Who is a happy and effective investor?

In my opinion, he is someone who can confidently grow his investment portfolio through realistic means and without much stress. This confidence enables him to do what really matters to him as money is not the main objective of what he does. A happy and effective investor epitomizes “true financial freedom” because he knows that he can rely on the returns of his investment portfolio when he retires.

Contrary to popular belief, a happy and effective investor does not need to have a degree in finance or be an analyst (like me) or a stock broker. He just needs to have certain habits that are easy to adopt.

In this article, I’ll be sharing what I believe are some of the essential habits of happy and effective investors.

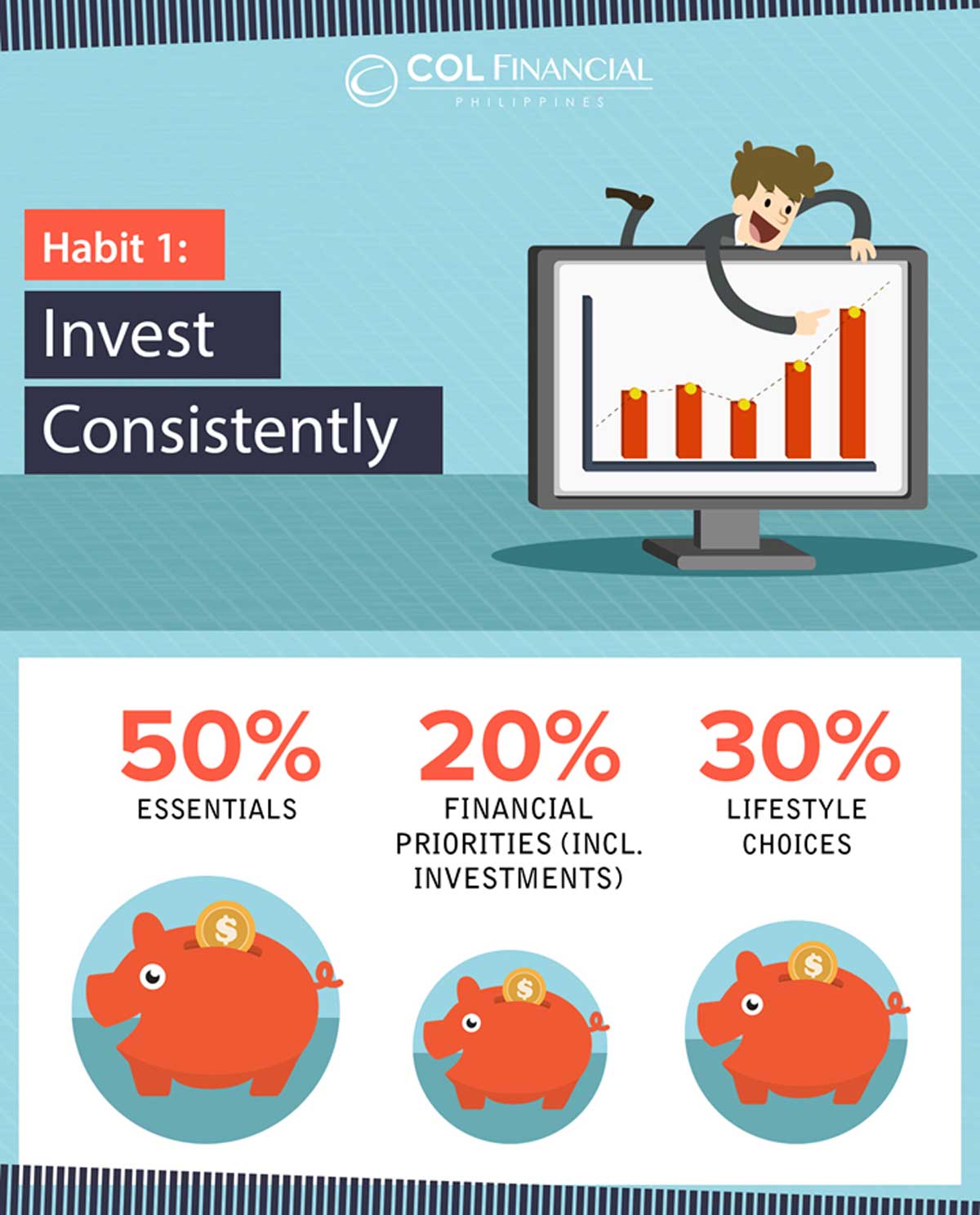

HABIT 1: INVEST CONSISTENTLY

A lot of people don’t invest because they think that getting a high paying job is enough to guarantee financial freedom. Ironically though, having a high paying job is not enough to guarantee financial freedom. If it were so, why are numerous highly paid celebrities and athletes bankrupt a few years after retirement? Moreover, according to a study by LIMRA on “when 25 year olds today reach 60”, a vast majority will be broke (63%), while 5% will still need to work. Only 1% will be wealthy and 4% will be financially independent.

