2022 has been shaky for traders and investors alike. From time to time, we were given glimmers of hope. However, the markets had other plans as any ground gained by equities or crypto alike would only be given back. Overall the majority of market indices failed to break out of their downtrends. Nonetheless, opportunities were still present throughout the year. Traders needed to be quick and decisive to profit from the markets. The chances to make a trade this year were mostly niche or in volatile movements. Let’s take a look at the market’s 2022 highlights!

What happened in the markets this 2022?

Inflation vs. the world

Throughout the year, almost everyone was fixated on inflation – and for good reason. Prices of goods and commodities soared at a historically fast pace. Whereas inflation usually takes years before citizens start to take notice, this year we all saw the cost of goods and services increase in what felt like an instant.

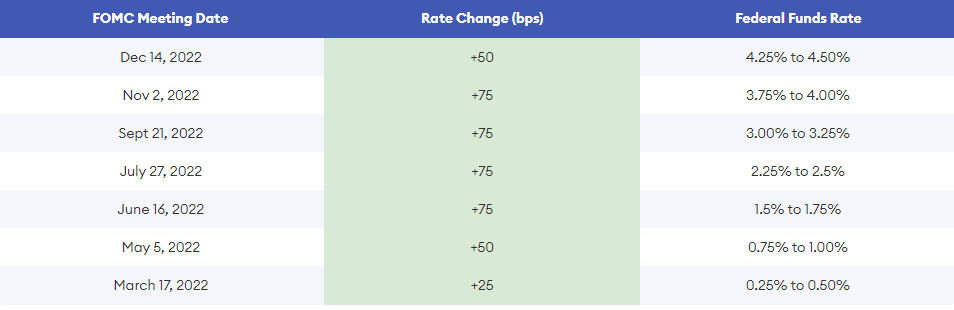

This has also been the main reason why the majority of markets slumped. To stop inflation, central banks had to hike rates aggressively which caused investors to steer away from stocks and even cryptocurrencies. Notably, the U.S. Fed raised rates by a total of roughly 4% in just one calendar year. With liquidity getting sucked out of the markets, the majority of risky assets have yet to come back from the waves of selling.

The crash of different cryptocurrency institutions

2022 also saw cryptocurrencies face multiple challenges. Early on in the year, everyone was shocked to see $LUNA prices fall sharply. As the protocol was forced to reduce interest rates, an exodus of capital occurred as investors no longer felt confident in the token. The fraudulent and manipulative activities of the co-founder and CEO Do Kwon later on came to light and confirmed that something was indeed wrong.

As cryptocurrency prices continued to slump lower, different firms started having trouble staying alive due to financial problems. 3AC, and the more recent FTX, were both big players in the industry that collapsed as they faced liquidity problems.

Despite the rough times, the industry as a whole is still alive. Binance notably started an emergency fund to help struggling enterprises get through the bear market. Saying that everyone needs to help each other now more than ever, the exchange is hoping to keep the industry alive and going.

While it seems like most of the news this year was gloomy, of course, there were still some bright spots in the market. As always, if you look hard enough there will always be profits to earn.

Top Stocks

In the local markets, there were a few noteworthy names that performed well this 2022.

$ABA (118.48%)

Throughout the whole year, $ABA led the local markets. While other stocks were going lower and lower, $ABA kept on making new highs. As investors were hoping for positive developments, share prices kept on rising. Even after the stock’s recent decline, $ABA still has the highest YTD in the Philippine market with a 118.48% gain throughout the year.

$SCC (61.12%, 47.86%)

Along with $ABA, $SCC was one of the few stocks that showed relative strength early on in the year. Throughout the bear market, the stock barely wavered. It would retest its 50-day moving average only to make new highs once more. As coal prices soared in the commodities market, $SCC saw its valuations increase as it was a direct beneficiary. However, the trend recently snapped after the release of dividends caused investors to lose interest in the stock. Nonetheless, $SCC still gained a big 61.12% throughout the year.

$DMC (47.86%)

While $DMC and $SCC were very correlated throughout the whole of 2022. With $DMC being the parent company of the latter, it benefitted from the rising prices of coal which caused its share prices to rise. However, the two lost their strong correlation with $DMC outperforming $SCC in recent weeks. Analysts have noted that $DMC has shined with a good performance in the properties sector despite interest rates being at elevated levels. Although having a lower 47.86% YTD, $DMC still has its momentum intact and might look to make higher highs this coming 2023.

As for the U.S. stock market, most tech stocks got hammered this year. FAANG stocks are down by more than 20%, with other tech names falling by as much as 60%. The bright spot for the U.S. markets was in the energy sector, as some issues showed resilience.

$STNG (322.01%)

As the Ukraine-Russia war saw supply chains get disrupted, oil tankers were in a good position to see increased revenues. $STNG took advantage of this and used the increased profits to gain a better financial position. Throughout 2022, they lessened their debt which led to cash balances more than doubling. Overall, $STNG saw share prices grow by more than 300% and it looks like momentum is still strong for the stock.

$TRMD (285.30%)

Another oil shipping company, $TRMD saw the same success as $STNG this 2022. $TRMD experienced net profits grow exponentially, which allowed them to shell out record-high dividends to investors. This wasn’t left unnoticed as share prices grew by as much as 285.30% throughout the year.

$FSLR (79.84%)

Outside of stocks benefitting from the oil crisis, solar stocks also gained some ground this 2022. $FSLR was one of the bigger winners in the industry as it got added to the S&P 500 index. On the back of solid valuations and a movement towards renewable energy, share prices gained 79.84% over the year.

Looking back

2022 was a tough year for everyone. However, it shouldn’t be taken for granted as the markets gave us unique ways to make a buck. Traders and investors that succeeded in this bear market were mostly those who were dedicated to finding opportunities and were quick to act. As for those who weren’t as successful, there were plenty of lessons to be learned. Lessons that can’t be found anywhere outside of real-world experience.

The beauty of the markets is that there will always be opportunities in the future, so whether or not you were successful this year – the 2023 markets will surely present puzzles for us to solve and get past.

TRACK FOREIGN FLOWS ON INVESTAGRAMS

Find a new edge in the market. With the Foreign Flows feature, you can:

See what foreign funds are buying and selling

See the foreign funds composition in stocks you’re monitoring

Check out our foreign flows tracker here: https://www.investagrams.com/Stock/ForeignFlows