Backtesting is an essential part of your trading success.

When you begin your journey in the markets, usually the first thing we look for is a strategy to analyze the stocks or assets we’re trading. We scan through a few articles online, watch a couple of videos, and read countless books to find strategies that have been proven to be successful for other trades. There’s nothing wrong with this process, but it’s often much better to check if the strategy you’re going to use would have worked in the past.

This is where backtesting comes in. When you backtest a strategy, you try to see if the particular strategy would allow you to take advantage of specific opportunities.

For example, if you’re studying a momentum strategy it’s best to check if the strategy would have worked during a bull market and if it allowed you to latch on to the market leaders. In contrast, if you’re backtesting a bottom-fishing strategy then it’s best to practice this during a bear market to see if you would have been able to pick the bottom.

So now the question is, “How many practice trades should I make?” Truth is, you wouldn’t know if a strategy actually works if you only test it out on 10 different occasions. The minimum sample size enough to yield significant results would be at least 100 sample trades per strategy, but the more the merrier.

The problem in the past was there was no backtesting application available to test your strategy in the Philippine market. You would have to do it manually; you would need to manually scroll through the chart, mark when you bought and sold the stock, then jot down the results. This takes out a lot of time and energy.

This is the reason why our Investagrams team developed the Investa Backtest. We wanted to automate the backtesting process that could be used in the Philippine market. Not a lot of traders backtest the strategies they use, many just use a strategy they learned immediately because they found out about it from their mentor or a famous trading book. A big reason why backtesting was not a mainstream thing before was due to the fact that there was no automated way to do it.

But guess what, we weren’t just going to limit our backtester to our local market. You can also backtest your strategies in the GLOBAL ARENA as well! You can test to see if your strategy can fare well in US stocks, Commodities, Cryptocurrency, and Forex! We want traders here in the Philippines to see that there are opportunities that we can take advantage of in the global markets, and backtesting your strategy in different assets is a great way to start.

So now, how do you access and fully utilize the Investa Backtest?

Here’s a spoiler: Backtesting is EASY with this new feature!

