The stock market: an entity that began in 16th century Netherlands as industrialization began to take hold.

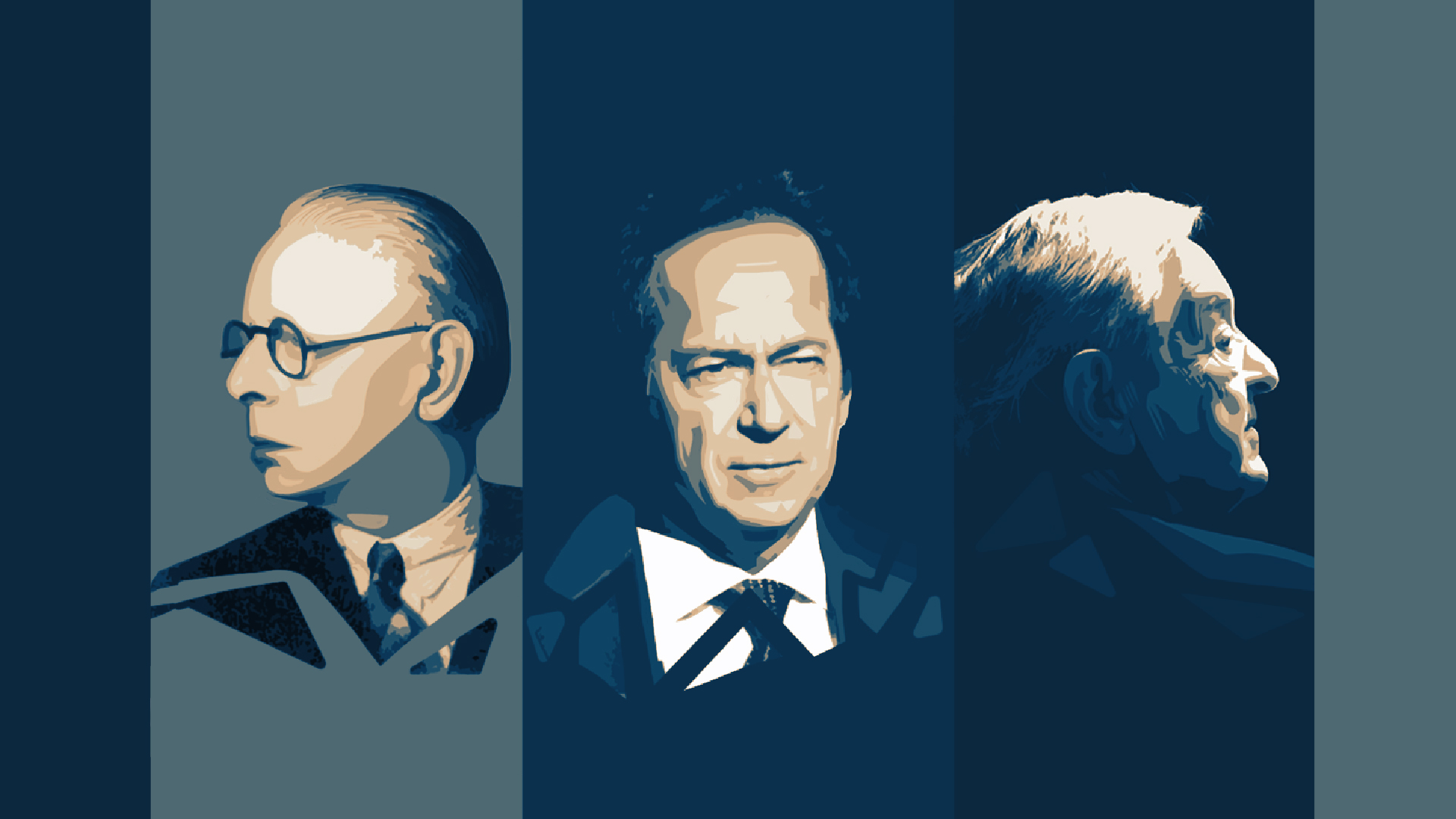

Over time, the concept of jointly owning a company spread outside of the Netherlands, to every part of the developed world. As the concept grew in complexity, a need arose to differentiate oneself; and over the years, many individuals have stood out with their trading strategies that garnered them millions — even billions — in profit. Below are three standout traders from as early as the 1800s up until the modern-day, and the trading strategies that helped them earn big.

