Let’s give a round of applause to Mercurial for being this week’s Featured Trader!

Mercurial has only been a member of the Investagrams community since 2020, but that hasn’t stopped him from becoming a very active member. He constantly shares his own views and opinions on his trades, and really anything happening in the markets.

A couple of weeks ago, Mercurial posted one of his trades in PSE:EMP. Emperador is a liquor company that mainly sells brandy products famously known in the Philippines for being affordable, but still great for hangouts. Mercurial saw an opportunity to trade a reversal, and his preparation and efforts paid off as PSE:EMP had a strong price run recently.

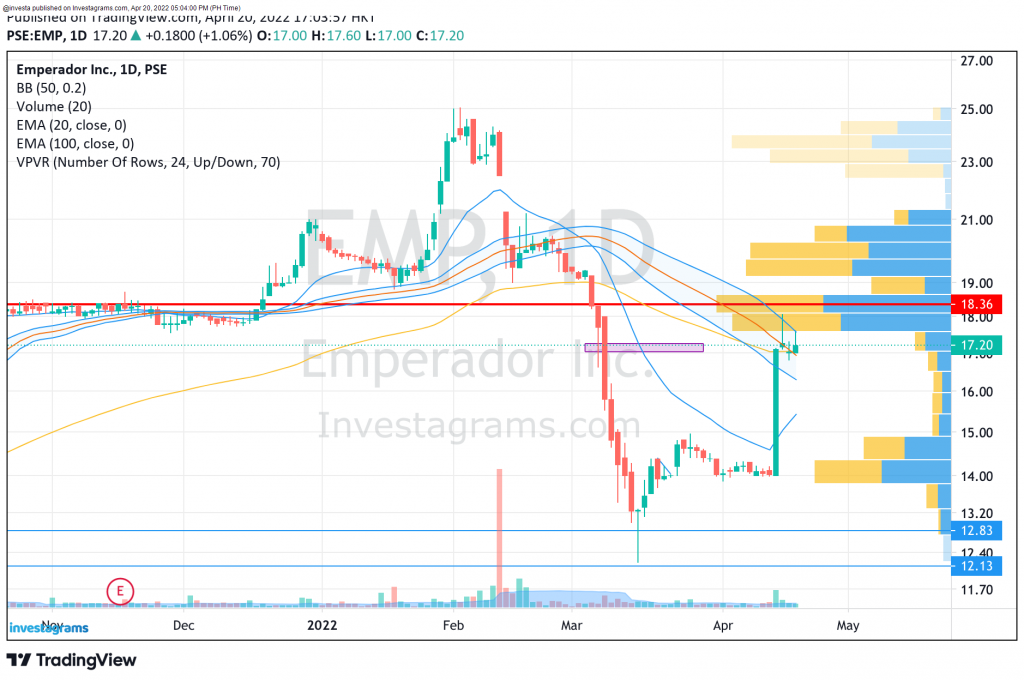

After a broad market sell-off, select stocks started to bounce back. PSE:EMP took a bigger beating than the rest as the stock experienced multiple days of big red candles. The downward momentum was very strong until price hit a brick wall at the 12.00PHP/sh support level. The stock then experienced an onset of buyers, forming what looked to be a reversal. Although it took a while after the technical pattern formed, PSE:EMP completed an inverse head and shoulders pattern and broke out all the way past 17.00PHP/sh price levels.

TECHNICAL STANDPOINT

In terms of price action, PSE:EMP came from a strong downward move. As the price was going down, traders started to wonder when the stock would bounce. After a long while, hope came when a bullish divergence appeared right as PSE:EMP right as prices came into the major resistance around the 12 peso per share area. As prices started bouncing back, an inverse head and shoulders was forming. Usually a sign of a reversal, an inverse head and shoulders is completed when the neckline resistance is broken. It took a while for the stock to really surge after breaking through the neckline, but the wait was worth it as the stock price reached levels as high as 17PHP/sh. This is the ideal target for PSE:EMP as this was a resistance level where a lot of trading volume occurred.

FUNDAMENTAL STANDPOINT

PSE:EMP is the liquor company of Andrew Tan’s Alliance Global Group. A staple in the Philippines, Emperador is well known for its product Emperador Light, an affordable brandy that is in almost every inuman in the Philippines. Aiming to grow bigger, Emperador is planning to go global as they will introduce their products to new markets. In order to fund their efforts, they will do a secondary listing, but on the Singapore Exchange, where they expect to raise up to PHP1.5B through proceeds.

What should be my next step?

As PSE:EMP is already at a big resistance level where a large amount of transactions occurred, many are already looking to lock in profits, or maybe even sell all of their shares. For those who haven’t gotten any shares yet at lower prices, it might be wise to wait and see how the markets will unfold in the coming weeks. As there are a lot of headwinds for the Philippine Stock Market, there is a lower chance for breakouts and surges to keep on moving in the same direction as compared to when we are in a bullish environment. The key behavior to look out for should you want to enter, or re-enter, in PSE:EMP would be to see how prices are reacting around the major resistances from PHP18.00 – 20.00. The best case scenario would be for prices to consolidate above broken levels and to possibly creep up higher in anticipation of the company’s foray into the global market.

Once again, KUDOS to Mercurial for being this week’s Featured Trader! Enjoy your 14-day InvestaPrime Access and continue to be an inspiration to the trading community.