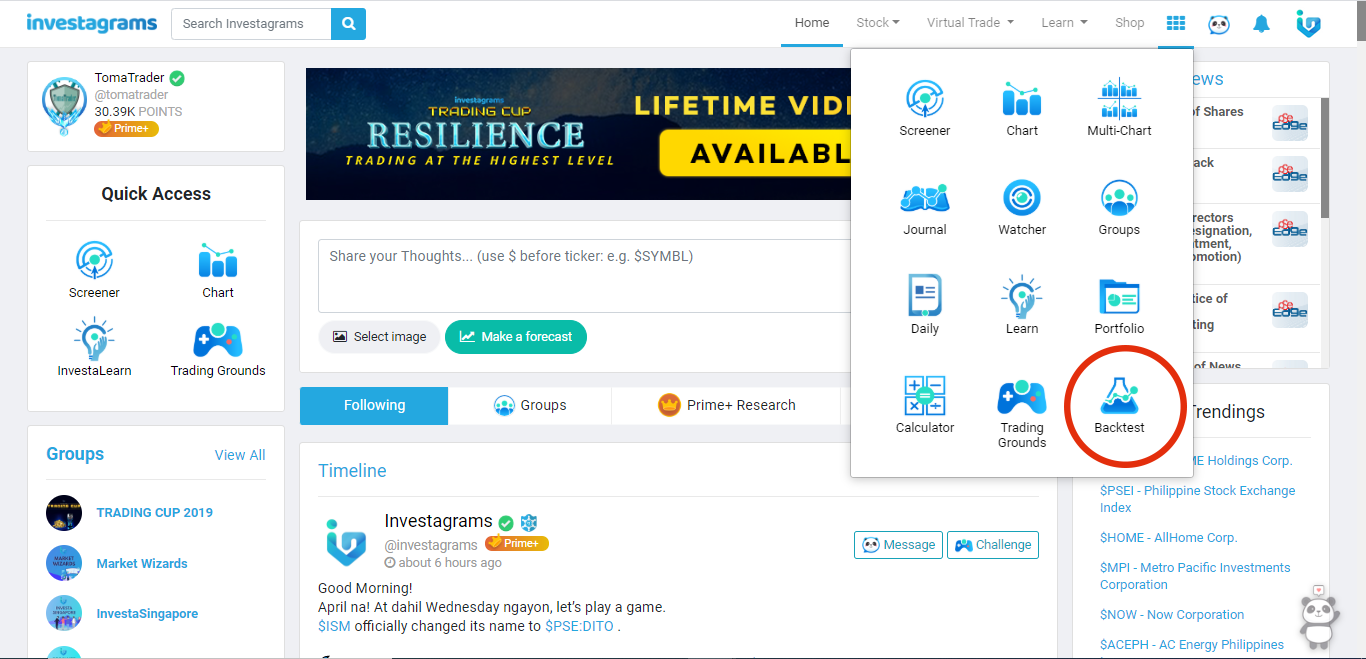

Step 1: To find the Investa Backtest, simply login to your Investagrams account then click the multi-tool tab then click “BACKTEST”.

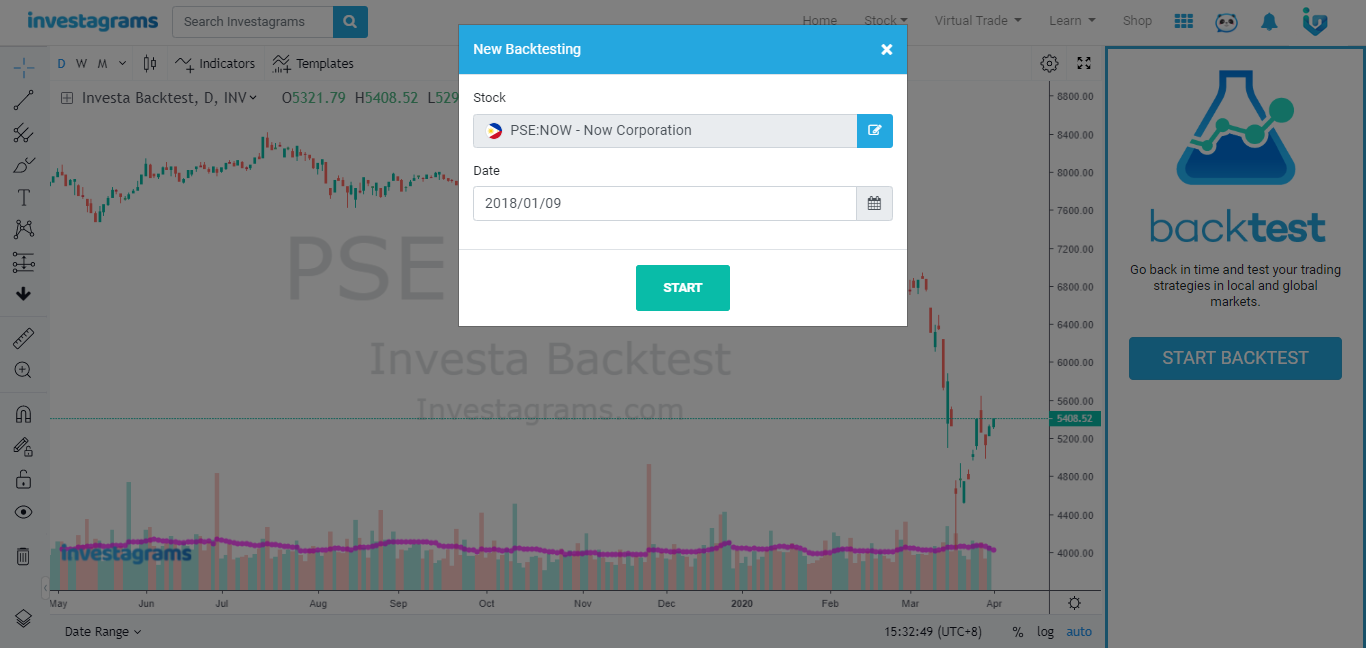

Step 2: You will then be redirected to the Investa Backtest page. We suggest that you set your indicators first then click “START BACKTEST” to begin.

Step 3: Choose the stock where you would like to backtest your strategy and the specific date. Then it will be as if you were taken back in time as if you’re trading the stock during your chosen time period.