Although getting a job that pays well is important, it is also equally important to invest consistently to become a happy and effective investor.

How much should you set aside? The 50-20-30 rule stipulates that you should consistently set aside 20% of what you earn on financial priorities which include investments. When you get a bonus, strive to set aside 50%for investments.

Resist the temptation to buy things that you want but don’t really need. Just remember that when you choose investments over your wants, your investments will eventually allow you to buy what you want. Every year, my husband and I set aside a certain amount for my children’s investment accounts because we believe giving gifts that keep on giving.

While investing consistently can be difficult like sticking to a diet or an exercise plan, you can do something to help you stay the course. For example, you can schedule an automatic fund transfer out of your payroll account equivalent to 20% of your salary every payday that will go towards the purchase of mutual funds or UITFs. COL Financial already has a function that allows automatic monthly investing of stocks and mutual funds.

HABIT 2: AVOID TIMING THE MARKET

When the market corrects,investors usually sell their positions with the intention of buying back when the market recovers. Intuitively, this should be a more profitable strategy as investors avoid big draw downs in the value of their portfolios.

However, studies show that timing the market is a very dangerous habit. According to a study conducted by Davis Advisors (using Bloomberg data), investors who just stayed invested in the S&P 500 from 1994 to 2013 would have generated an annual return of 9.5%. On the other hand, investors who had missed the 10 best days of the market during the same period would have seen their returns diminish to only 5.5% annually,while those who had missed the best 60 days would have generated a loss.

The same holds true for the Philippine stock market. In fact, market timers are hurt even more significantly given the greater volatility of local stocks. While investors who just stayed invested in the PSEi from 1996 to 2016 would have generated an annual return of 9.4%, those who had only missed the 10 best days would have already generated a loss of 0.4%!

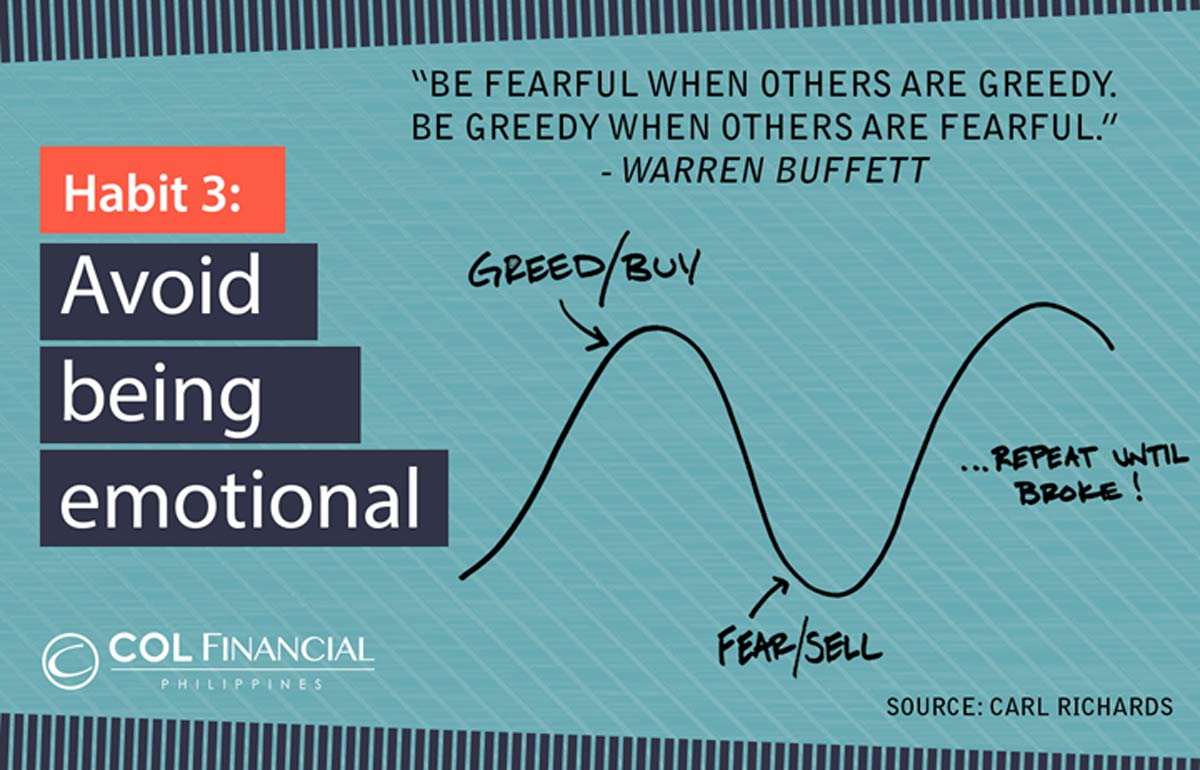

HABIT 3: AVOID BEING EMOTIONAL

Investing in the stock market can be a very exhilarating exercise which is why many investors choose to trade actively instead of sticking to an investment plan that simply involves buying funds and some individual stocks on a regular basis. After all, a lucky investor who makes the right bet could more than double his money in a short span of time. For example, earlier this year, MAC was trading at less than Php3.00/share. Now it’s worth almost three times more at Php8.50/share! Assuming that you were the lucky investor who bought MAC earlier this year, you would be much richer today! People might also say that you are a genius for spotting MAC at such a good price making you feel proud of your achievement.

