The BIGGEST STOCK MARKET COMPETITION in the Philippines is here!

Welcome to Investagrams Trading Cup 2019!

We are back with the BIGGEST PRIZE POOL in Investa Trading Cup history with 1 MILLION PESOS base cash prize at stake on top of the bonus pot!

This competition is OPEN TO ALL and will run from

September 23, 2019 until December 20, 2019.

1. Registration. Participants may register until September 20, 2019 (Friday), before the competition officially begins on September 23 (Monday). Don’t worry, you will receive a notification once you have been automatically added to the Competition Room and the Trading Cup is about to begin.

Important note: Only one (1) entry and account per person is allowed. If you have more than 1 account to join the competition, you will be disqualified.

Click here for more information on how to join.

2. Platform. The participants of Trading Cup 2019 will use the Virtual Trading Platform of Investagrams which tracks the real-time stock price movements in the Philippine Stock Exchange (PSE). The system automatically calculates transaction fees to make it more realistic.

To know more about Investa vTrade, click here.

You can access the platform through web, or download the app on Google Play or App Store.

3. Goal. The goal of the game is simple — trade your account for the whole competition period and aim for the highest profits. The players with the highest rankings while playing within the rules will be recognized as winners.

4. Starting Capital. Each player will start with PHP 100,000 virtual money to trade.

5. Trading Hours. Weekdays from 9:30AM to 12:00NN and from 1:30PM to 3:30PM— just like the regular trading hours in the PSE. You cannot trade during off-hours and on weekends. Also, no trading shall be done at the pre-close period of 3:15 to 3:20PM— the system will resume trading at 3:20:01PM.

6. Tradable Stocks. Participants can only trade the listed tradable stocks for this competition. The tradable stocks are filtered by our system and qualifies as liquid and actively traded stocks.

You will be able to access the whole stock list once you are added to the Competition Room.

7. Diversification. To promote diversification and risk management, maximum exposure in a single stock can only be 1/3 or 33.33% of the portfolio. This requires the participant to buy at least 3 different stocks should they want to fully invest their portfolio. The system won’t allow you to allocate more than 33.33% in a single stock.

8. Buying and Selling Conditions. Participants now have two options when transacting. The first option is to transact using the current price of the stock and use market orders to buy and sell specific stocks at their real-time prices. The second option, is to transact using our new LIMIT ORDERS. By using Limit Orders, you won’t need to watch the market the whole day in order to transact in the market. Take note, however, that Limit Orders do not apply for cutting your losses. There is NO automatic stop loss order, so you will need to cut your losses manually. Check out our guide here on our new Limit Orders and upgraded VTrade: Our New and Upgraded Investa vTrade: Limit Orders

- Buy – You can buy the same stock multiple times within a day.

- Sell – You can only sell the same stock two (2) times in a day. This will be strictly observed in order to avoid abuse. This includes selling in TRANCHES. Example: If you bought 1000 shares of $SMPH at 39 then sold 300 shares at 39.10, then you have only one (1) sell transaction left for $SMPH within the day.

9. Holding period for all stocks

- Initially the twenty (20) minute time lock was only for stocks PHP 3.00 and below. However, due to the illiquidity of the market and behavior of some participants we will now be applying the twenty (20) minute time lock for taking profits to ALL STOCKS. Again, this is to avoid widespread and rinse-repeat trades. There are instances where specific names are simply bought due to the 2-2.5% widespread sold after 5 minutes once the stock has been ticked up.

- There will be no timelock or restrictions when selling at a loss.

10. Fluctuation rule for taking profits. This is to further protect the competition against ‘rinse-and-repeat abuses’. For stocks that are PHP 2.99 and below + other illiquid names that may be added, you will not be able to sell your position at a profit for 24 hours unless the price is FIVE (5) fluctuations above your average price. For stocks that are PHP 3.00 and above, you will not be able to sell your position at a profit for 24 hours unless the price is THREE (3) fluctuations above your average price.

- 24-hour time lock. If in the scenario that your position still has not gone above the fluctuation rule for taking profits, you will only be able to sell it at any price 24 hours after your made your purchase.

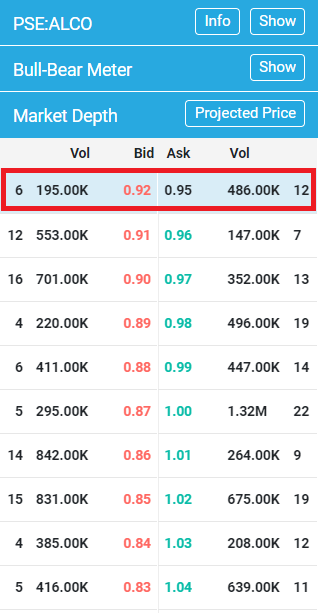

11. For stocks that will be detected by our WIDE-SPREAD DETECTION SYSTEM (WSDS).

- The Wide-Spread Detection System’s main condition is that the first (1st) best bid and ask should never be more than 2% at any moment during open market session (9:30AM to 12:00NN | 1:30PM to 3:15PM | 3:20:01PM to 3:30PM).

