As we started our trading career, our focus is all about making profits. We searched for the What, When, and Where rather the How and Why of trading and investing. As we progress and dig deeper, we eventually stumble to this word which many veterans mostly talk about — BACKTESTING.

What is Backtesting?

Backtesting is simply testing a trading/investing strategy, plan, and rules in the historical data.

Why is Backtesting Important?

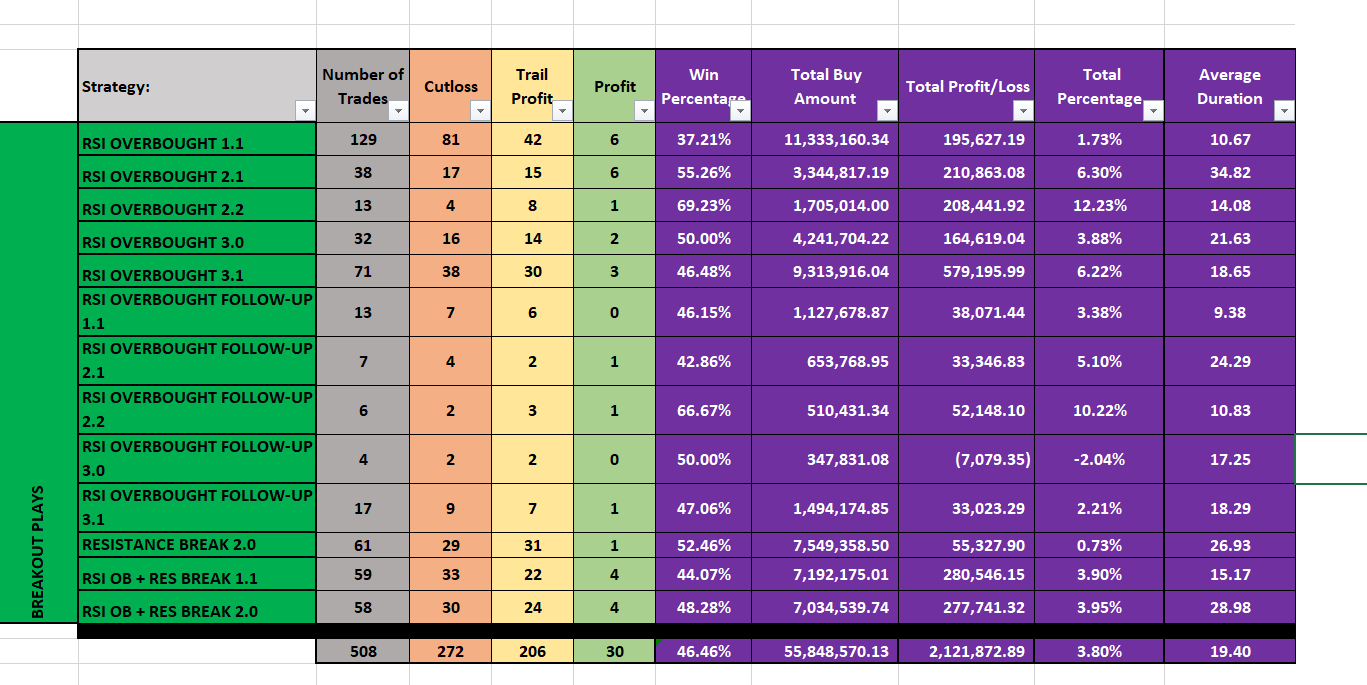

As you might already know, one of the components to be a consistently profitable trader is you must have an edge on the market. A trading plan if repeatedly executed will yield a constant profit on your desired timeframe. Some traders can achieve this through a repetitive process of losing money, experimentation, and switching mentors/coaches. Through time, they gain the experience and knowledge that can personalize the summation of the process then compile it to become their own edge.

However, this might take years and an ample amount of tuition fees that you will be giving to the market.

Backtesting will help to minimize that learning curve by testing the trading plan in the historical data of the market. No matter where the strategy came from, it is best that you test it first to check if it is in accordance to your personal goal, style, and availability. This will give you confidence and conviction that your trading plan might yield positive results in the future.

How Does Backtesting Work?