Most of the time though, investors are unlucky. According to a study by Dalbar and Lipper, the average stock fund investor returns from 1994 to 2013 is only 5.0%, trailing behind the average stock fund return of 8.4%. This is because investors typically buy at the top and sell at the low as they are overcome by greed and fear. This is why Warren Buffett said to “Be fearful when others are greedy and greedy when others are fearful.”

HABIT 4: ACCEPT VOLATILITY

Investing a certain portion of your portfolio in the stock market is important if you want to beat inflation and retire comfortably. However, a lot of people avoid investing in the stock market because of volatility. Unlike bank deposits, returns of stocks are very volatile. Even worse, they can go down in value and there are always many reasons why the market can go down in value (Examples: election of Trump as U.S. president, the declaration of martial law in Mindanao, Fed rate hike).

Although stocks are volatile, they also generate significantly higher returns compared to bank deposits. Moreover, the market goes up more frequently than down. For example, during the last 29 years, the market was up 20 years while it was down only 9 years. Total return during the said period was also substantial at 795%, significantly beating returns of bank deposits!

HABIT 5: BUY WHEN THE MARKET GOES ON SALE

January and July are my favorite times to go shopping since shops have their semi-annual sales. Like me, most people get excited to go shopping when stores go on sale.

However, the opposite is true when the stock market goes on sale. Instead of buying stocks, typical investors avoid the stock market, worrying that there must be something wrong.

In contrast, the happy and effective investor gets excited when the market goes on sale. He understands that buying when the market goes on sale allows him to generate even higher returns as history has shown that markets eventually recover after falling substantially in reaction to negative developments such as the Asian Financial Crisis and the Global Financial Crisis.

HABIT 6: DO YOUR HOMEWORK

People normally rely on tips when choosing which stocks to buy.

However, a happy and effective investor understands that to pick the right stock, he needs to do his homework. He knows that for share prices to remain in an uptrend, profits also have to be rising. This is based on the logic that profitable businesses are worth more. After all, who would want to buy a business that is losing money? He tries to understand what drives companies’ earnings, and determines whether these drivers are currently favorable for the company.

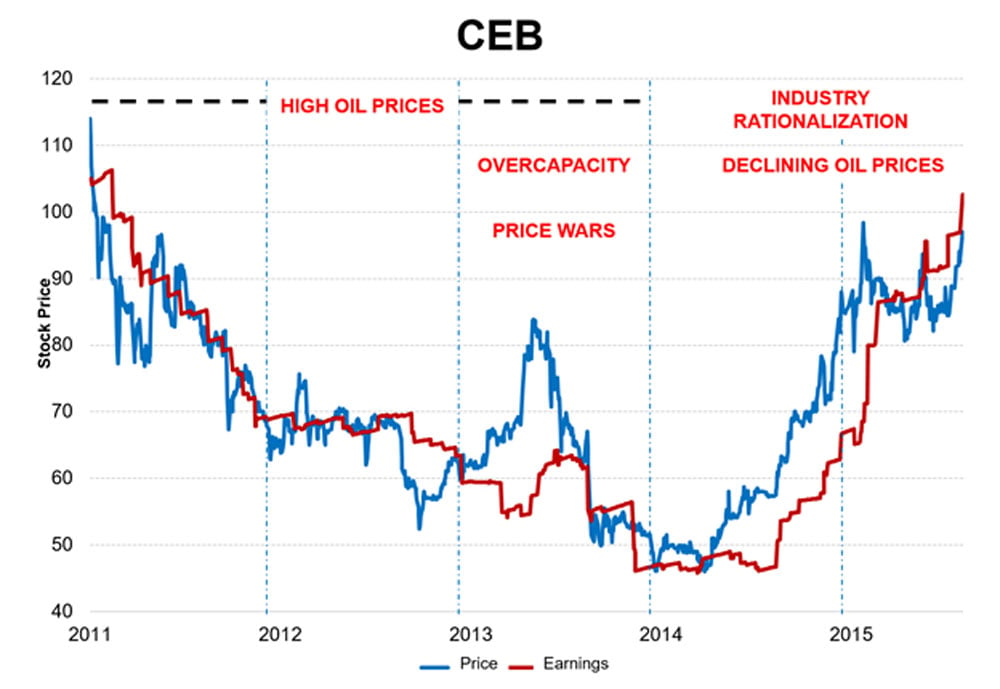

For example, from 2011 to 2013, CEB’s share price was on a downtrend because the price of oil was rising and oil is one of CEB’s major costs. At the same time, the airline industry was suffering from overcapacity as the growing popularity of low cost carriers encouraged new players to come in. This led to price wars that negatively affected CEB’s profitability.