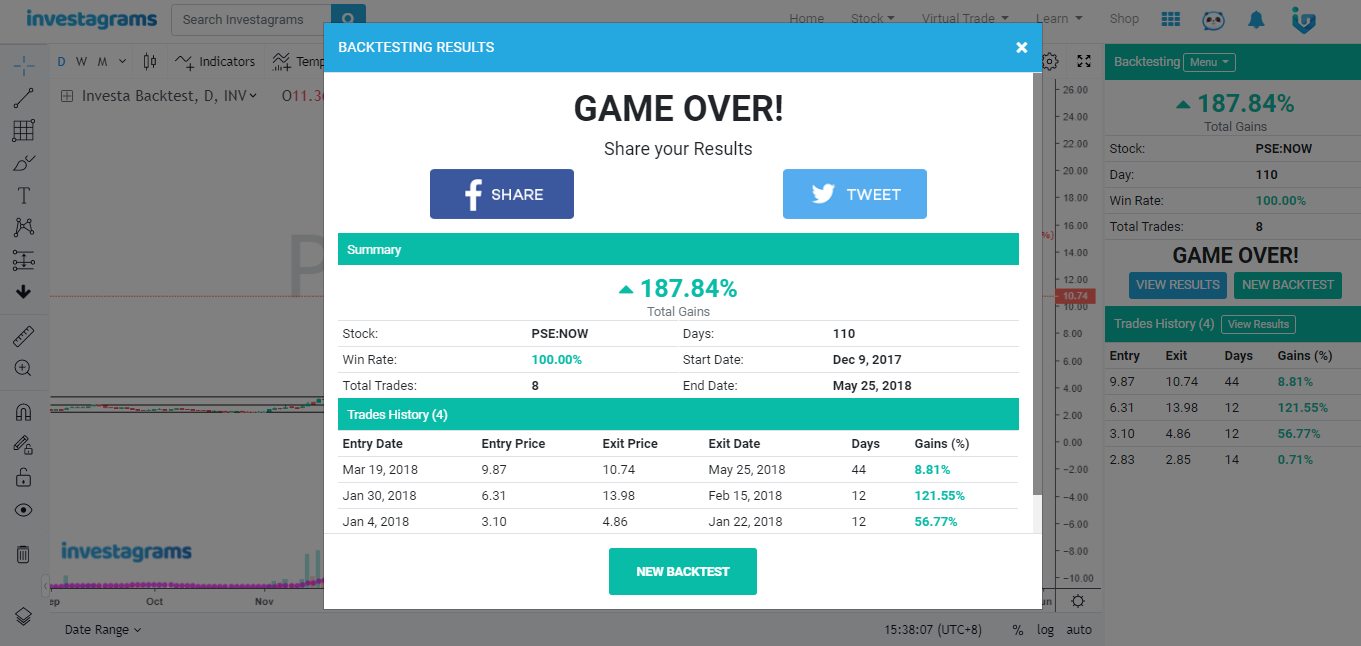

Step 4: TRADE! Simply click “NEXT DAY” or click “Q” on your keyboard to make the next candlestick appear, this means the trades you’re making are all end-of-day trades. On the right side of the screen you’ll see the results of your trades. So if you’re backtesting a momentum strategy, $NOW would be a good candidate to practice on as it skyrocketed in a short period of time last January 2018.

Step 4 (continuation): While if you’re backtesting a bottom fishing or reversal strategy, you could trade bluechip stocks back in 2008 during the last market crash. Always remember, don’t just stick to one stock when backtesting a strategy. Choose from a variety of stock until you reach a minimum of 100 samples.

Step 5: Once you’re finished on a particular stock simply click “END BACKTEST” to see the summary of your results. You can jot down everything on a notebook or place it in an excel sheet as you continue to reach 100 or more samples. Then simply click “NEW BACKTEST” to start again on a new stock!

That’s about it! Our tech team made the Investa Backtest as easy as possible for everyone to use so all of us can benefit from the process of backtesting. On a final note, another advantage of backtesting a strategy is you can actually find potential flaws or room for improvement to make the strategy even better.

Start your backtesting here today and use the extra time during the enhanced community quarantine to study and restructure your trading strategy: www.investagrams.com/backtest

Happy Backtesting, mga ka-Investa!