It has been awhile since we’ve featured our fellow traders in the community. To start off the year, let’s congratulate PreserveYourCapital a.k.a @pc for being this week’s Featured Trader!

Trader PreserveYourCapital is one of our most active traders on the platform as he consistently shares his personal insights and continues to add value to the Investa community.

What makes trader PreserveYourCapital standout is the way he includes his own checklist PLUS a catalyst to back his analyses of his trades, which makes beginners understand them easily!

Trader Preserve Your Capital is fond of using the moving averages 20,50,100,200, and simple which are commonly used and effective indicators to determine the short-term and long-term trend of the stock. Trader PreserveYourCapital posted his analysis on PSE:AGI back on January 24. Based on the chart, it is clear that it respects MA 50 and is trading above MA 20 indicating a strong short-term and long-term uptrend. I recommend buying on support areas set by trader PreserveYourCapital or when prices touch MA 50 level for better prices.

Kudos to PreserveYourCapital for spotting a good trade on PSE:AGI! Just like he said, the stock made a minor correction to close the gap at the P12.25 – P12.35 levels before a strong bounce to the P12.7 area. PSE:AGI began its uptrend in the 4th quarter of 2021 after it broke the first resistance set at P11.35.

Fundamental Analysis [PSE:AGI]

After a long consolidation phase that happened during the first 3 quarters of the year, PSE:AGI finally started its rally by the end of November. We interpret that this movement was caused by the further easing of restrictions in the country which boosted productivity in the different sectors. More to this, PSE:AGI has consistently bought back shares which is a good fundamental catalyst for investors in the stock market. Companies usually do share buy-backs for 3 reasons:

- To preserve stock prices

- The Stock Price is Undervalued

- To look financially attractive to their investors

Aside from moving averages, PreserveYourCapital also loves to use the Ichimoku Cloud when making trading decisions. According to his analysis on PSE:MONDE back on January 25, the stock has been retesting the cloud for the past few trading days and he is currently waiting for a buy signal once price breaks the cloud. Take note that the stock is in an uptrend if price is trading above the cloud, vice versa. As always, he adds the catalyst which is the possible inclusion of PSE:MONDE to the index.

After making a strong +65% rally from its listing date, PSE:MONDE has struggled to break past the P20.00 – P21.00 area causing it to tumble -25% from it’s all time high. PSE:MONDE tried to recover which only validated a Head & Shoulder pattern when seen at a longer time-frame, a bearish technical indicator causing it to tumble by -20%. We recommend buying this stock once indicators start to show bullish signals on this stock. In the case of PreserveYourCapital, he considers this stock to be bullish once prices break above the Ichimoku cloud.

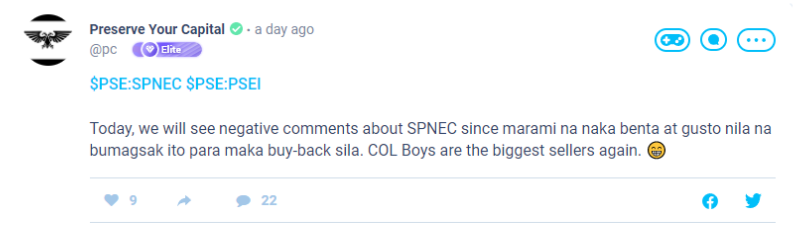

PreserveYourCapital has also been an interactive member in the community by creating engagement posts that are relatable and entertaining to other traders. One of his latest posts garnered 9 reacts and 22 comments, showing how other community members are enjoying the topic as it acknowledges the bashers of PSE:SPNEC who only wish to buy-back the stock at a lower price. You have to do what you got to do, right bashers?

Job well done to those traders who learned and gained profits by following the insights provided by PreserveYourCapital, and congratulations for being this week’s Featured Trader! Let’s continue to be an inspiration to the trading community.