Conventional wisdom tells us that in order to reap high rewards in any endeavor, a huge amount of risk must be taken. We’re here to tell you that this cannot be farther from the truth. Don’t get us wrong, there will be some instances where you may need to risk big to win bigger. However, if we’re placing it in the context of trading the financial markets, the “High Risk, High Reward” saying is not the absolute truth.

“Low Risk, High Return” is not something you’ll usually hear from your uncle when you ask him what it’s like to invest in the stock market. This is why many beginning traders go all-in on names that they think will go ‘TUDAMOON!’ Mark Minervini said it best in his book Trade Like a Stock Market Wizard; to cut it short, he gave factual statements showing that you don’t need to risk big to make a fortune from trading.

People who have an “I run on adrenaline” type of personality are usually those who do bad in trading. They’re in it to become a millionaire by next week, they want the returns to arrive instantaneously. However, what they don’t understand is that becoming a great trader is a process of perpetual learning. If you want to become a consistently successful trader you will first need to truly believe that you are running a marathon, not a 500-meter sprint.

If you’re in the markets seeking action, you will be very prone to breaking your own trading rules. Once that happens, all hope may be lost in an instant. Always remember, at any moment during your trading journey even just ONE mistake can lead to financial ruin. This is especially true if you fall for the temptation of going all-in because of the belief in “High Risk, High Reward.”

So what’s the best way to find “Low Risk, High Reward” scenarios?

1. You will first need to develop solid risk management parameters.

Above all else, you will need to have studied and applied solid risk management rules to your system. If you’ve read any of the market wizard books, you’ll know that RISK CONTROL is one of the most essential ingredients they mentioned needed for consistent success in all financial markets. Without proper risk control metrics, despite finding “Low Risk, High Reward” opportunities, you won’t be able to execute efficiently during times you will need to cut your losses small.

2. Have a RISK-FIRST mindset.

No matter how advanced or complex your risk management procedures are, without the proper discipline it will all be for nothing. The problem with most traders is that they only take into consideration the potential reward they will gain if their trade idea materializes. What they fail to take into careful consideration is the risk they’re taking. Whenever you make your trading plan for a specific stock, always remember to focus on protecting the downside first then the upside will take care of itself.

3. BE PREPARED!

Even with the most complex risk management parameters and the undying discipline to execute on your stops, if you’re not available to check the market at a specific time you might just miss out on cutting your losses small. This is a problem the INVESTAPRIME solves; all InvestaPrime subscribers gain access to the InvestaWatcher. With the InvestaWatcher, you will receive real-time price and news alerts via in-app notification, email, and SMS.

4. Understand how much RISK you’re taking in all trades relative to the REWARD.

This is definitely the most important factor you will need to consider; how much risk you’re taking in a trade relative to the potential reward. Conventional wisdom says that a Risk Reward Ratio (RRR) of at least 1:2 is ideal, but if you can find opportunities with 1:3 RRR or higher, then much better. Also, the best type of trades are those where the downside is limited while the upside of unlimited. We’ll be showing a series of examples for better visualization.

Here’s an example of a low risk, high reward trade. As seen in the chart, $ATN’s structural support was at around the 1.33-1.35 area and it was clearly in a trading range. While it’s major resistance at the time was around the 1.58-1.60 area. Having a swing trader mentality, you could’ve accumulated shares of $ATN at it’s support area then sold it close to its resistance. By identifying its support area, you could place a wide stop to give the stock more room or a tight stop (as used in the example) so you can quickly cut your losses in the case of a breakdown.

