in a single release or in a one time pre-payment term.

It does not matter how much of a sure thing you may think it is. Sound principles dictate that you may want to test the waters first, and perhaps give only a small down payment. And as the project goes forward, gradually increase your exposure as you gain more confidence in its ability to progress smoothly.

It is no different in investment or trading. Proper risk management necessarily involves proper position sizing and limiting risk of losses. Most experts opine that one should not risk more than 2% to 3% for every trade, and no more than 6% of your total portfolio.

A good practice is to buy in tranches of maybe 3 to 4 portions of your allocation. It may be in equal portions or in certain percentages of your allocation for a certain stock. This way, exposure and risk will be limited to a small percentage especially at the beginning of a trade or in the initial entry. There is a lot of literature and on the topic of position sizing, and a good one you may come across with are the writings of Van K. Tharp. (as shown here). It might be overwhelming at first but the ideas and concepts are well worth the nosebleed.

The size of allocation for each stock in your portfolio must also be properly managed. Portfolio-based investors usually do periodic reviews based on their set metrics and will actively facilitate re-balancing on a regular basis. This practice assures that only winners are maintained and the laggards and losers are promptly removed.

As a simple measure and gauge that you are properly position sized, market veterans will only have this to say,

“You must be able to sleep soundly at night.”

And finally as a recap of how to best protect your investment as a trader, this image of a recent scene in the series of unfortunate events so far for 2020 should be fitting and will remind you of the best risk management practices that every one of us must adopt and embrace.

I am pretty sure you get the picture.

Contributor:

Name: Jojo Gaston

Investagrams Username: @JojoGaston0

About the Contributor:

Jojo Gaston is a partner/mentor at BoH Society, an online trading support group that provides traders’ education, and data-driven trading format for local stocks, forex, and other foreign markets.