Jesse Livermore (1877 – 1940)

Perhaps one of the most famous names in the trading world, Jesse earned huge amounts of money through trading. He successfully shorted the 1929 market crash, earning him millions. However, throughout his life, he would gain big, lose it all, then gain again — in an endless cycle that eventually caused him to take his own life. However, he had a remarkable run, and Reminiscences of a Stock Operator (1923) — an unofficial biography of his life — is considered a must-read for traders. Jesse was considered a trend trader: he would analyze trends in the stock market and trade depending on whether it was on an upward or downward trend. Rather than basing it all on intuition, he would analyze the market and data before making a trade. Though this seems like common sense today, during his time, trading was based on rumors and speculation — his style of trading was entirely new. He also practiced Top Down Trading: he determined the wide-range market condition, then looked into industry groups following the general direction of the market, and sought out the strongest stock in that industry to invest in. Additionally, he identified a “sister stock” that he would follow along with the stock he invested in, as he believed that the condition of the sister stock would also reflect in the stock he invested in. As he once said, “There is nothing new on Wall Street. There can’t be, because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.” Thus, patience, top-down trading, and a careful analysis of the market are important aspects of his immensely successful day-to-day trading.

George Soros (1930 – Present)

Chairman and founder of Soros Fund Management, he earned the title “The Man Who Broke the Bank of England” after he made over $1B on a bet that the British pound would depreciate in value. His ability to pull this off is a great example of his speculator trading strategy, wherein he makes huge bets on the direction of financial markets — essentially making a bet that the value of his stock will either rise or fall. When he predicted that the value of the British pound would crash, he borrowed billions worth in pounds and converted them to German marks. Thus, when the pound crashed, he was able to profit off the difference when he paid back the lenders. To engage in such trading, Soros looks at the economic, political, and social factors that affect industries in the future. He looks at trades from a long-term perspective — what will happen, and the events that are happening, that will shape prices in the far future. An example of this was when he invested in Japanese markets after the 2011 Fukushima disaster. Many investors exited Japan, as they did not think Japan would recover from the disaster. However, Soros saw an opportunity in the distant future: Shinzo Abe taking over as Prime Minister. A few months before Abe took office, Soros invested in Japan’s equity markets, and, just as he predicted, markets picked up rapidly after Abe took over. This shows Soros’s ability to look past the herd mentality of many traders, and analyze markets from a long-term perspective, ultimately allowing for long-term gains. However, a word of caution: as this strategy banks heavily on speculation and requires investing huge amounts of money, one should be able to afford a loss in order to implement it. It is an extremely high-risk high-reward style, requiring a good analysis of the trade and risk management plan beforehand.

John Paulson (1955 – Present)

John Paulson is the founder of Paulson & Co. and made his mark on Wall Street by successfully shorting the real estate market in 2007. At a time when many were losing money, he was one of the only ones to earn big. After his success, he made an impressive trade run from 2007 – 2010 by shorting housing, bank, and gold stocks, effectively increasing his already large fortune. His main trading strategy is position trading: he invests in stocks for the long-run, believing in trading with a high probability of getting returns in the long-run rather than short-term buying and selling. Along with his philosophy of investing for the long-run, Paulson also believes in having an exit strategy in case the stock surprisingly turns south for a longer period of time. He stresses that one should not “fall in love with a company” because by becoming attached to that stock, it becomes harder to identify when it is depreciating for good. Additionally, Paulson uses a contrarian strategy, buying and selling contrary to the popular belief at that time. He believes in going against the current market trends to generate profits, as trends cause frenzies and bubbles that will eventually crash. He looks for share prices that are lower than the value he sees in a company, because if the value is intrinsically higher then the price will eventually go up, allowing him to generate profits in the long-term. Paulson’s strategy, in essence, is all about patience and waiting out on his stocks; because as he once said, “Our goal is not to outperform all the time — that’s not possible. We want to outperform over time.”

Conclusion

As seen from the three traders above, there are many trading strategies that have worked overtime. However, as John Paulson said, “No one strategy is correct all the time.” Every trading strategy has its downfalls, and periods when they just do not align with market conditions. All three of the abovementioned have experienced losses due to their philosophies — George Soros lost a huge amount of money when he bet wrongly on the US markets rising in 1987, and again during the 1999 tech bubble. In conclusion, as much as one can learn from the trading strategies utilized by the best, perhaps the biggest takeaway from their careers and experiences — both good and bad — implementing the strategies, is that one should never expect to win big and experience success at all times. Expect losses, plan for them, and come back with an even better strategy to conquer the complicated, and at times frustrating, the world of stocks.