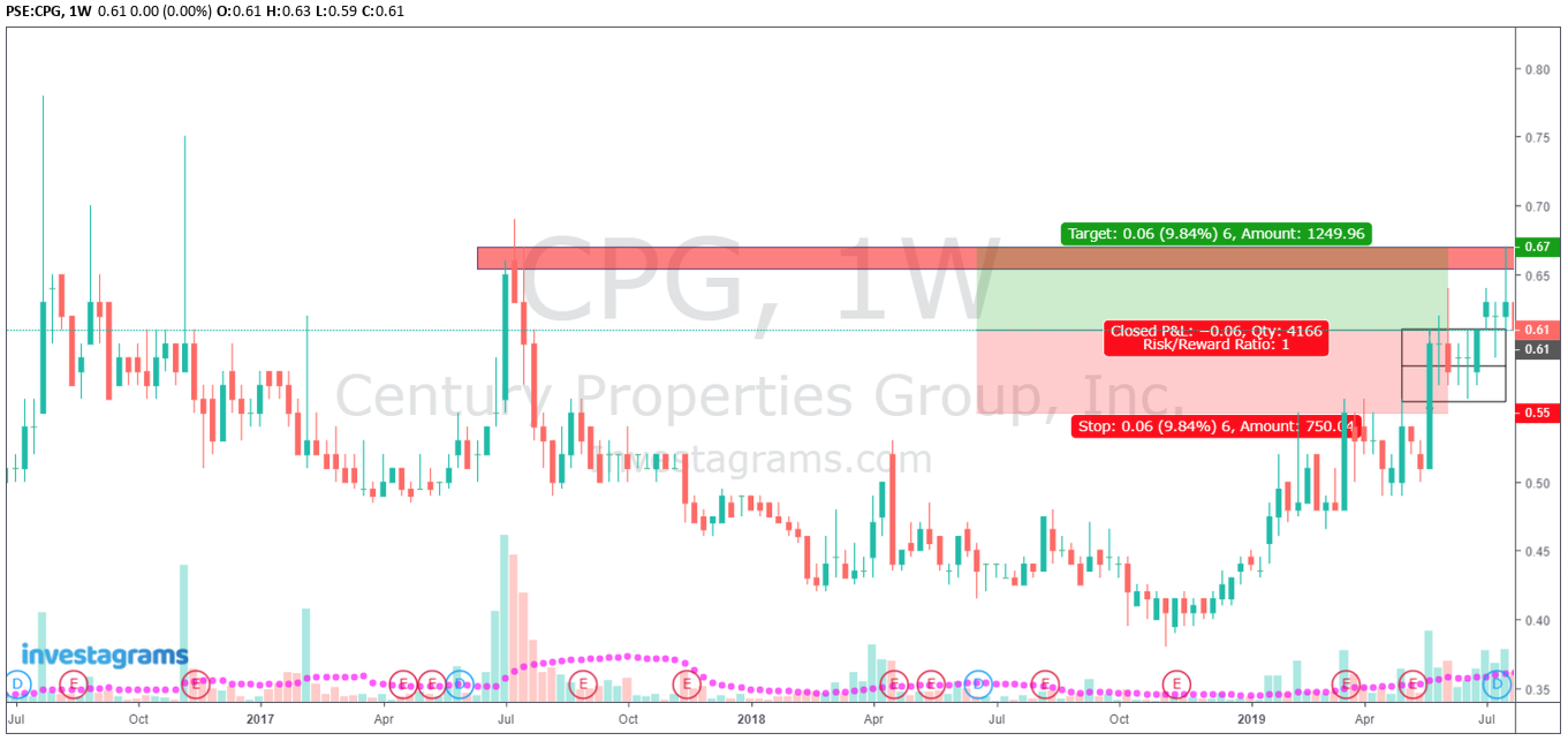

This is an example of a bad RRR trade. As seen in the chart above, the RRR is 1:1, meaning that you’re risking the same amount of money for the potential to make the same amount of money. Yes, if the trade goes as planned then you can make a nice profit. However, if you do this consistently in the long run, knowing that we’ll only be right less than 50% of the time on our trades, then at best your performance will simply be breakeven.