However, towards the second half of 2014, oil prices started to fall. The industry also consolidated as airlines that were losing money either closed shop or were bought out by the bigger players. The said factors led to the rebound of CEB’s profitability and its share price.

Aside from knowing where profits are headed, the happy and effective investor makes sure that he is paying a reasonable price for the stock he is buying. This is measured by the price relative to the amount of earnings that the company is expected to generate or the P/E ratio. The lower the P/E ratio, the better, as this would improve a stock’s return potential.

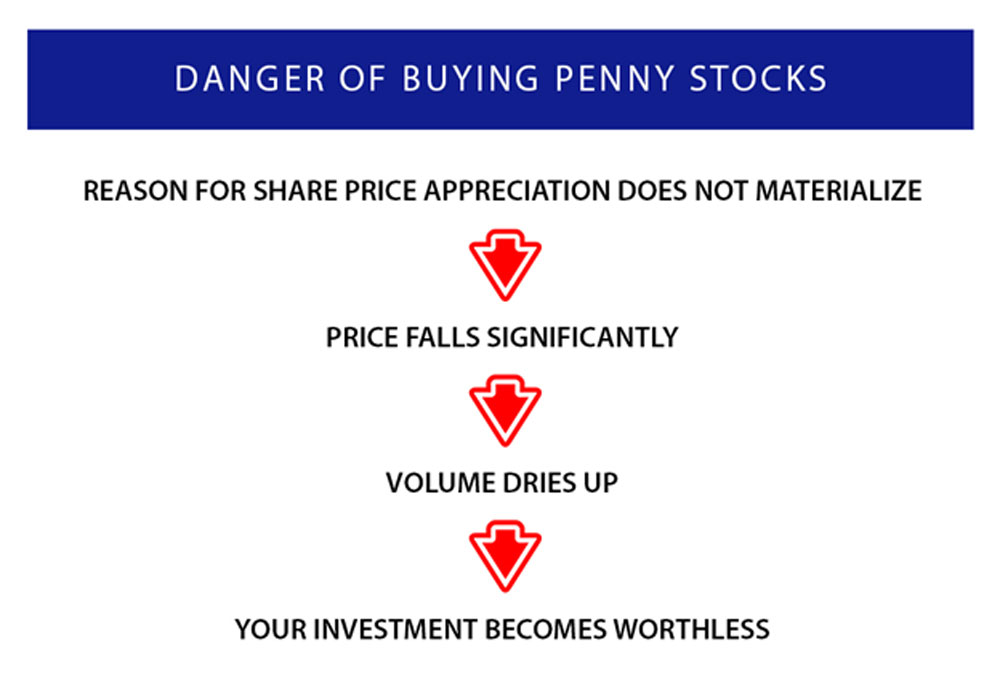

A happy and effective investor avoids buying penny stocks based on tips. He understands the dangers of buying penny stocks, which could lead to his investment becoming worthless.

For example, in 2012, CAL was one of the most popular IPOs as its share price rallied by 219% in 9 days! However, at the peak, CAL was trading at 73.7X P/E which was very expensive considering that the PSEi was trading well below the said level. Moreover, instead of going up, CAL’s profits went down. As a result, share prices fell significantly.

HABIT 7: BE COST CONSCIOUS

The happy and effective investor understands that active trading, while exciting, is very costly. Did you know that the cost of buying and selling a stock (including taxes and commissions) is around 1.1%?

When buying funds, the happy and effective investor also studies fees that are charged by asset management companies. These include front load and back load fees, penalties for early redemption, management fees (0.25% to 2.15%) and other costs (up to 2.25%). Unfortunately, higher fees do not necessarily translate to better performance.