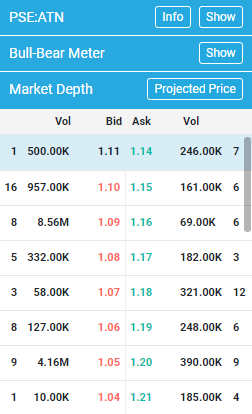

Fig 1. Real-time Market Depth / Orderbook

showing the first (1st) best bid-ask data.

Example: $ATN (Refer to Fig. 1)

Given:

1st best bid = 1.11

1st best ask = 1.14

Formula:

X = (1st best ask – 1st best bid) / 1st best bid

Condition:

If X is greater than 2% then WSDS detects that the stock is wide-spread and can be abused.

Solution:

X = (1.14 – 1.11) / 1.11 = 0.02700 x 100% = 2.70%

Verdict:

Since X is greater than 2% then the stock is wide-spread as computed by the system.

- The participant will be given a prompt that the detected stock is not tradable upon executing a buy or sell transaction.

- The stock will again be tradable once the system detects that the spread of the 1st best bids/asks are below 2%.

12. Revision of Tradable Stocks. Investagrams has the right to remove any stock from the list should it suddenly become too illiquid, abusable and/or delisted. Furthermore, Investagrams may also add new stocks on the tradable list as new stocks become more active and tradable in the market. All changes will be announced before implementation.

In such cases that a stock is to be removed, we will follow this process:

- Investagrams shall notify all the participants via the Investagrams Platform before the market opens.

- If you still have the stock in your portfolio, you can sell it at any point in time at your discretion.

13. Trading Halt. Stocks that are on a trading halt will not be tradable. A halted stock will only become tradable again after two (2) minutes from its trading resumption. If you already have a ‘halted stock’ in your portfolio then you have the option to dispose of it early or hold onto it until it resumes.

14. Initial Public Offering (IPO). All upcoming IPOs that will happen while the Trading Cup is on-going will be added on its SECOND (2nd) trading day.

15. Shorting. Shorting is not allowed in this competition.

16. On Trading Abuses.

- Day trading opportunities on natural market moves are normal, but please take note that Investagrams will be on full-guard against participants that abuse illiquid opportunities. We want our winners to show real trading skills that are applicable in the PSE. Abuse of intraday spread trades will NOT BE TOLERATED. These rules are set to protect against the usual ‘rinse-and-repeat’ abuses that are mostly used in virtual trading competitions like this.

- Read more about ‘rinse-and-repeat trading abuse’ here and why this is not characteristic of a realistic trading strategy.

- Any player that has more than 10% of their profits from rinse-and-repeat wide spread, illiquid and other abusive trades will be penalized or DISQUALIFIED depending on the severity of their offenses. We will be able to validate this through our data and algorithms that verify the historical transactions of each participant.

- Any form of hacks, cheats, and abuses shall not be tolerated and will have corresponding repercussions. Suspicious behavior that may not be specified in the rules may also be flagged as ‘abusive’ trading behavior. Warning shall be sent after Investagrams has reviewed and confirmed that the actions are against the integrity of the competition. All trade records shall be verified and those who fail to follow the rules will be disqualified.

- Participants will only be given ONE (1) warning, any participant who has constantly repeated any abusive trading behaviors (whether illiquid stocks, system abuses, loophole abuses) will instantly be DISQUALIFIED. Investagrams has the right to review any suspicious activity, and if the behavior is deemed inconsistent with real life trading then the said player shall be disqualified.

