An index is a collection of securities that represent a certain market, sector, or asset class. For example, the $PSEi consists of the top 30 companies in the Philippines. On top of this, it aims to reflect the state of the economy. However, since a lot of things can happen over a span of time, index rebalancing are done in order to better reflect economic progress.

What is an Index Rebalancing?

First of all, an index is made when stocks are bundled together. These stocks are called the constituents of the index, and the index aims to track the price changes of the entire group.

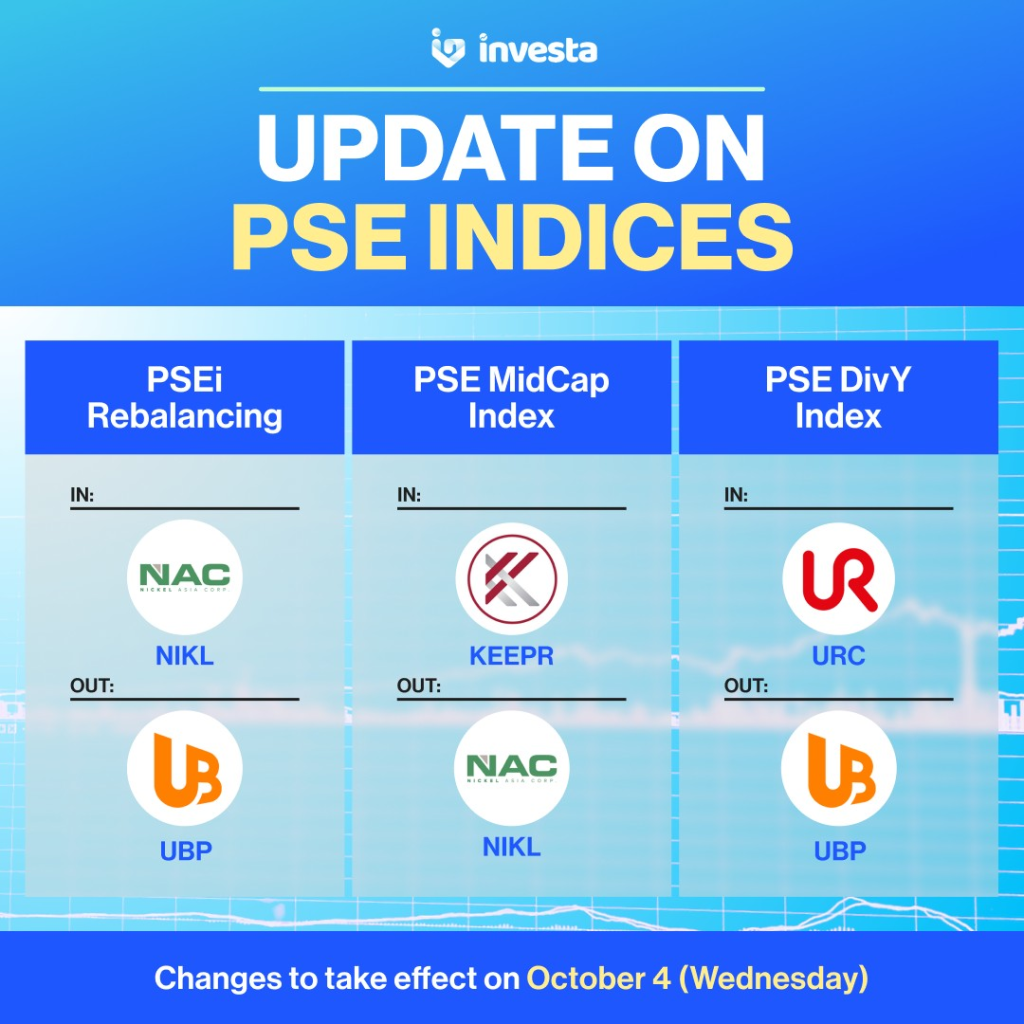

Index rebalancing refers to adjusting the weights or composition of the securities in the index on a regularly scheduled basis. The frequency and method of doing so depends on the type of the index. For the Philippine index, the goal is to track the biggest 30 companies with adequate representation from each industry. The index also takes into account the free-float of the stock. The $PSEi usually rebalances stocks. An index rebalancing of the $PSEi is done as the free-float adjusted market capitalization of stocks change.

Why is an Index Rebalancing Important?

Index rebalancing is important for several reasons:

- It ensures that the index reflects its intended market segment or investment theme accurately and consistently over time.

- It prevents the index from becoming too concentrated or skewed towards certain stocks, sectors, or regions that may have performed well or poorly in a given period.

- It reduces the tracking error and improves the performance of index funds or exchange-traded funds.

- It provides opportunities for investors to buy low and sell high by rebalancing their portfolios in line with the index changes.

What are the Challenges of Index Rebalancing?

Index rebalancing also involves some challenges and costs, such as:

- Transaction costs: Rebalancing requires buying and selling securities for funds, which incur commissions, bid-ask spreads, and market impact costs. These costs can reduce the net returns of the index and its followers.

- Market timing: Rebalancing can cause price distortions or volatility around the rebalancing dates due to increased trading activity.

- Information leakage: Rebalancing may reveal information about the index composition or methodology to other market participants, who may exploit it for arbitrage or front-running purposes.

How does this affect your portfolio?

If you are an investor in the Philippine stock market, the biggest thing you have to take into account is that price action will often be affected by impending rebalancings. Before the announcement, stocks that are about to be dropped tend to sell off even before the news comes out. Likewise, stocks that are about to be included can experience increased buying. The adage “buy the rumor, sell the news” often comes true with rebalancings locally. As such, make sure to pay close attention to how prices move as an index rebalancing nears,

Your trading or investing activities shouldn’t revolve entirely around them, but paying attention to them could help you save money from some losses, or even take advantage of bullish price action!