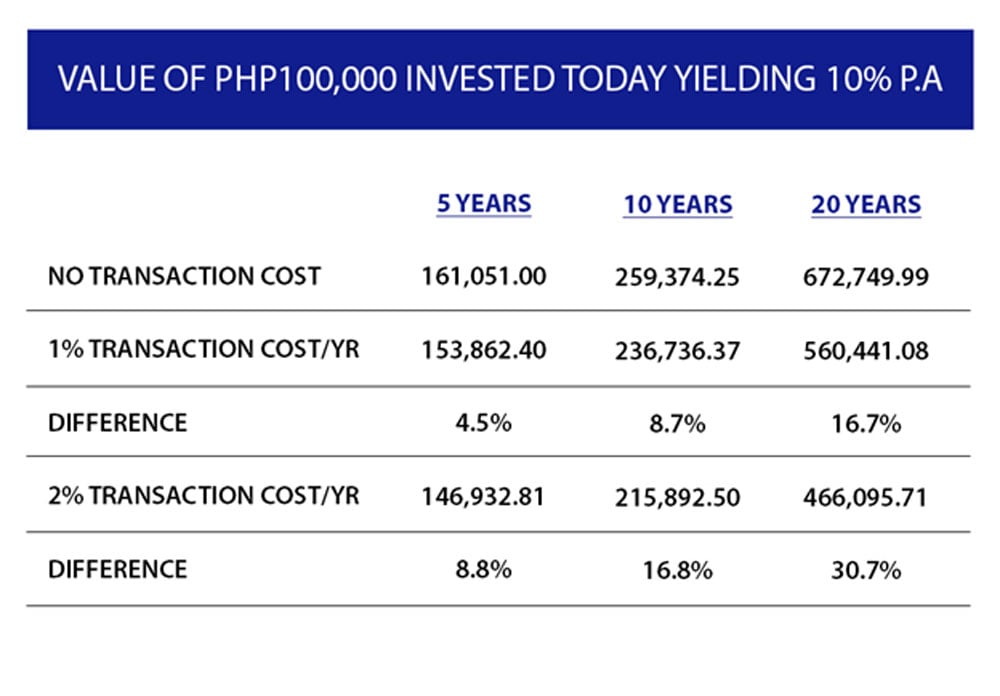

While costs of 1% to 2% may seem small, the slight reduction in portfolio returns spells a big difference when compounded annually over a long period of time. For example, a Php100,000 portfolio that generates a compounded annual return of 10% would be worth Php259,000 in 10 years. This is 8.7% more than a portfolio that generates a compounded annual return of 9.0% (because of a 1% cost annually) and 16.8% more than a portfolio that generates a compounded annual return of 8.0% (because of a 2% cost annually)! The difference increases even more over time as can be observed in the table below.

HABIT 8: DIVERSIFY

When I was a teenager, I remember envying classmates who had Sony Walkman. During my teenage years, having a Sony Walkman meant that you were “cool”.

When I had my first baby, I wanted to make sure that all the pictures I took of my baby were perfect. This was why I always bought Kodak film since I didn’t want to leave anything to chance.

However, cassette tapes and film cameras are now obsolete. And if you had only bought shares of Sony and Kodak because of the popularity of the Walkman and film cameras twenty years ago, the performance of your portfolio would be very disappointing.

The happy and effective investor understands that diversification is important to manage risks. Aside from protecting his portfolio from significant volatility resulting from unforeseen incidents (such as obsolescence of products), diversification also helps him manage the cash flow of his investments, so that he will not be forced to sell investments at a bad time.

Below are some basic types of diversification.

HABIT 9: THINK LONG TERM

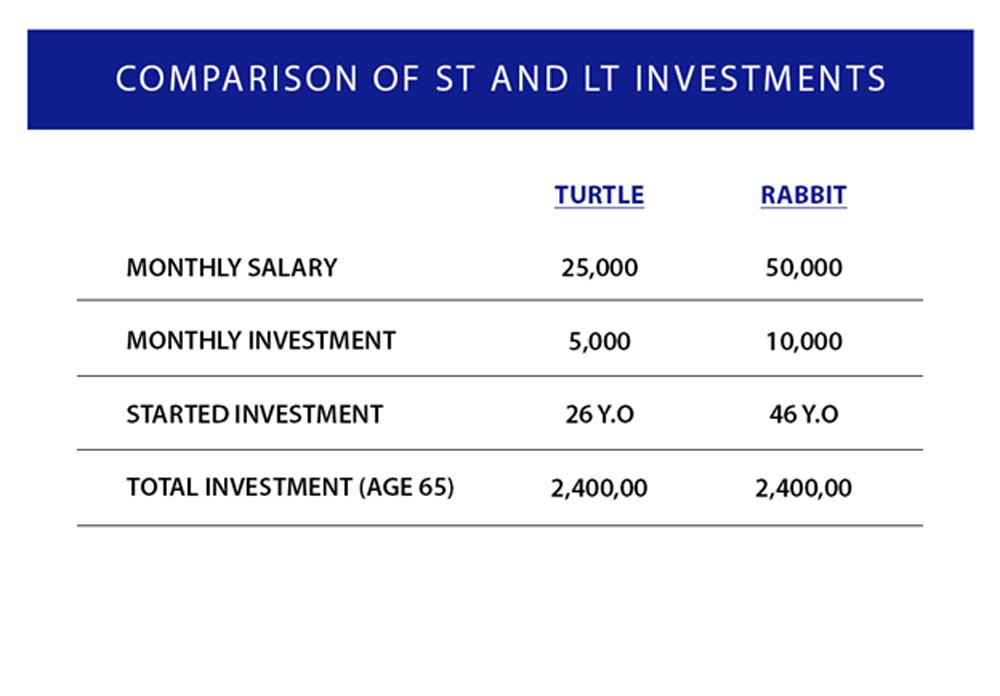

The happy and effective investor is a long-term investor. He understands that by investing long term, he is maximizing the power of compounding to grow the value of his portfolio.