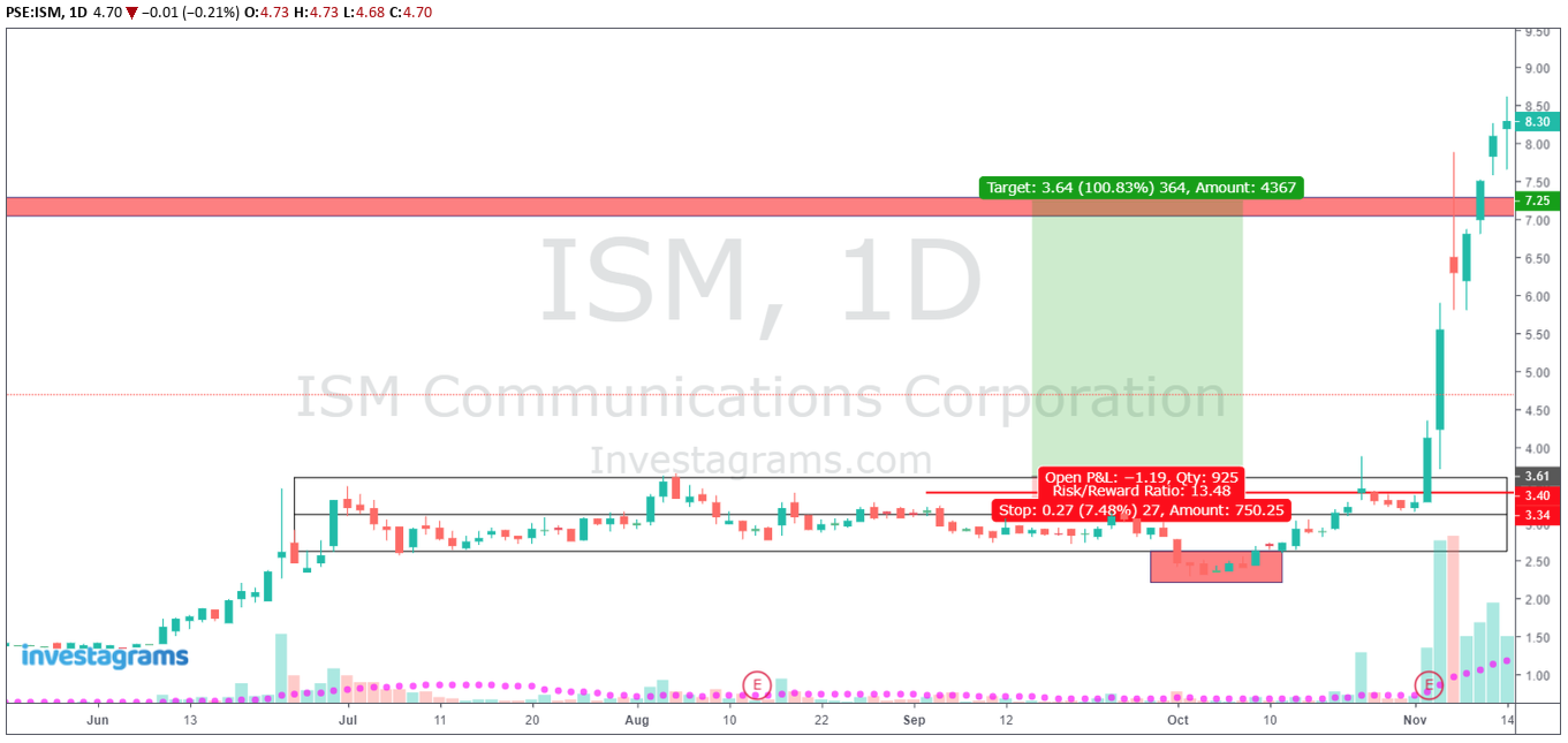

Here’s another example of a trade with a good Risk Reward Ratio, but this time in the context of a potential breakout. Seeing that $ISM was in a long consolidation, we should know that the longer the base the larger than potential breakout once price breaks the resistance. What you’ll need to do now is check a longer-term timeframe to find its multi-year resistance level as a potential target profit.

Looking at the longer-term timeframe, we now know that a good potential target profit area would be 7.50 to 8 pesos. And as we already know, $ISM was able to reach that area in only a few days time.

As seen in the chart, the RRR of this trade idea was 1:13 with an upside of 100% and a downside of only -8%. Take note, however, that trades like this don’t happen often. At best, these type of monster plays may only happen ten times per year.

IN CONCLUSION

In order to reap high rewards from trading the financial markets, it doesn’t necessarily mean that a great amount of risk needs to be taken as well. As traders, we will be wrong on our trade ideas at least half of the time. This means that in order to become consistently successful in our journeys, we will need to make more than we lose on a consistent basis.