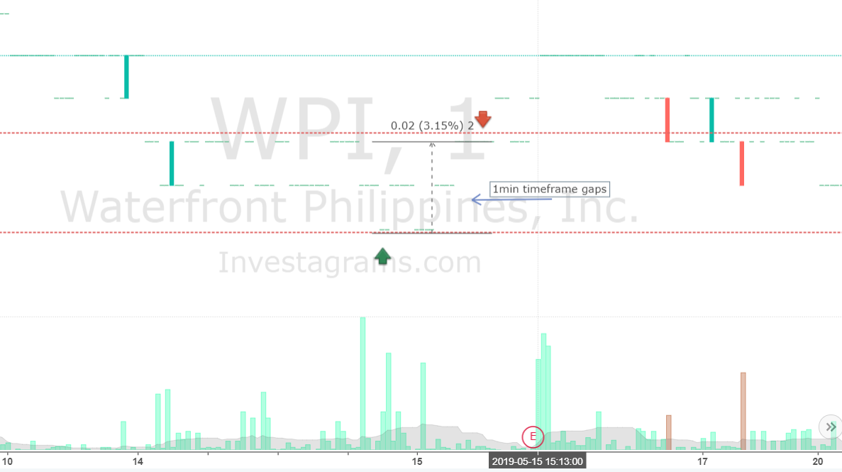

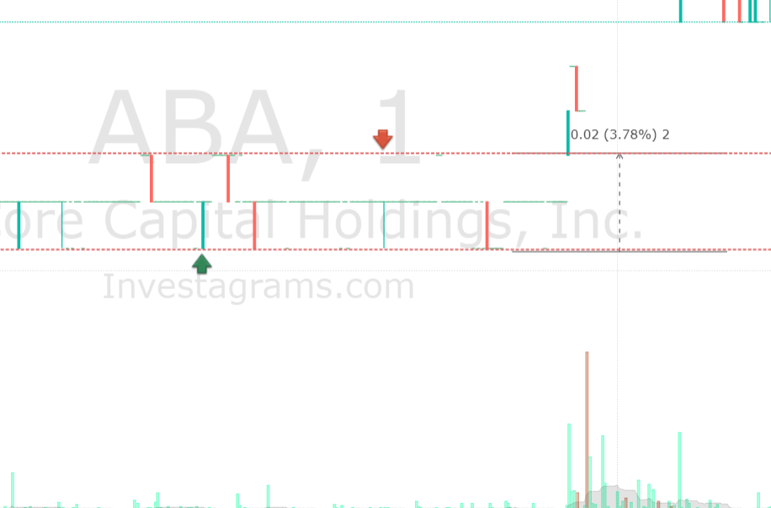

- Questionable Transactions. Questionable transactions will be cross-checked through the buy and sell transaction time and the traded stock. Stocks that have more than 2% consistent gaps in the one (1) minute timeframe within the transaction period shall be deemed invalid and Investagrams has the right to deduct the profits from the said transactions. It is normal to trade natural intraday moves and gaps can really happen, but if a participant is constantly trading stocks that have gaps within one (1) minute timeframe and their profits from these kinds of scenarios make up more than 10% of their total profits, then he/she will be automatically disqualified.

Fig 2. Example 1 for one (1) minute time frame gaps with buy (green arrow) and sell (red arrow) transactions

Fig 3. Example 2 for one (1) min. time frame abusable 2% gaps

Fig 4. Example 3 for one (1) min. time frame abusable 2% gaps

Investagrams will warn the player that is proven to be constantly transacting with illiquid stocks with 2% one (1) minute gaps. Basically, any stock that has 2% spreads and do not really have a trend is included in this definition. After the first warning, any player that is proven to repeat this kind of behavior shall be disqualified.

17. Unexpected events. In the case of an unexpected event which interrupts the operations of PSE or the system of Investagrams, the competition shall be frozen and paused. Further notice shall be given and trading will resume once everything is back to normal.

18. Participant rankings. Overall participant rankings are constantly updated every ten (10) minutes and automatically ranked by Investagrams’ system according to net profit gain/loss. Traders ranking from Top 1 to 40 will be constantly checked.

19. Deliberation period and the announcement of winners. At the end of the competition, at least one (1) week deliberation period shall be given to Investagrams’ team of moderators to verify trades and the confirmation of winners. The participants with the highest net profits will win. The resulting Top 1 to 40 participants after deliberation will be announced as the official winners.

20. Modification and adding of rules. Investagrams has the right to modify the rules of the competition and add protective measures against any future abuses that may arise to ensure the integrity of the Investagrams Trading Cup 2019. Announcements shall be made if there are any changes. Rest assured, we prioritize keeping the competition as FAIR as possible to all participants.

21. Ignorance of the rules is no excuse. All participants are expected to have read and understood the rules and mechanics of Investagrams Trading Cup 2019. These are published for the participants’ information and protection. Ignorance of these rules and mechanics is not an acceptable excuse for violation.

22. Sponsors. Apple is not involved in any way in this competition. The sponsor(s) is/are solely responsible for providing the prize(s) listed herein. The prize(s) won are not apple products, nor are they related to apple in any way. The responsibility of organizing this competition and distributing the prize(s) are the sponsors’ responsibilities. Apple does not sponsor this competition in any way.