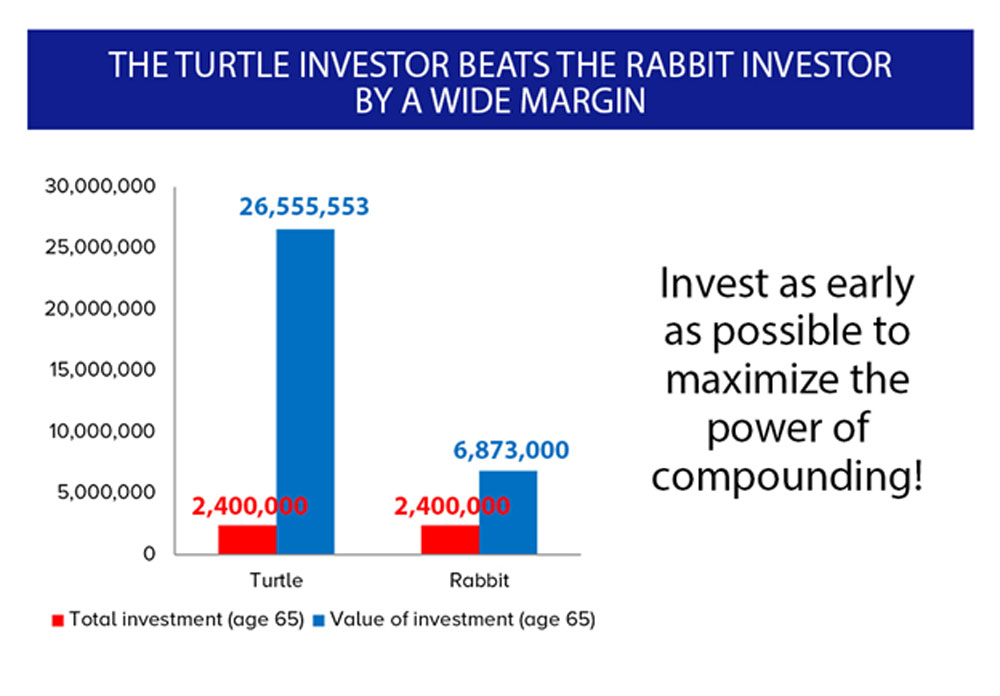

Did you know that by age 65, someone who invested Php5,000 a month starting at the age of 26 will have significantly more than someone who invested Php10,000 a month starting at the age of 46? This is despite the fact that both have set aside the same amount of Php2.4 Mil as investments.

