Life is a series of small decisions that compound and magnify over time.

When you choose to be disciplined even on the amount of food you intake even when it’s just lessening the consumption of rice or soft drinks, a day won’t matter but a hundred days of that would take a faster effect of notice coupled with exercise and a better selection of food. So it is with weight management that we can see this translating to most every facet of our lives. Indeed Naval Ravikant said that “All returns in life are compound interest whether money, relationships or habits”. She doesn’t love you at first sight. It just grows over time. Play the long term game.

A friend told me to listen to his podcast so I’m linking it here if you wish to know more about the entirety of the episode:

Naval Ravikant: How to be Rich

https://open.spotify.com/episode/1DW2fkyEkgZaEP40Mj6H9m?si=yw9hyGOlSEaDTs6woz-1Ag

The Rational Optimist Principle

You have to be a rational optimist. You have to know the downside but be action biased nonetheless. Cynics and Pessimists unfortunately have given up and so the world to them is where nobody can do anything. This is why they’d rather you fail than succeed to make them look less bad.

It reminds me of an entrepreneur who asked the audience if they’ve eaten and if they could raise their hands if they owned a smartphone — everyone raised their hands and so he said his TAM (total addressable market) was so huge. The CEO I’m pertaining to was Tim Steiner who headed Ocado, the leader of online groceries in the U.K.

He built his business 20 years ago in 2000 even when there was just the start of the internet wireless infrastructure and when smartphones were too bulky and too expensive, he decided to believe that e-commerce was a future for mankind and built a traditional retail company with a technology component.

OCDO got listed 2009 and 11 years later is 22X from the lows and 11X your money from the IPO price. What astonished me about Ocado is that the founder built his company even when nobody was truly a strong believer in e-commerce. Of course, today these are no brainer the safest companies and the most valuable ones. The top ten market caps of the world all belong to the e-commerce space with all the platforms accelerating growth by an excess of 30-300% whether small or large bases. In fact from a secular trend, not only is this space the fastest-growing secular trend – but it also is the default and what people today expect.

Historical Timeline of Select Ecommerce Giants:

Amazon 1-2700 ; 23 years

Ocado 100-2200: 11 years

Shopify 18-900: 6 years

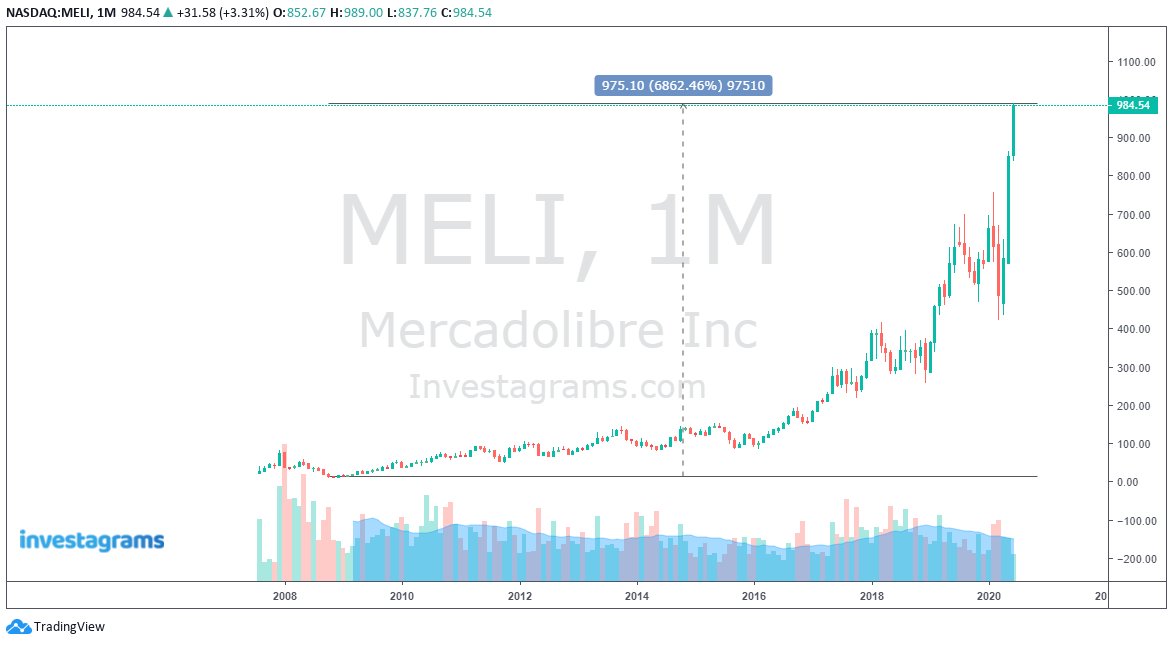

Mercado Libre 7-1000; 11 years

JD 19-60; 7 years

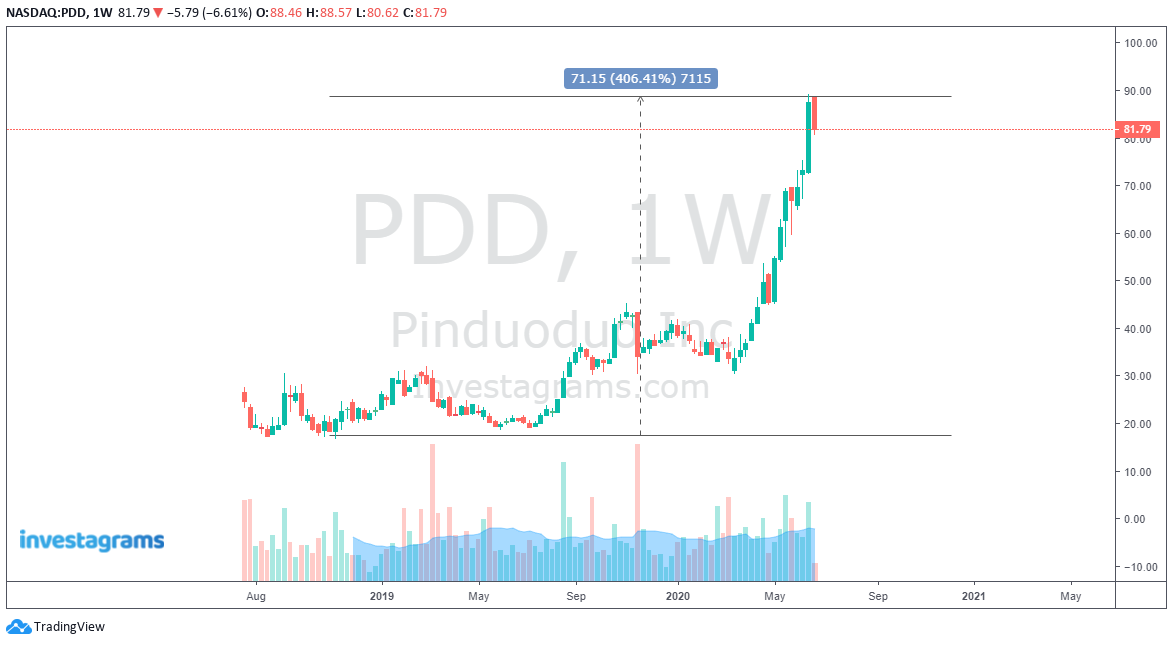

Pinduoduo 16-90: 3 years

Sea Limited 10-110: 3 years

Alibaba 68-240: 6 years

Etsy 7-95: 5 years

Investing in online commerce was and truly has been a rewarding trend even in the year of the pandemic especially since the already strong secular trend got even more accelerated and had a higher penetration rate throughout the world as the physical retail shops and stores had to close down. Not only did they recover the first during the March 23 global low, but they also had as a sector been the first to go all-time highs and continue to lead the market higher. While their valuations may prompt excessive price to sales ratios, some may argue that these are warranted considering their huge potential especially as some of them have barely scratched the surface versus their country’s counterparts.

A few months ago, Facebook invested $5.7B for a 9.9% stake in India’s largest conglomerate Reliance Industries to further help India’s JIO Mart which effectively serves as India’s aspirations to be an e-commerce giant powered by WhatsApp payments. It, of course, sent both stocks surging more than 10% the next day and consequently more than 30-40% the next few months but it ultimately shows to you that while it may seem that Amazon’s been growing forever, the point is that Amazon’s 26% growth in e-commerce this 1Q2020 is still the highest quarterly revenue it made over the last 23 years as we are talking about growing 26% when you’ve been growing from less than 1Million revenues to ultimately 75billion or 1 to 75,000 million.

Bill Gates famously said that we overestimate changes in 2 years but underestimate long term changes in 10 Years.

Source: TheQuotes

How many people are underestimating the online education trend? The remote work collaboration trend? The financial digital payment trend? Some of these trends have been underpinned and underway for over 10 years. While many people may have appreciated these services more so during the pandemic, the crisis only was a catalyst to accelerate previously strong existing trends that sent most of them from 100-300-500% increases in over 3 months from the March low to the present June highs. If you don’t believe me, check the charts Square 37-100, Fastly 11-60, Zoom video 80-240, Chegg 30-70.

Notwithstanding all the secular winners, we do note that historical corrections on even the secular winners can happen and actually has a high probability of giving entries to others who think “they’ve missed the ride.”

While I’m pleased to tell you I’ve made 70-200% gains on some of the names I’ve mentioned above, it was mostly brought about by being aware that these sectors stand to benefit the most from the pandemic but also have the understanding that my upside was irrationally higher than my downside. This was especially true with our conviction plays on Sea Limited and Pinduoduo. (We first covered these names as buys inside our Awesome10x inner circle group at 30 and 19 respectively.) I also had featured it in my classes and spoke a lot about it even on my social pages publicly.

Please check them out and follow me for great Awesome10x returns.

See you and may you have Awesome10x returns too! ⁃ Nikki Yu, CMT

Contributor:

Name: Nikki Yu

Investagrams Username: @facelesstrader

Channels:

Twitter: @facelesstrader

Spotify: Facelesstrader

Website: www.awesome10X.com

Facebook: www.facebook.com/FacelesstraderPH

Medium: medium.com/@nikkiyu

Youtube: Awesome10X

About the Contributor:

Nikki Yu holds a Chartered Market Technician (CMT) designation, is Philippine Chapter Chair and has been working in the financial industry for over a decade. Prior jobs include equity research assistant, private bank marketing assistant, equity trader and broker. She is currently a financial advisor to clients in Wealth Securities Inc. and lives in Manila Philippines. She enjoys teaching about the markets and holds workshops teaching individuals how to create their long term nest eggs. Her medium profile www.medium.com/@nikkiyu. Her Spotify channel is Faceless Trader. Twitter is @facelesstrader. She teaches people how to globally invest in 10X trends via www.awesome10X.com. Subscribe to her free daily and weekly videos through Youtube: Awesome10X.