1. You need a precise trading plan that you must commit in testing.

For example:

Entry: Buy at the end of the trading day whenever a Hammer Candle bounce at EMA50

Trail Stop/Profit: Sell 1% below the lowest resistance area

Cutloss: Sell whenever Price is 3% below the EMA50

Risk to Reward Ratio: At least 2

Portfolio Sizing: Max 20%

Note: Any changes in the rules will reset your backtesting process.

2. Open a chart, select a market, and select a date when you will start your testing. It is highly advisable that you check more than 5 years of historical data so that you can capture different kinds of market trends and cycles.

3. Refrain from having a bias at any point of the testing. It is much better to have a bias in finding trades that will disprove your trading plan.

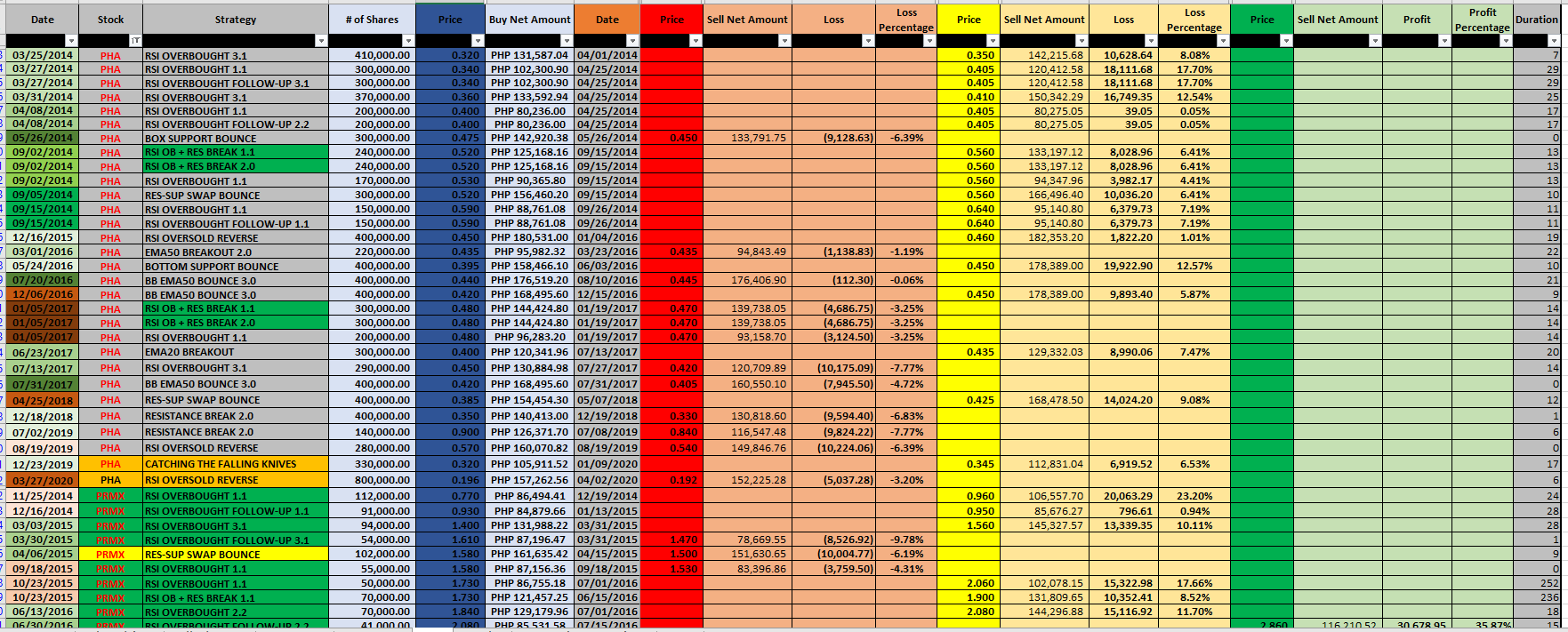

4. Record the data you acquired from your testing process.

5. If you are satisfied with the profitability and accuracy, you can now start to test it out in the actual market by virtual trading or putting on small bets. If not, do the process all over again until it satisfies your desired edge.

Note: It is good to start with a single and simple strategy then slowly adding your desired indicators to filter out your set-ups.