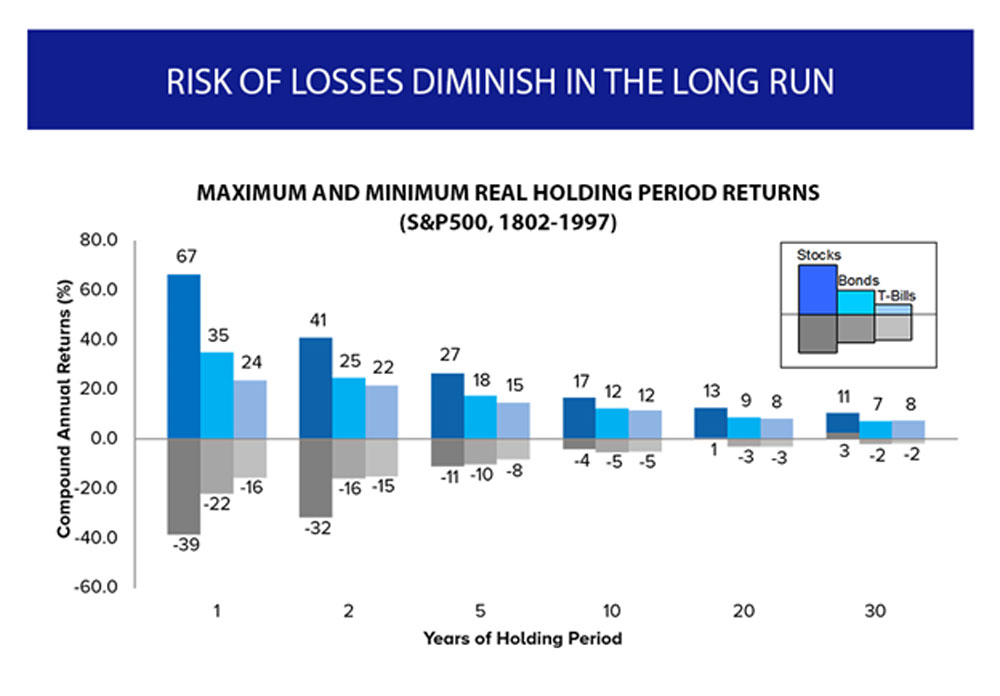

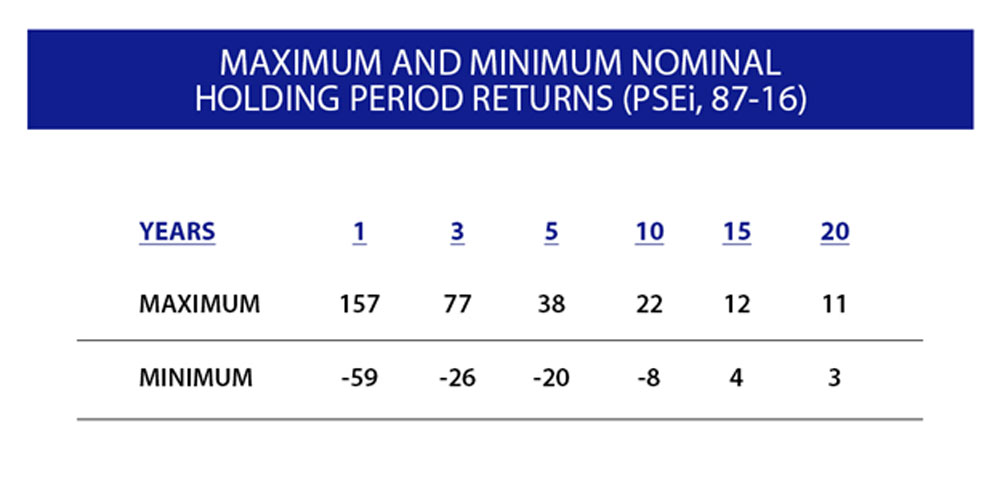

The happy and effective investor also knows that when investing in the stock market, the risk of losses diminishes in the long run. Based on the study of the S&P 500’s performance from 1802-1997, it was impossible for an investor to register a loss assuming that he had a investment time horizon of at least 20 years. The same holds true for the Philippine stock market based on the study of the PSEi’s performance from 1987-2016.

