Let’s give a round of applause to DG Capital for being this week’s Featured Trader!

DG Capital has been a member of the Investagrams community since 2018. Whenever he posts on the platform, he always provides valuable and detailed insights.

Just the other week, DG Capital posted one of the stocks he has been watching that is showing some promise. PSE:DNL is the stock of D&L Industries, a chemicals holding company for various companies that produce food ingredients, colorants, additives, resins, and many more.

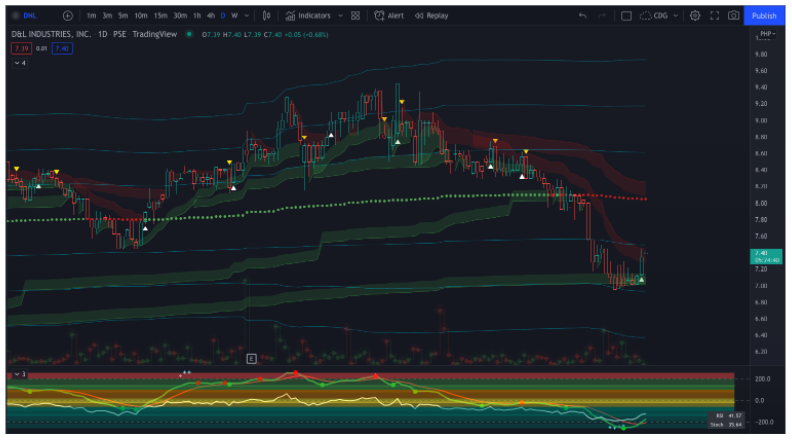

As the overall market saw a dip in share prices, DG Capital noticed that there could be an opportunity to buy at support for PSE:DNL. Despite the short-term bearish sentiment in the markets, he was able to spot a potential trade for a quick profit if prices reached his target of around PHP8.00share. As the market rebounded, so did PSE:DNL, confirming our featured trader’s analysis.

TECHNICAL STANDPOINT

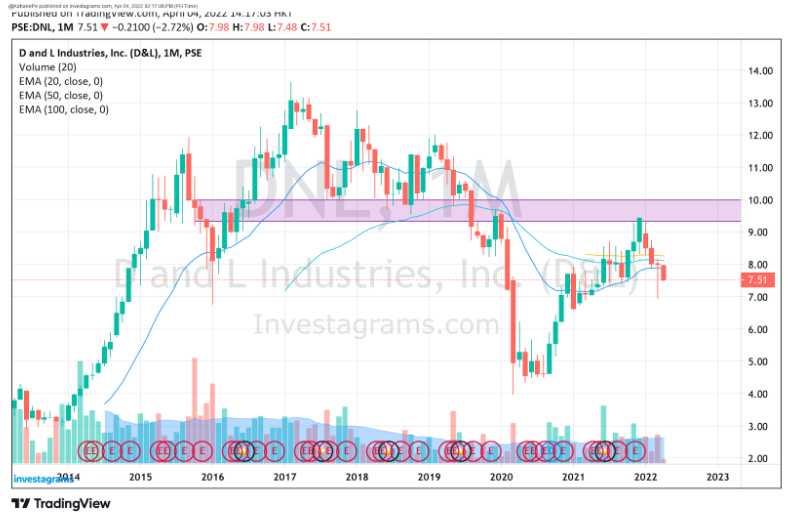

In terms of price action, PSE:DNL was within an uptrend as prices were steadily climbing after consolidations every now and then. What snapped this was the recent volatility in the markets that caused traders and investors to rapidly sell their shares across almost every stock in the market. Although most traders shy away from stocks with falling prices, DG Capital saw an opportunity to trade a potential bounce. The 7 peso mark served as a strong support, and he knew that a break of the PHP7.5 level would mark the continuation of the bounce/reversal for the stock. Once that level was broken, the next level to look out for was the 8 peso mark, which also served as DG Capital’s take profit area. As we all we know, things worked out for him and his planning and execution led to a good profitable trade.

FUNDAMENTAL STANDPOINT

PSE:DNL is a midcap company that deals with product customization and specialization. They manufacture different products, from food ingredients to chemicals for personal/home care use, raw materials for plastic, and even aerosol products. As with the majority of businesses, their bottomline income was hit by the pandemic. However, they have started to bounce back as their financial figures have matched or even outpaced pre-pandemic levels.

What should be my next step?

Although PSE:DNL has been performing financially well, we still can’t say for sure if this would translate into a strong uptrend as there are a lot of headwinds from the global markets. For traders looking to trade this stock, it may be wise to sit back and wait to see what will happen next if you didn’t take the opportunity to trade the bounce play. As with a lot of stocks in the PSE right now, there is no clear indication of what will happen next. An ideal situation for PSE:DNL would be for the PHP9.5 level to break along with a strong pattern to emerge that will give a clear signal to traders that the bulls are in control.

Once again, KUDOS to DG Capital for being this week’s Featured Trader! Enjoy your 14-day InvestaPrime Access and continue to be an inspiration to the trading community.