In my previous article, When is the Best Time to Invest? where I discussed when is the best time to invest, I made it clear that buying fear and selling greed does not apply all the time.

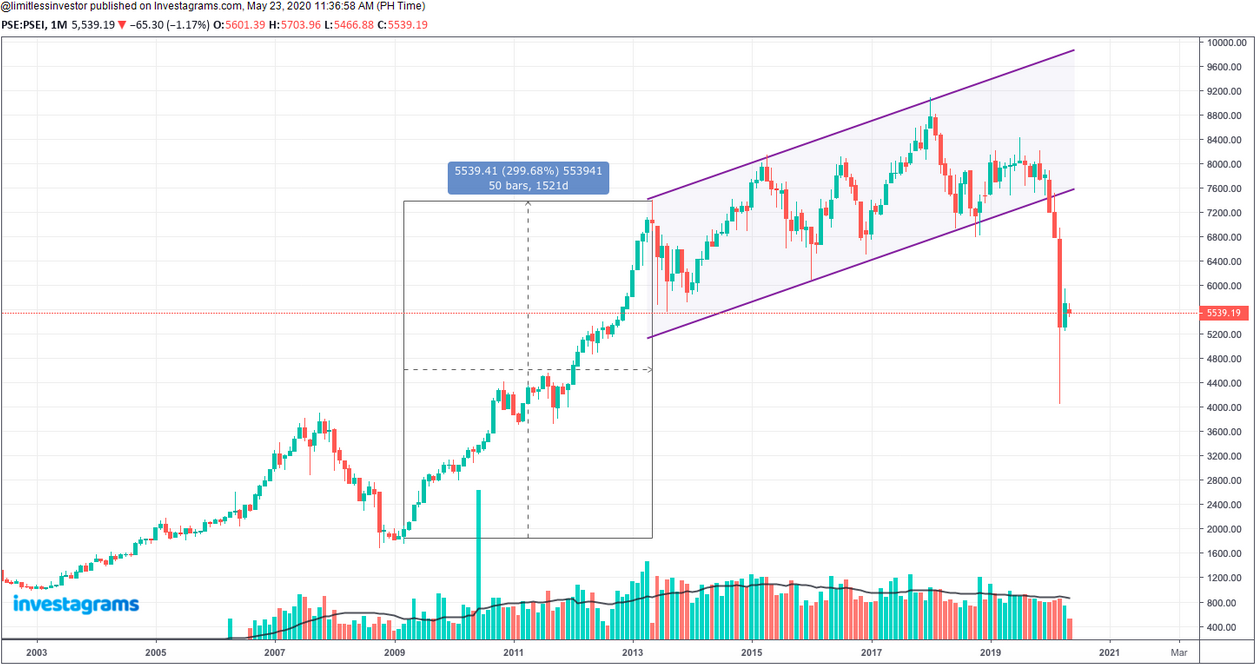

The $PSEi has enjoyed a long run bull run from 2008 bottom-up until middle of 2013 posting a +300% from the bottom. But still hasn’t changed the trend from 2013 to 2018 and just resulted in multiple pullbacks.

The country pre-Covid19 was one of the top producers of millionaires. These are not just peso millionaires but in dollars as well. With an economic boom of the rich getting richer, money flows from one place to another. Thus producing more millionaires along the way and this growth is attributed as well to stock market gains.