HABIT 10: REVIEW YOUR PORTFOLIO

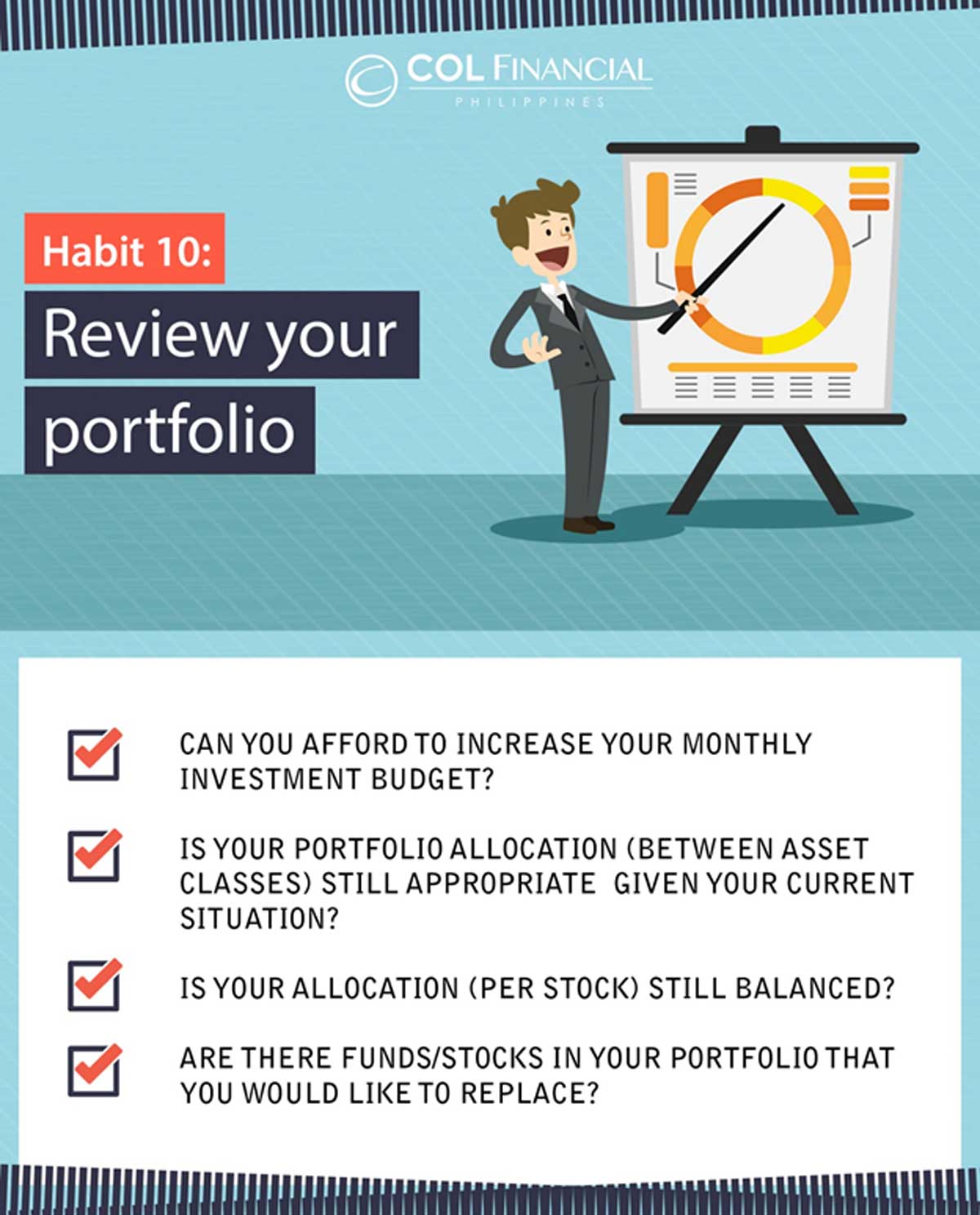

A happy and effective investor diligently reviews his portfolio on an annual basis. He determines whether he can increase the amount of money that he sets aside as investments. For example, did he get a pay increase or a big bonus that will allow him to invest more?

He also checks whether his portfolio allocation between different asset classes (such as stocks or bonds) is still appropriate given his current situation. For example, will he have a major expenditure soon that will require him to reduce his equity exposure?

He also tries to see whether he still likes to keep the individual stocks in his portfolio and whether his allocation to the different issues is still balanced or acceptable. Have fundamentals changed? Or is the stock now too expensive, making it a good time to lock in gains?

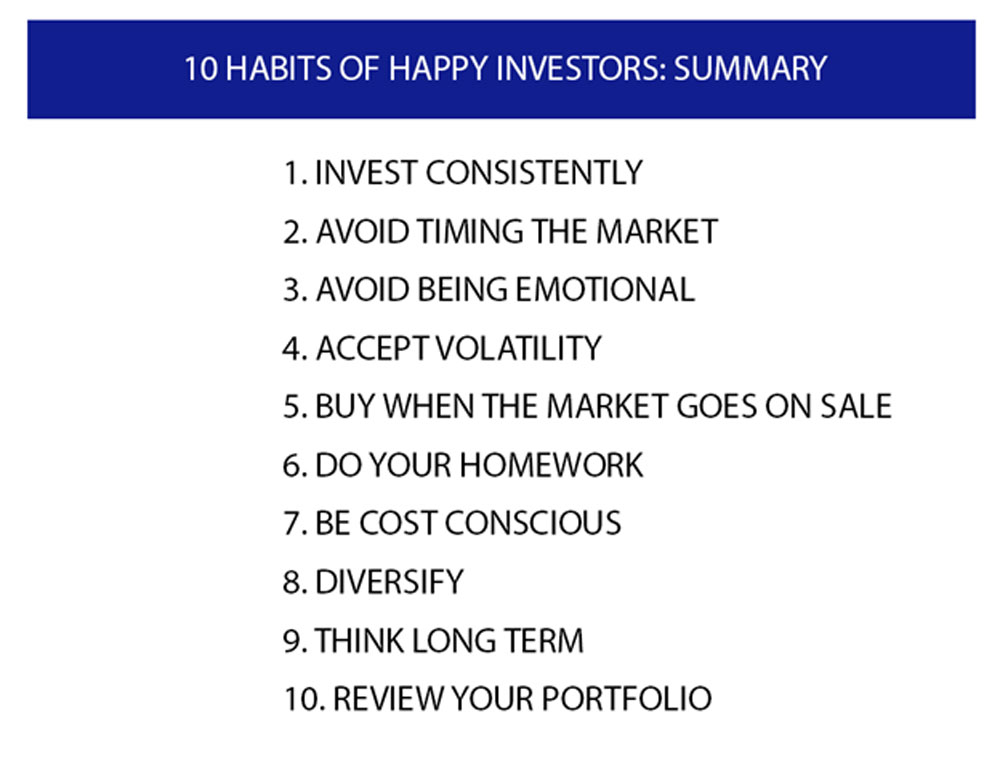

In summary, here are the 10 habits of happy and effective investors. I hope that you can adopt these habits so that you can become a happy and effective investor.

Subscribe to InvestaDaily for more articles like these, or sign up for Investagrams to access special features to help you reach your first million!