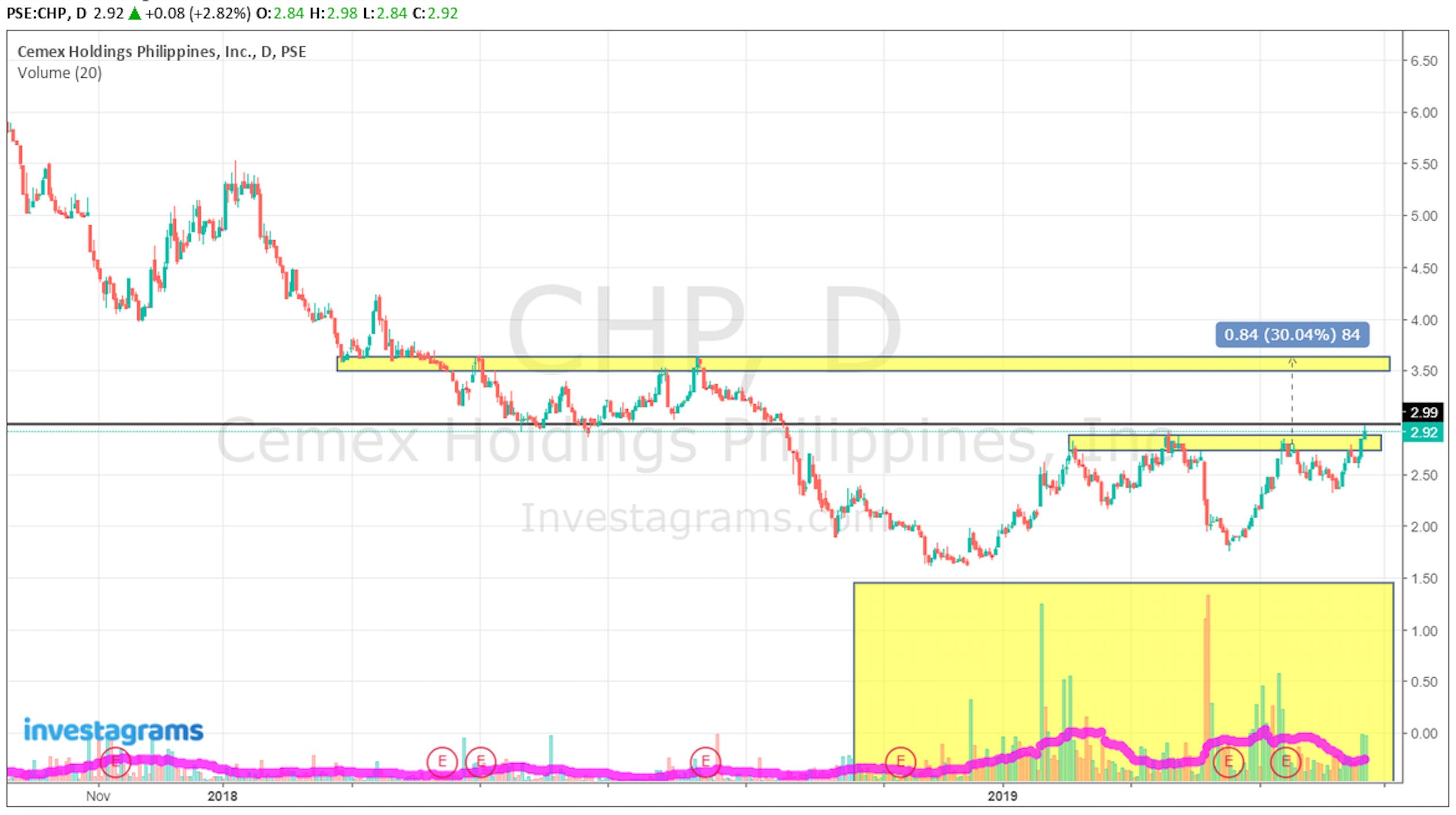

Congratulations to K E R L O, also known as @carlosamonte, for spotting $CHP (Cemex Holdings Philippines, Inc.) 17 days before it even formed its Inverse Head and Shoulders bullish reversal pattern! He notes that there could be two possible ways to enter the stock: either at the 0.5 or 0.168 Fibonacci levels for aggressive traders, or at the breakout of the neckline at 2.80 for those who want to wait for confirmation.

Initial Spot:

A few days after:

Here’s what happened a few days after Carlo posted his initial view on $CHP. He noted that if you weren’t able to catch the dip towards support levels, it’s okay since that would’ve been a very risky and aggressive buy. Carlo reiterates that the next optimal entry is the breakout from the Inverse H&S pattern at 2.80 area. He also gives everyone a very important reminder, if you planned to purchase $CHP when it broke out, then you should also practice proper risk management and place your stop below the breakout level. Lastly, he says that possible take profit areas would be 3-3.20, then possibly 3.40-3.60 levels.

On Technicals:

Currently, $CHP has already broken out of its Inverse H&S pattern on above average volume. Taking a look at a longer-term view, we can see that the volume activity since the end of 2018 is MASSIVE compared to the months prior, indicating that a reversal, or at least a counter trend rally, may be brewing. Take note, $CHP is still in a long-term downtrend. There’s still a ton of overhead supply since there are still trades holding on to losing positions which may act as a resistance as prices continue to climb higher. So, unless there’s a significant catalyst that indicates a reversal, a swing towards 3.50-3.60 levels may already be a good area to trim majority of your position.

Kudos again to Carlo for spotting the $CHP more than two weeks before the Inverse Head and Shoulders pattern was completed. Your FREE one-month InvestaJournal will be accessible to your account soon! Let’s all keep an eye on this stock this coming trading week to see if it can potentially break the 3 pesos resistance.

Congrats also to everyone who was able to ride his analysis – you possibly gained around 25% coming from its bottom at 2.32 and last Friday’s close at 2.92 or it’s breakout!