Once we take our first step into the world of the financial markets, the information we usually seek is what’s the best stock or asset to buy as of today. We immediately search for buy recommendations or strategies focused on buying a stock. Many traders come into the market with the mindset of buying the best-performing stocks in the hopes of rapidly compounding their capital. There’s nothing wrong with this, but the problem is many newcomers to the market forget that there’s also the potential for financial ruin in any market. Most of the time risk management is forgotten about.

We discover the stock market either through something we saw online, a seminar we attended, or a friend who made some money in the market. However, what we usually see or hear is all the upside we can get if we begin our investing journey. What’s failed to be given the emphasis on are the potential catastrophic losses that can occur if done the wrong way.

It’s true that the stock market is the ultimate equalizer of wealth that has the potential to exponentially compound your capital. However, besides focusing on the amount of money we can make, we need to understand the risks involved as well. Most importantly, we need to ingrain in our minds that LOSSES will always be part of the game. Countless traders try to avoid getting losses, but the problem is losses are UNAVOIDABLE.

What’s important is managing your losses effectively and cutting them while they’re small. There’s a proverbial saying in the world of trading, “Keep your losses small and let your winners run.” This is something that has been followed by some of the best traders in history, but it’s easier said than done. In the words of renowned market wizard Ed Seykota, “The elements of good trading are 1. Cutting your losses | 2. Cutting your losses | 3. Cutting your losses. If you can follow these three rules, you may have a chance.”

You may be wondering, why does Ed Seykota have to be so redundant? Couldn’t he have said cut your losses just once?” Well, the reason why he puts the utmost emphasis on cutting your losses and not finding the best buying strategy is if you fail to cut your losses even once, it could mean the end of your career as a trader. If you miss out on a stock that goes up 100%, it may hurt but there’ll always be other opportunities. However, if you fail to cut a loss while it’s still small, sooner or later you’ll be taking the mother of all losses. All it takes is one big loss to ruin years’ worth of profitability.

Whenever we close a position, we want to see only three kinds of results. Either a big win, a small win, or a small loss. There should be absolutely no room for a BIG LOSS in this equation. As mentioned above, all it takes is one undisciplined day that you don’t cut a loss while it’s small to ruin everything you worked hard for. Remember, you’re dealing with your hard-earned money here.

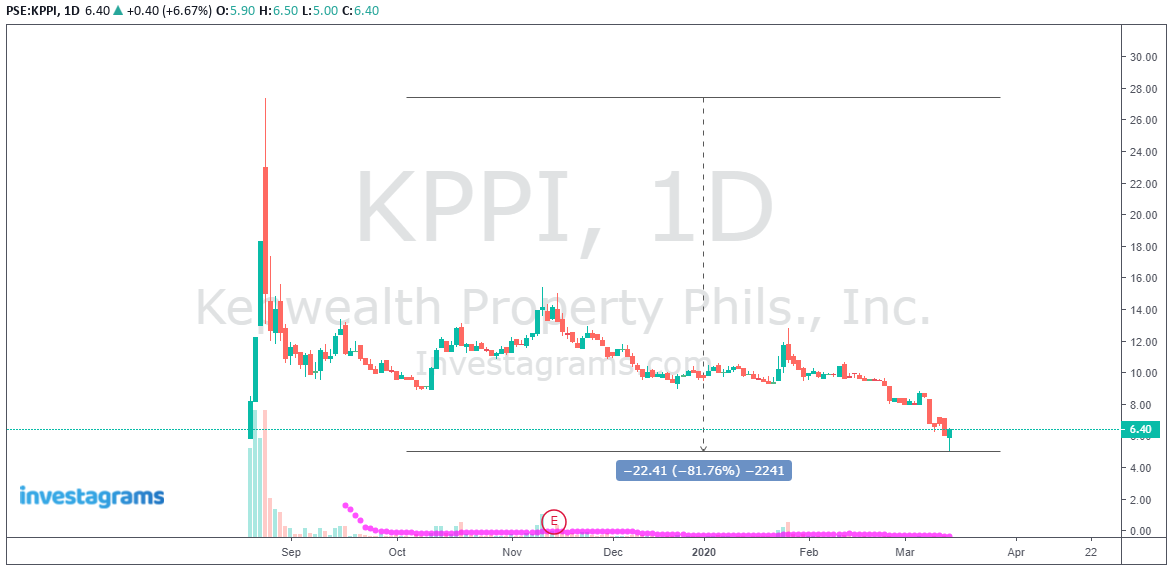

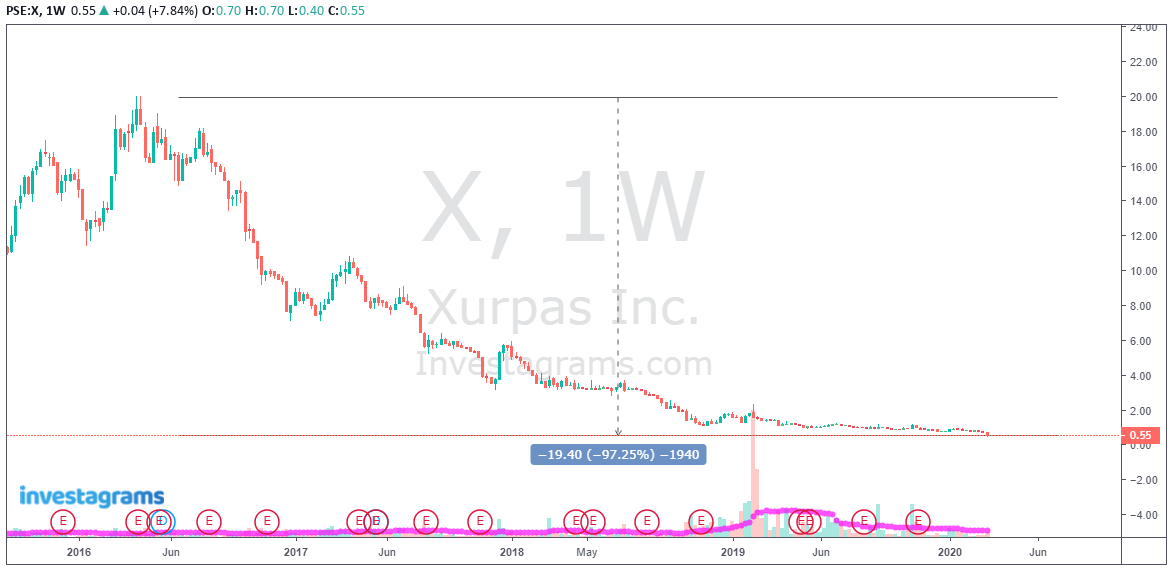

Do you want to see what can potentially happen when you don’t practice risk management?

These are just some of the many names in the Philippine Stock Market that have gone down -70% and more in recent memory. This doesn’t even mention the numerous stocks that have suffered the same fate in previous years. This is also something that happens in ALL financial markets: Equities, Currency, Commodities, Cryptocurrency, you name it!

You will always take losses in trading, but the best way to treat it is the cost of doing business since it’s unavoidable. If you’ve read a good amount of trading books there’s always one theme that’s present; the importance of managing your risks. The examples above should be enough justification to encourage everyone to also give enough emphasis on handling the downside and protecting your capital.

Mga ka-Investa, this article was written in the midst of the market crash due to the Covid-19. We don’t know when the dust will settle and when the market will finally reverse, but what’s important for now is to practice risk management at the highest level. Until we’ve seen a confirmed bottom, we’ll never know how much further the global markets may drop. Risk management is what will keep you alive in the markets in times like these.

Godspeed, everyone!