3 Ways of Doing Backtesting

1. Manual Backtesting

The most common way in testing the market. You will manually check the charts of the desired market and list down the data that you will gather in the process.

Advantages:

1. By running through the charts, you will be able to recognize the patterns, DNA, and fractals of the market.

2. It will help you get familiar with the weaknesses and strengths of your trading plan.

3. It will help you gain more confidence in trading the actual market.

4. This will help your approach to trading to be as automated as possible.

Disadvantages:

1. You might have a bias to your strategy especially if you are tempted to check the later part of the chart.

2. This is a long process that might take you months or years to master.

3. Prone to biases and errors.

Tip: You can use the InvestaJournal to store your backtested data.

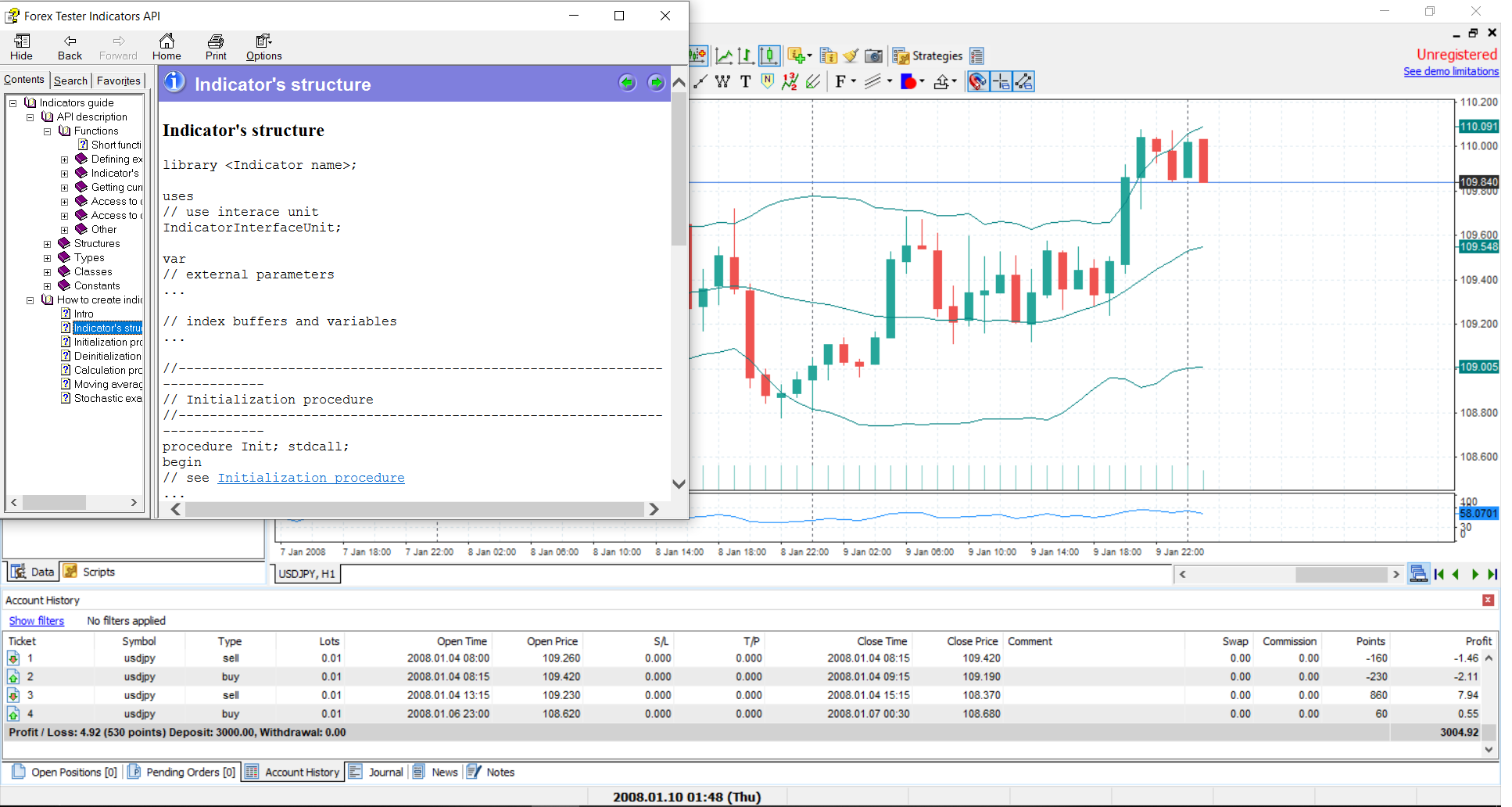

2. Automated Backtesting

There are applications or programs that will do the testing on your behalf. Some might require you some skills in programming language to be able to test your desired strategy or specific trading plan.

Advantages:

1. Quick way to check if the strategy has an edge.

2. Precise and accurate based on the exact data you input.

3. You will be free from bias and errors.

Disadvantages:

