iAmLimitless, a.k.a @transpire, is spotlighted for this week’s featured trader! Spot how he used his indicators in order to set up a clean entry and exit in his trade in $MREIT.

A clear entry and exit strategy in stocks is important because it helps investors make informed decisions, manage risk effectively, and avoid emotional decision-making.

Let’s examine how @transpire utilized his indicators to create a defined trading setup.

ANALYSIS FROM @TRANSPIRE

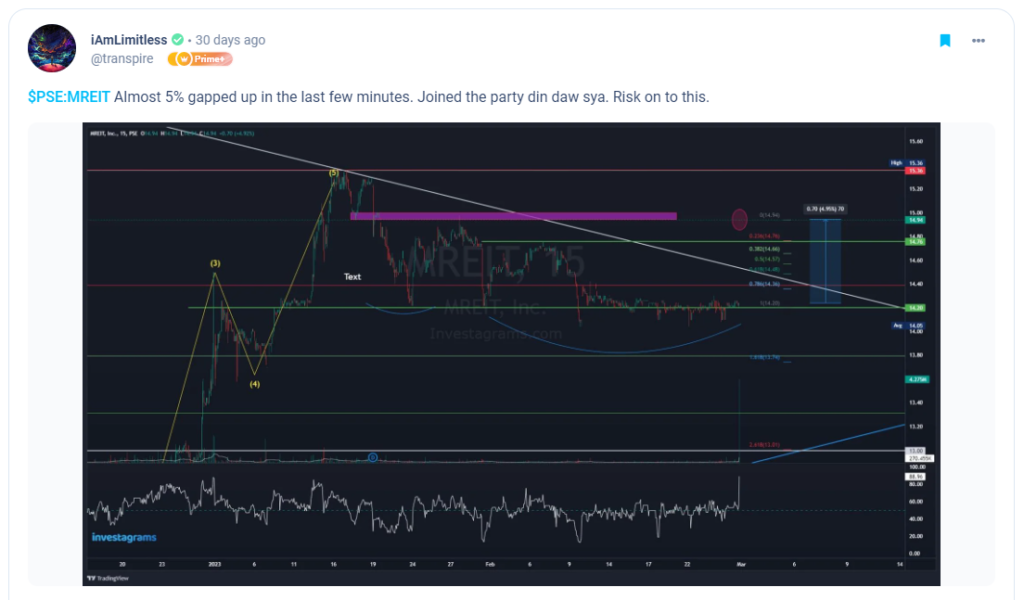

From @transpire’s post, it can be seen that $MREIT is ranging in its support level at the 14.20 level. From here, @transpire spotted that the stock is forming a rounded double-bottom pattern which is often seen as a bullish sign, indicating that the stock has reached a support level where buyers are willing to step in and push the price back up. With a good entry pattern, @transpire’s next goal is to find a good exit, which he found in the stock’s resistance at the 14.94 level.

On the same day, $MREIT soared in price and reached a high that exactly hit @transpire’s exit at the 14.94 level, increasing by about 5%.

TECHNICALS OF THE TRADE

In order to attain a clean entry and exit on $MREIT, @transpire utilized the rounded double-bottom pattern and simple Support and Resistance (also known as S/R).

A gradual and rounded shape variation of the classic double bottom pattern is known as the rounded double bottom pattern, which is commonly observed in stock charts. The pattern appears when the stock price drops to a particular level, rebounds, drops again to the same level, and then rebounds again, resulting in two troughs at nearly the same level, forming a “U” shape on the chart.

Traders and investors can utilize the rounded double-bottom pattern to discover possible buying opportunities in stocks, as well as to set price goals and stop loss levels. Like any other technical analysis pattern, the rounded double bottom should be used with other kinds of analysis. It should be independent of the primary basis for trading choices.

Support and resistance are two crucial concepts in technical analysis used by traders and investors to identify potential price levels where a stock may encounter buying or selling pressure. In @transpire’s setup, he used resistance in order to find a clean exit. Resistance is an important level in technical analysis that can be used to set a sell signal in stocks. When a stock price reaches a resistance level, it is expected to encounter selling pressure, as the supply of the stock is stronger than the demand at that level. Traders and investors may use this as an opportunity to sell their positions, as they expect the stock price to fall from the resistance level.

FUNDAMENTALS OF THE TRADE

MREIT Inc. has announced that it has obtained regulatory approval to transfer four grade A PEZA-accredited office properties worth P5.3 billion from its parent company, Megaworld Corp. The properties are located in McKinley West and Iloilo Business Park and include Festive Walk 1B and Two Global Center in Iloilo Business Park, as well as One West Campus and Five West Campus in McKinley West, Taguig City.

MREIT will exchange shares for the buildings in the new acquisitions, which will have a total gross leasable area of 44,567 square meters. This will increase MREIT’s asset portfolio by 16 percent to 325,000 sq.m. in GLA from the current portfolio of 280,000 sq.m.

MREIT also stated that as of the end of 2022, the four prime office properties have an occupancy rate of 96 percent, which is significantly higher than the industry average of 80 to 81 percent. The properties will be exchanged for 263,700,000 primary common shares at P20 per share, representing a 41 percent premium over MREIT’s current price of P14.20 per share on March 24, 2023.

Kevin Tan, MREIT’s president, expressed his optimism about the asset infusion, saying that it will help drive growth. The high occupancy rate of these buildings is proof of the quality of MREIT’s assets and strategic locations. The company has already started booking revenues from the assets since January, and the properties are expected to increase MREIT’s dividend payments to its shareholders.

WHAT SHOULD BE YOUR NEXT MOVE

Currently, $MREIT is pulling back after hitting its local resistance at the 14.94 level. When a stock is pulling back, it can be a concerning experience for investors. It is important to take a step back, evaluate the situation, and make informed decisions based on the available information. You can easily navigate the situation and make informed decisions by being patient, analyzing the reason for the pullback, reviewing the investment strategy, remaining disciplined, and focusing on the long-term goal.

Once again, KUDOS to @transpire for being this week’s featured trader! Enjoy your 14-day InvestaPrime Access and continue to be an inspiration to the trading community.

Aside from your real-time PSE data access, let’s make your stock market journey easier with InvestaPrime!

For as low as P324, you can easily scan over a hundred stocks, set price alerts and have an automatic list of leading stocks to access in just a few taps:

Subscribe to Prime today!