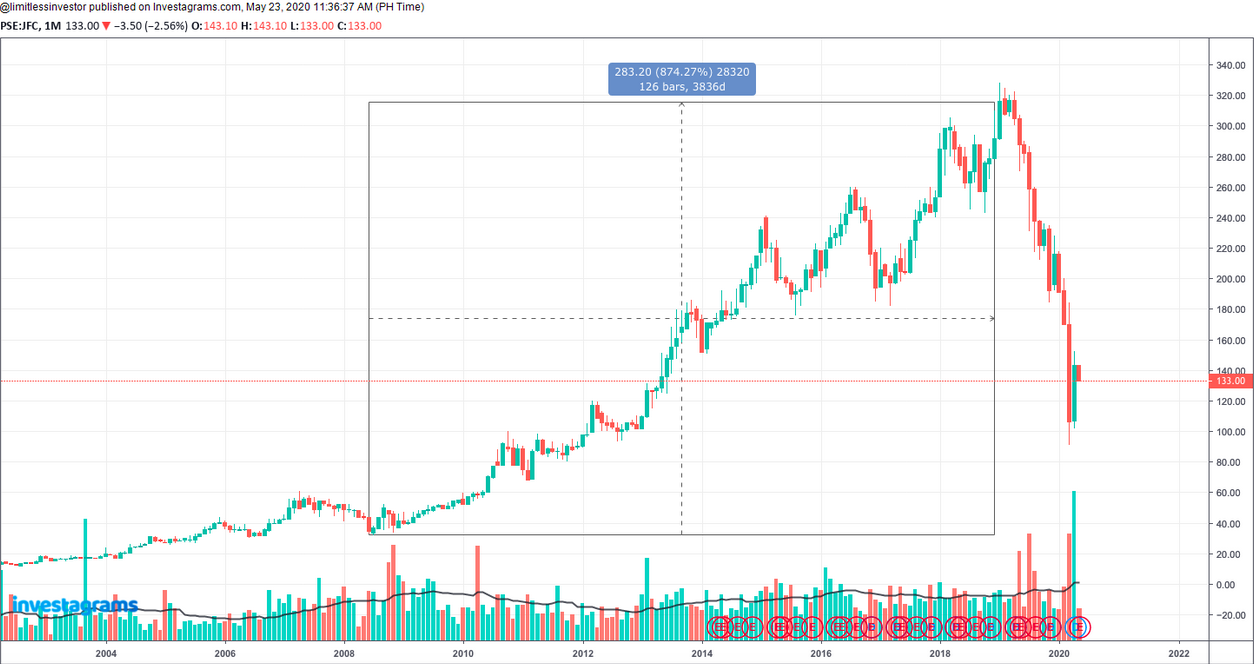

One of the most popular brands and stocks, Jollibee ($JFC) gained more than +800% from the bottom of the 2008 crash till its peak in the middle of 2018. A capital of Php100,000 invested in this stock would have become Php900,000 in just 10 years if one sold in the middle of the 2018 peak.

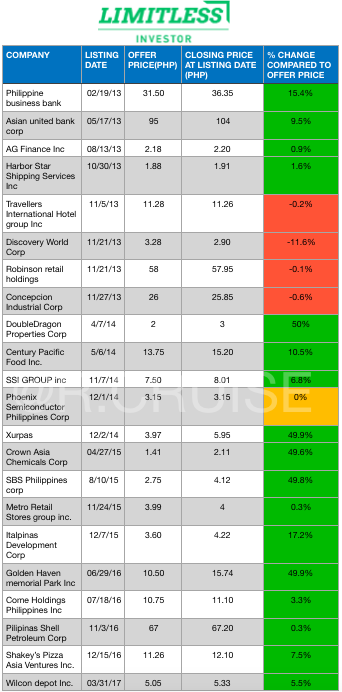

As posted in the previous article, in a bull market when everyone is earning and everyone feels like a genius including myself, you will hear a lot of success stories made from the surge in stock prices. There have been many successful IPOs (initial public offerings) such as Wilcon ($WLCON) trading from Php5 now at php15.28 as of the posting of this article. That resulted in 200% gain.

But it’s not Christmas every day. There are also recent IPOs that did not materialize positively. Such as Axelum ($AXLM) from its IPO price of Php5 is now trading Php2.75 as of this posting which resulted in -41% loss. Another example would be $DMW, a property company with an IPO at around Php12 to now trading Php6.50 as of this posting. That resulted in a -50% loss in value.

Most IPOs come from a bullish stance. When a company wants to list in a stock exchange, they either want/need to get more funding or pay the debt. They are bullish that the public will buy shares of their company. We had 22 IPOs on record from 2013-2017 and based on their first trading day out of the 22 stocks on average it returned 14.3% on the 1st trading day. There are 17 issues up including Wilcon which was mentioned in this article.

One of the IPOs in the table mentioned was $CHP or Cemex Holding Philippines. A cement company that decided to go public due to the BuildBuildbuild (BBBx3) program of the administration anticipating that demand for cement will be high.

On its first trading day, it reported a 3.3% gain. It was trading around Php11 in 2017. But as of this posting, it’s trading close to Php1. From its IPO price to the current trading price it has now resulted in more than -90% loss. Imagine being a director and shareholder of a company you helped build, but your investment in terms of paper value has already lost -90% if you held since the stock went public.

There are more cases like this, for this example, a big name like SHELL ($SHLPH)

Not all stocks go to heaven. Cheap stocks can get cheaper and at the same time expensive stocks can get more expensive regardless if indicators are showing signs of weakness and/or overbought level. See $MAC and $HOUSE charts above.

In conclusion, risk management is the name of the game. Whether in stocks or other assets like real estate, commodities, paintings, cryptocurrencies, etc. It is important that you must know when to exit your investment or trade when it goes against your initial bias.

You need to understand the risk you’re taking relative to the potential reward. Do your own research so you can make INFORMED decisions. It’s not Christmas every day and nothing is permanent. This current Covid-19 crisis has wiped out a lot of wealth globally. The only thing we can control are our emotions and risk.

Contributor:

Name: R. Cruise

Investagrams Username: @limitlessinvestor

Channels:

www.investagrams.com/Profile/limitlessinvestor

www.facebook.com/imlimitlessInvestor

www.instagram.com/limitlessinvestor

https://t.me/limitlesstraders

www.tradingview.com/u/Limitless-Investor

www.youtube.com/channel/UCTAuxhwjliCGHBsPNQx32Xw

About the Contributor:

Limitless Investor / R Cruise – Elliottician, private fund manager, and cryptocurrency liquidity provider. Trading for 6 years already but considered a true trader for the previous 3.5 years only as he believes that a true trader must have gone through and traded a bear market. Whether in the long or short side is profitable. Specialty in reversal trades, psychology combined with Elliott Waves and fundamentals.