1. You might not recognize the market’s patterns, DNA and fractals.

2. Most of the applications are costly.

3. Requires programming skills.

4. Most softwares are for Forex or Foreign Markets.

3. Semi-Automated Backtesting

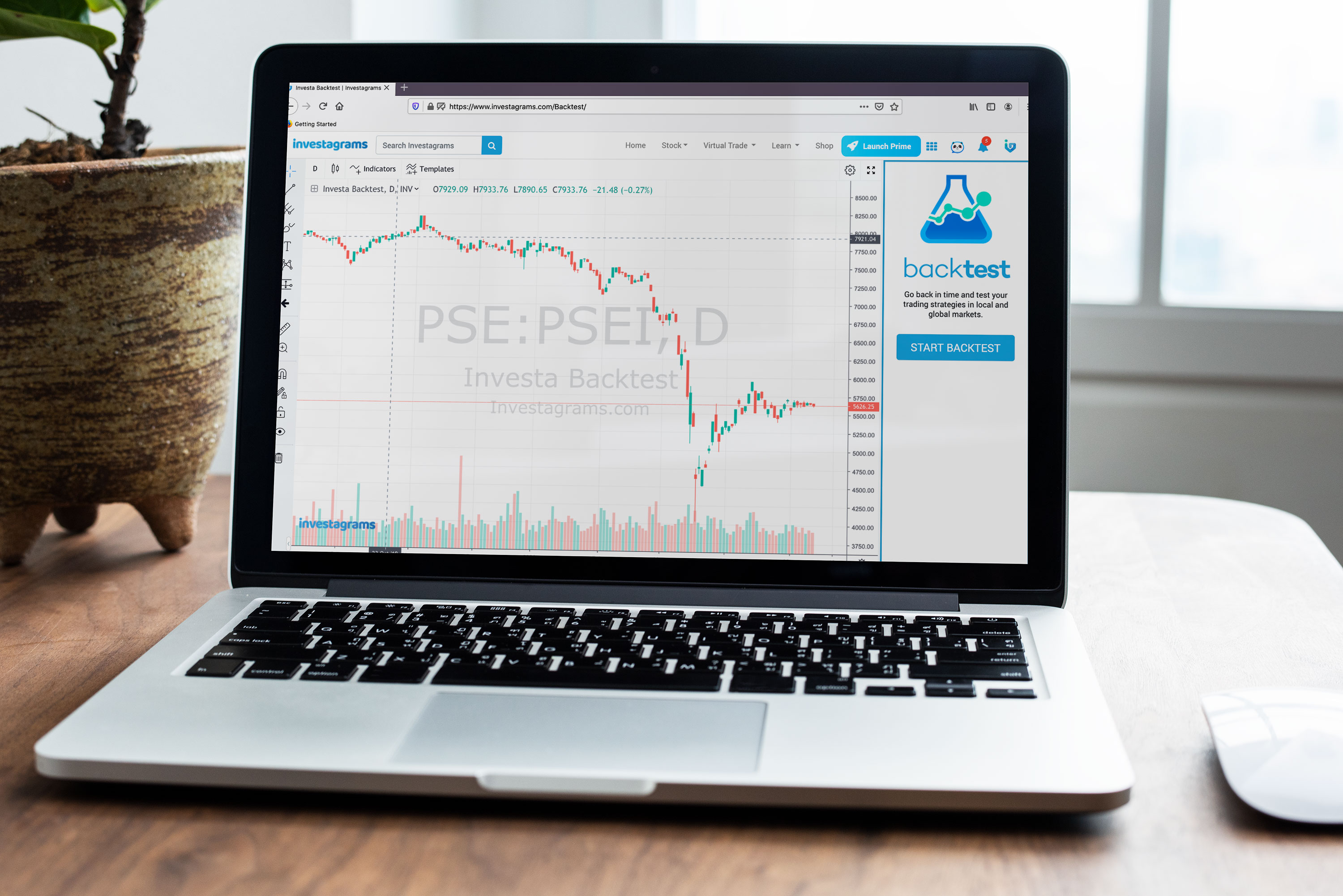

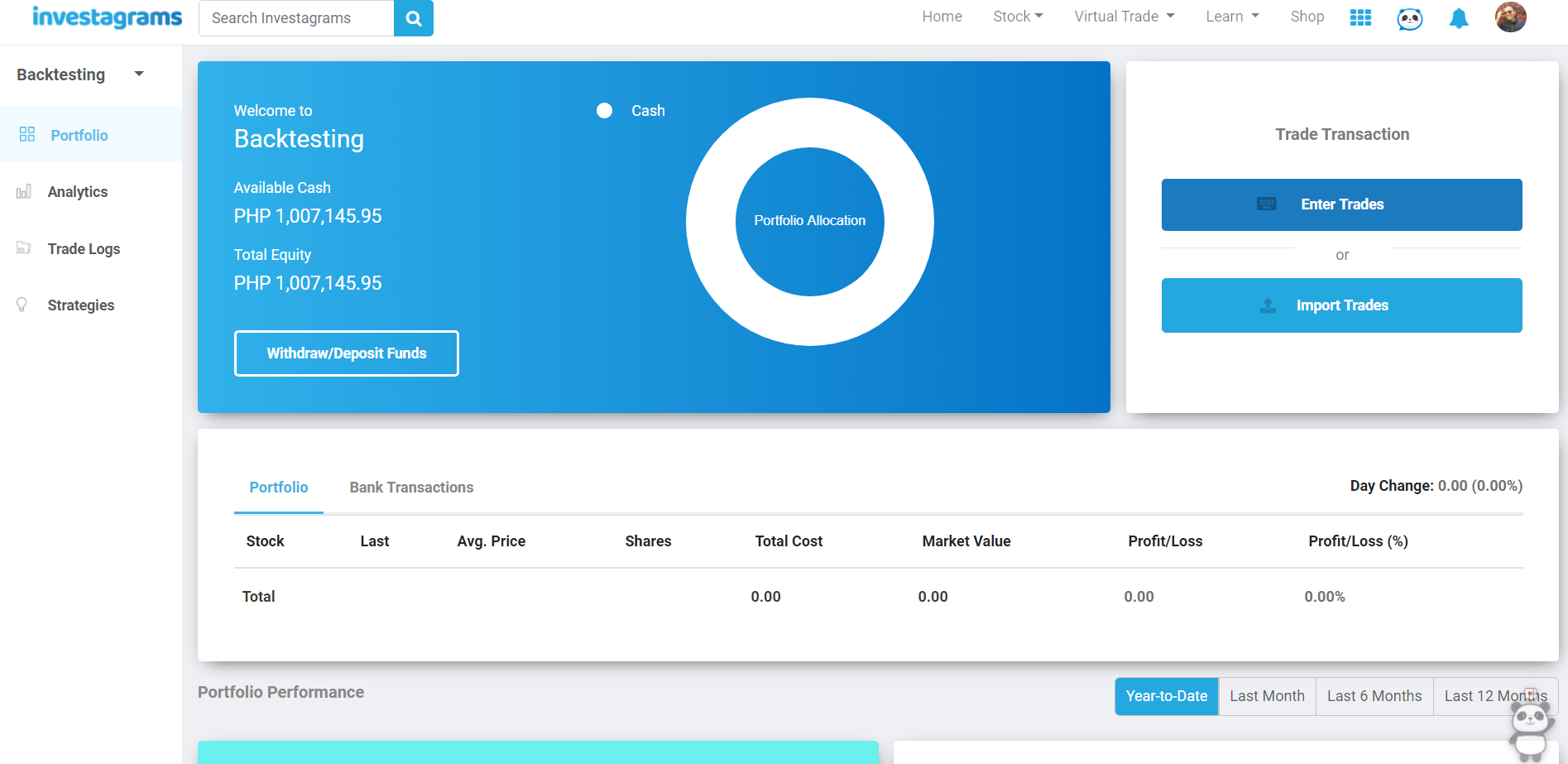

There are applications or programs that will assist you in your backtesting process. Some programs may either record data of your manual testing, giving you the feel of the actual market fluctuations or automatically compute your strategies’ edge. One example of this is Investagrams’ Backtest.

Advantages:

1. Same advantages as Manual Backtesting.

2. Faster than Manual Backtesting.

3. Biases and errors will be lessened.

Disadvantages:

1. Slower than the Automated Backtesting.

2. Has scenario restrictions depending on the program.

In Conclusion

Backtesting is one out of countless steps to becoming a consistently profitable trader. This is a good foundation in building your confidence in executing your trading plan especially in times of drawdown.

Past results are not determined by future results, but history repeats itself especially in the market because it is driven by human emotions. Equipping yourself with the edge of Backtesting will at least give you the stamina to finish this marathon.

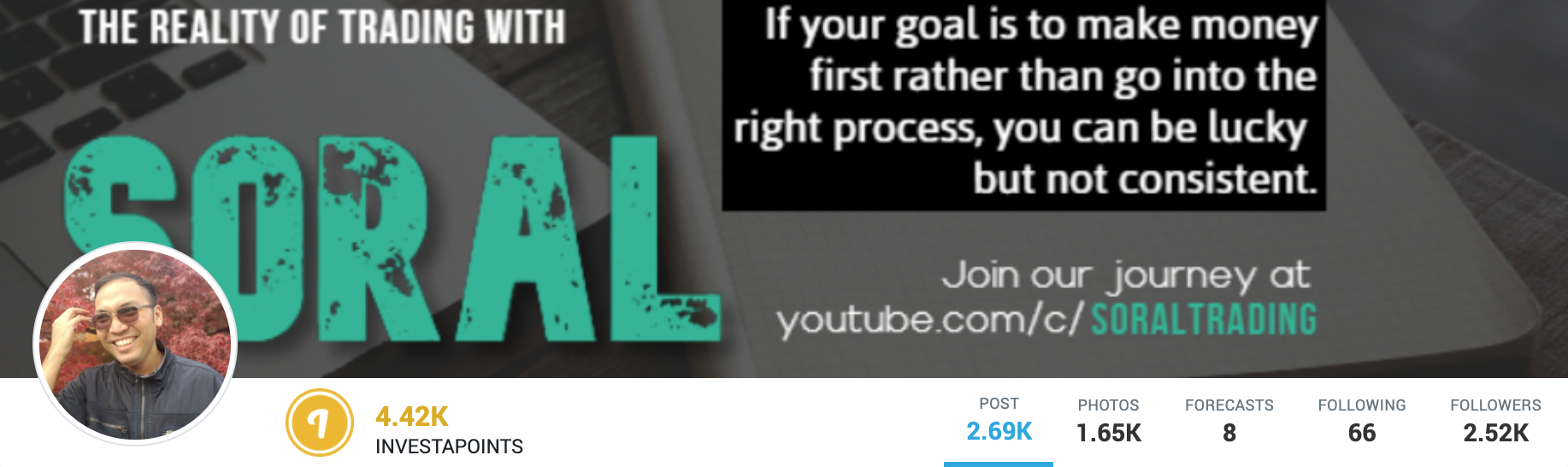

Contributor:

Full Name: Jan-Angel Echano

Investagrams username: @Soral

Channels:

www.investagrams.com/Profile/soral

www.facebook.com/soraltrading

www.twitter.com/SoralTrading

www.instagram.com/jan_soral/

www.anchor.fm/soral

www.youtube.com/c/SoralTrading

About the Contributor:

A passionate trader who aims to share the reality, the HOWs and the WHYs in trading. My goal is to help traders and investors like me to continuously improve and refine our skills to the path of mastery.